Declaration of Gift over Several Year Period Form

What is the Declaration Of Gift Over Several Year Period

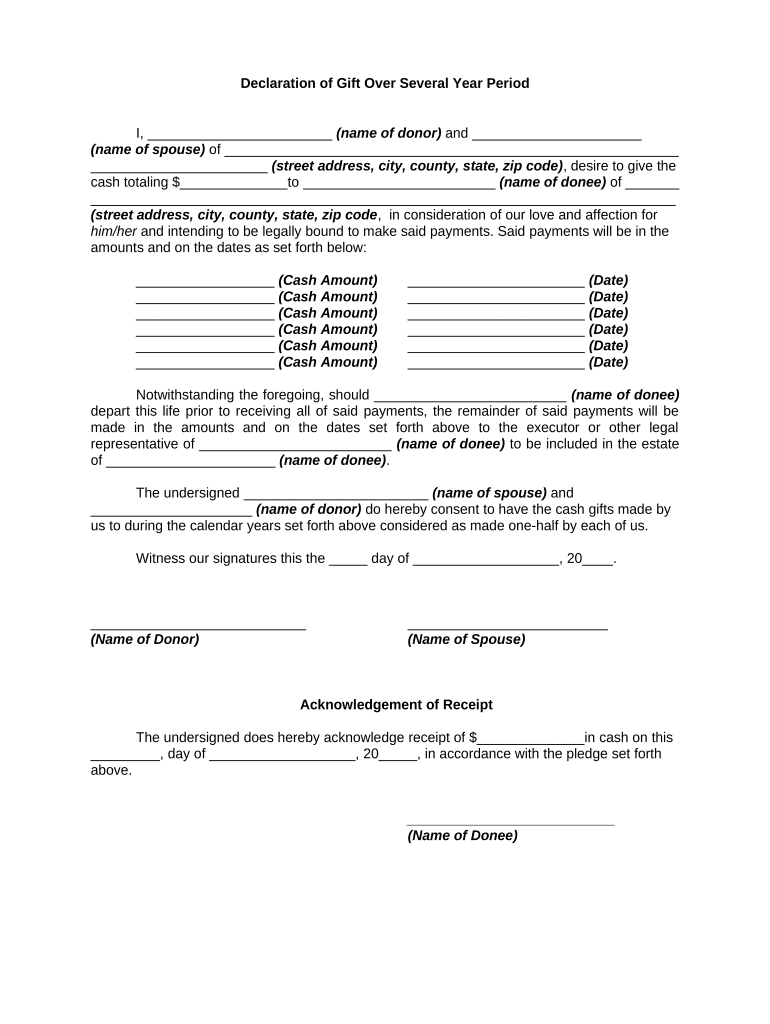

The Declaration of Gift Over Several Year Period is a formal document used to outline the transfer of assets or property from one individual to another over a specified duration. This declaration serves to clarify the intent of the donor and the recipient, ensuring that both parties understand the terms of the gift. It is particularly relevant in situations where the total value of the gifts exceeds the annual exclusion limit set by the IRS, which may trigger gift tax implications. This document is crucial for maintaining clear records and complying with tax regulations.

Key Elements of the Declaration Of Gift Over Several Year Period

Several essential components must be included in the Declaration of Gift Over Several Year Period to ensure its validity:

- Donor Information: Full name and contact details of the individual making the gift.

- Recipient Information: Full name and contact details of the individual receiving the gift.

- Description of the Gift: A detailed description of the assets or property being gifted, including any relevant identification numbers.

- Value of the Gift: The fair market value of the gift at the time of transfer.

- Gift Schedule: A clear outline of the timeline over which the gifts will be made, specifying amounts and dates.

- Signatures: Signatures of both the donor and recipient, along with the date of signing.

Steps to Complete the Declaration Of Gift Over Several Year Period

Completing the Declaration of Gift Over Several Year Period involves several straightforward steps:

- Gather necessary information about both the donor and recipient.

- Determine the total value of the gift and how it will be distributed over the specified period.

- Draft the declaration, ensuring all key elements are included and clearly stated.

- Review the document for accuracy and completeness.

- Both parties should sign the declaration, ideally in the presence of a witness or notary.

- Keep a copy of the signed declaration for personal records and tax purposes.

Legal Use of the Declaration Of Gift Over Several Year Period

The Declaration of Gift Over Several Year Period is legally binding when properly executed. It is essential to comply with IRS regulations regarding gift taxes, which may apply if the total value of gifts exceeds the annual exclusion limit. This document can be used as evidence in case of disputes or audits, providing a clear record of the intent behind the gift. Additionally, it helps in maintaining transparency between the donor and recipient, which is crucial for legal and tax purposes.

IRS Guidelines

When using the Declaration of Gift Over Several Year Period, it is important to adhere to IRS guidelines. The IRS requires that gifts exceeding a certain annual exclusion amount be reported on Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. Understanding the limits and filing requirements can help both the donor and recipient avoid potential tax liabilities. It is advisable to consult with a tax professional to ensure compliance with all relevant regulations.

Examples of Using the Declaration Of Gift Over Several Year Period

There are various scenarios where the Declaration of Gift Over Several Year Period can be applied:

- A parent gifting a portion of their estate to their child over several years to minimize tax implications.

- A grandparent transferring funds to grandchildren for education expenses, structured over multiple years.

- A business owner gifting shares of their company to an employee as part of a long-term incentive plan.

Quick guide on how to complete declaration of gift over several year period

Effortlessly Complete Declaration Of Gift Over Several Year Period on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your paperwork quickly without delays. Handle Declaration Of Gift Over Several Year Period on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Digitally Sign Declaration Of Gift Over Several Year Period with Ease

- Access Declaration Of Gift Over Several Year Period and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to preserve your modifications.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and digitally sign Declaration Of Gift Over Several Year Period and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Declaration Of Gift Over Several Year Period?

A Declaration Of Gift Over Several Year Period is a document outlining the details of a gift made over multiple years. This declaration is important for tax purposes and helps clarify the intent behind the gift. Using airSlate SignNow, you can easily create and eSign this declaration to ensure its legality.

-

How does airSlate SignNow facilitate the Declaration Of Gift Over Several Year Period?

airSlate SignNow simplifies the process of creating a Declaration Of Gift Over Several Year Period by providing customizable templates and an intuitive interface. This allows users to fill in their details quickly and securely eSign the document. Moreover, the platform ensures that your documents are legally binding and compliant.

-

Can I customize the Declaration Of Gift Over Several Year Period using airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of the Declaration Of Gift Over Several Year Period. Users can easily modify the text, add necessary clauses, and incorporate any specific terms related to the gift. Our customizable templates offer flexibility to meet individual needs.

-

What are the benefits of using airSlate SignNow for my Declaration Of Gift Over Several Year Period?

Using airSlate SignNow for your Declaration Of Gift Over Several Year Period provides a host of benefits, including time-saving eSigning and automated document management. The platform is also cost-effective, reducing the need for legal consultations. Additionally, features like secure storage and easy sharing further enhance your experience.

-

Is there a free trial available for creating a Declaration Of Gift Over Several Year Period?

Yes, airSlate SignNow offers a free trial for users interested in creating their Declaration Of Gift Over Several Year Period. This trial allows you to explore the platform's features without any commitment. Experience firsthand how easy it is to generate, sign, and manage your documents.

-

What integrations does airSlate SignNow support for managing my Declaration Of Gift Over Several Year Period?

airSlate SignNow supports various integrations with popular applications, such as Google Drive, Dropbox, and various CRM systems, to streamline the management of your Declaration Of Gift Over Several Year Period. This ensures that you can access your documents easily and collaborate with others seamlessly.

-

Are the eSignatures on my Declaration Of Gift Over Several Year Period legally binding?

Absolutely, the eSignatures created using airSlate SignNow on your Declaration Of Gift Over Several Year Period are legally binding. The platform complies with eSignature laws, ensuring that all signatures meet regulatory standards. This provides assurance that your documents will hold up in court if challenged.

Get more for Declaration Of Gift Over Several Year Period

Find out other Declaration Of Gift Over Several Year Period

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe