Declaration Gift Form

What is the declaration gift form?

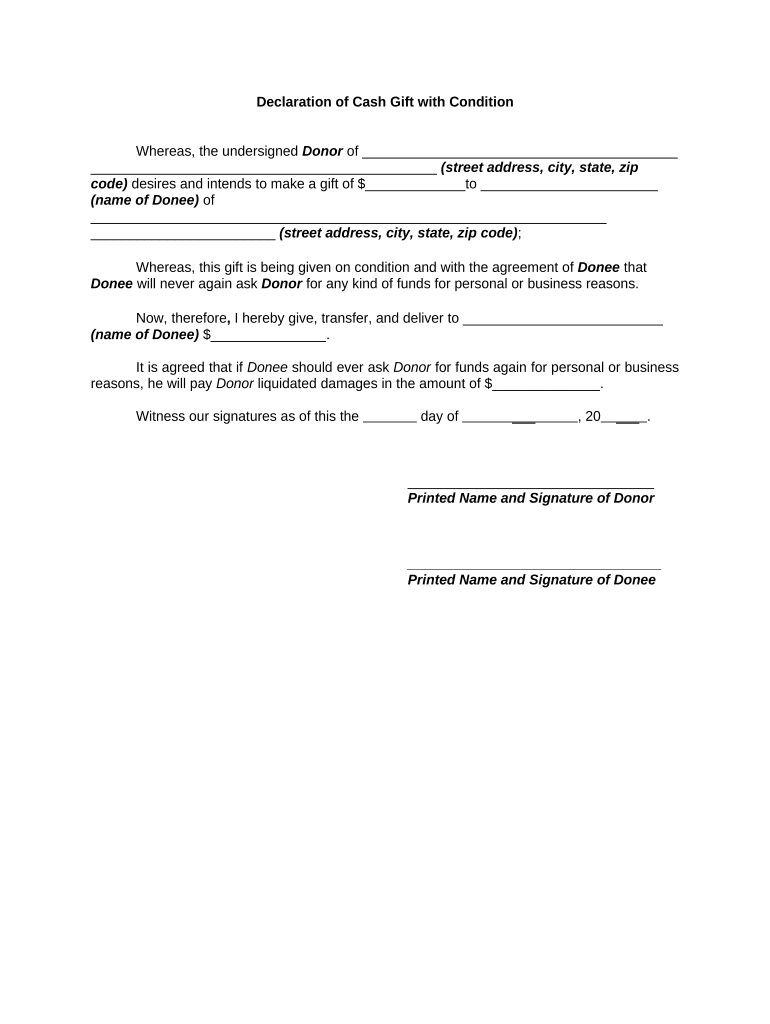

The declaration gift form is a legal document used to outline the terms and conditions under which a gift is given. This form is particularly important when the gift comes with specific stipulations, such as a gift with condition. It serves to clarify the intent of the giver and protect the rights of both the giver and the recipient. By documenting the details of the gift, including its value and any conditions attached, this form helps prevent misunderstandings and disputes in the future.

Steps to complete the declaration gift form

Completing the declaration gift form involves several key steps to ensure that the document is accurate and legally binding. First, gather all necessary information, including the names and addresses of both the giver and the recipient. Next, clearly state the value of the gift and any conditions that apply. After filling out the form, both parties should review it for accuracy. Finally, sign the document electronically, ensuring compliance with eSignature laws to enhance its legal standing.

Legal use of the declaration gift form

The legal use of the declaration gift form hinges on its ability to meet specific requirements. For the form to be considered legally binding, it must include clear terms regarding the gift, such as its value and any conditions attached. Additionally, both parties must sign the form, either in person or electronically, to validate the agreement. Compliance with relevant laws, such as the ESIGN Act and UETA, is crucial for the form to hold up in legal situations.

Key elements of the declaration gift form

Several key elements must be included in the declaration gift form to ensure its effectiveness. These elements include:

- Names and addresses: Clearly state the full names and addresses of both the giver and the recipient.

- Gift description: Provide a detailed description of the gift, including its value and any conditions attached.

- Signatures: Both parties must sign the form to validate the agreement.

- Date: Include the date when the gift is given to establish a clear timeline.

How to use the declaration gift form

Using the declaration gift form is straightforward. After completing the form with the required information, both parties should sign it. The signed document can then be stored electronically or printed for physical records. It is advisable to keep copies for both the giver and the recipient, as this ensures that both parties have access to the terms of the gift. If any disputes arise in the future, having a signed declaration gift form can provide clarity and legal backing.

Examples of using the declaration gift form

There are various scenarios where a declaration gift form can be beneficial. For instance, a parent may use the form when gifting a substantial sum of money to a child, specifying that the funds are intended for educational purposes. Another example could involve a grandparent gifting property to a grandchild, with the condition that the property remains in the family for a certain number of years. These examples illustrate how the form can clarify intentions and protect both parties involved.

Quick guide on how to complete declaration gift form

Complete Declaration Gift Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Manage Declaration Gift Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Declaration Gift Form with ease

- Locate Declaration Gift Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Choose relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that task.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or shared link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Declaration Gift Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a declaration gift in the context of eSignatures?

A declaration gift refers to a formal statement made using electronic signatures that signifies the transfer of ownership or intention to gift a particular asset. With airSlate SignNow, creating a declaration gift is streamlined, allowing users to sign and send documents quickly and securely.

-

How much does airSlate SignNow cost for sending declaration gifts?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you need to send one declaration gift or multiple documents, our competitive pricing ensures that you get a cost-effective solution without compromising on features.

-

What features does airSlate SignNow offer for creating declaration gifts?

airSlate SignNow includes features such as templates, document storage, and the ability to customize fields in your declaration gift document. This user-friendly platform allows you to automate workflows and easily manage your signing processes.

-

How can I integrate airSlate SignNow into my existing workflow for declaration gifts?

airSlate SignNow seamlessly integrates with various applications, making it easy to incorporate eSigning into your current workflow. Whether you use CRM systems or cloud storage services, our integrations ensure that you can create and manage your declaration gifts with ease.

-

What benefits does using airSlate SignNow offer for declaration gifts?

Using airSlate SignNow for declaration gifts brings efficiency, security, and convenience. With electronic signing, you can accelerate the gifting process, reduce paper usage, and ensure your documents are securely stored and accessible from anywhere.

-

Is it legal to use airSlate SignNow for declaration gifts?

Yes, documents signed via airSlate SignNow are legally binding and comply with electronic signature laws. This ensures that your declaration gift holds legal validity and provides a secure way to manage important documents.

-

Can I track the status of my declaration gift sent through airSlate SignNow?

Absolutely, airSlate SignNow offers tracking features that allow you to monitor the status of your declaration gift. You will receive notifications when your document is viewed and completed, helping you stay informed throughout the process.

Get more for Declaration Gift Form

- Business tax forms 2018 division of revenue state of

- Full payment of any amount due for a taxable year is due by the original due date form

- Free file fillable forms helpinternal revenue service

- Rd 110 city of kansas city mo form

- Rd 109 city of kansas city missouri revenue division form

- Assessor home page jefferson county missouri form

- Individual unique form feb 20 19pmd departamento

- Get and sign form 1528 physicians statement fill out

Find out other Declaration Gift Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word