Miller Trust Form

What is the Miller Trust

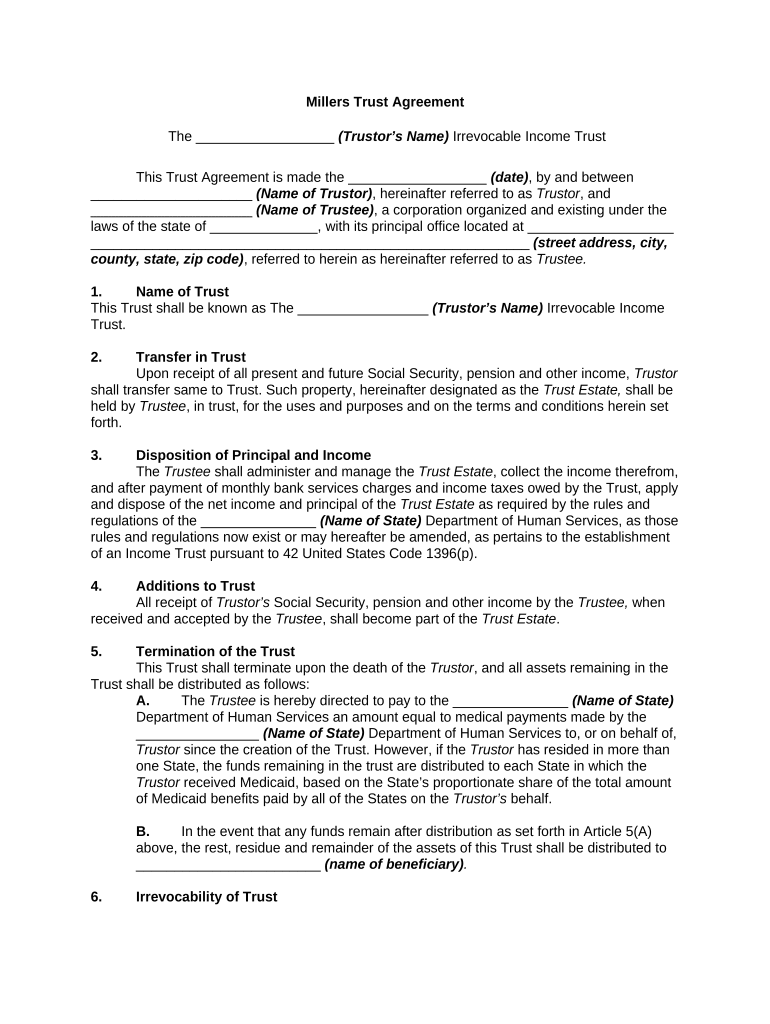

The Miller Trust, also known as a qualified income trust, is a legal arrangement designed to help individuals qualify for Medicaid benefits while protecting a portion of their income. This type of trust allows individuals with income exceeding Medicaid's eligibility limits to place excess funds into a trust, thereby reducing their countable income. By doing so, they can still receive necessary medical assistance without depleting their financial resources.

How to use the Miller Trust

Using the Miller Trust involves several steps to ensure compliance with state regulations. First, individuals must establish the trust by drafting a legal document that outlines the terms and conditions. Next, they will need to fund the trust with income that exceeds Medicaid limits. The trustee, who manages the trust, must ensure that distributions are made according to Medicaid guidelines. This often includes using the funds for qualified medical expenses, thus maintaining eligibility for benefits.

Steps to complete the Miller Trust

Completing the Miller Trust involves a series of clear steps:

- Consult with a legal professional to draft the trust document.

- Identify the income that will be placed into the trust.

- Designate a trustee to manage the trust.

- Fund the trust with excess income.

- Ensure that all distributions comply with Medicaid regulations.

Following these steps carefully can help ensure that the trust is set up correctly and meets legal requirements.

Key elements of the Miller Trust

Several key elements define the Miller Trust:

- Trustee: The individual or entity responsible for managing the trust and ensuring compliance with Medicaid rules.

- Income Limitations: Only income exceeding the Medicaid eligibility threshold can be placed into the trust.

- Distribution Guidelines: Funds must be used for qualifying medical expenses to maintain Medicaid eligibility.

- Legal Documentation: A formal trust document must be drafted and executed to establish the trust legally.

State-specific rules for the Miller Trust

Each state has its own regulations regarding the Miller Trust, which can affect how it is established and managed. It is essential to understand the specific rules in Tennessee, as they may dictate the income limits, allowable expenses, and reporting requirements. Consulting with a local attorney who specializes in elder law or Medicaid planning can provide valuable insights into these state-specific regulations.

Eligibility Criteria

To be eligible for a Miller Trust, individuals must meet certain criteria, including:

- Being over the age of 65 or having a qualifying disability.

- Having income that exceeds the Medicaid eligibility threshold.

- Residing in a state that recognizes the Miller Trust as a valid option for Medicaid planning.

Meeting these criteria is crucial for setting up the trust and ensuring that it serves its intended purpose.

Quick guide on how to complete miller trust

Complete Miller Trust seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Miller Trust on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Miller Trust with ease

- Find Miller Trust and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional pen-and-ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Miller Trust and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Miller Trust Tennessee form?

The Miller Trust Tennessee form is a legal document used to protect a portion of an individual's income when they are applying for Medicaid benefits. This form allows individuals to set aside funds that do not count against their income limit when qualifying for assistance. Understanding how to properly fill out the Miller Trust Tennessee form is essential to ensure compliance with state regulations.

-

How do I complete the Miller Trust Tennessee form using airSlate SignNow?

Completing the Miller Trust Tennessee form with airSlate SignNow is straightforward and efficient. You can easily upload the form, fill it out digitally, and add your electronic signature. This streamlined process eliminates the hassle of printing and signing documents in person, making it a convenient solution for anyone needing to submit a Miller Trust Tennessee form.

-

Are there any fees associated with using the Miller Trust Tennessee form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to access its features, including the option for electronic signature and document management. The cost to use the Miller Trust Tennessee form will depend on the plan you choose, but rest assured, our services provide an economical alternative compared to traditional methods. You can explore our pricing options on our website to find the plan that best fits your needs.

-

What are the benefits of using airSlate SignNow for the Miller Trust Tennessee form?

Using airSlate SignNow for the Miller Trust Tennessee form offers numerous benefits, such as ease of use, efficiency, and enhanced security. The platform allows for quick access to your documents anytime, anywhere, ensuring that you can complete your form on your schedule. Additionally, electronic signatures improve turnaround time and reliability, which is crucial when dealing with important Medicaid applications.

-

Can I integrate airSlate SignNow with other software while completing the Miller Trust Tennessee form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your documents seamlessly. Whether you are using cloud storage services or customer relationship management (CRM) platforms, you can easily link them for a more efficient workflow when preparing your Miller Trust Tennessee form.

-

Is it secure to use airSlate SignNow for the Miller Trust Tennessee form?

Yes, security is a top priority at airSlate SignNow. The platform employs advanced encryption and security features to ensure that your documents, including the Miller Trust Tennessee form, are protected at all times. You can confidently complete and send your documents without worrying about unauthorized access or data bsignNowes.

-

What if I need help with my Miller Trust Tennessee form?

If you need assistance with your Miller Trust Tennessee form, airSlate SignNow provides excellent customer support options. Our knowledgeable team is available to answer your questions and guide you through the process. You can also access our resources and tips on completing the form accurately.

Get more for Miller Trust

Find out other Miller Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors