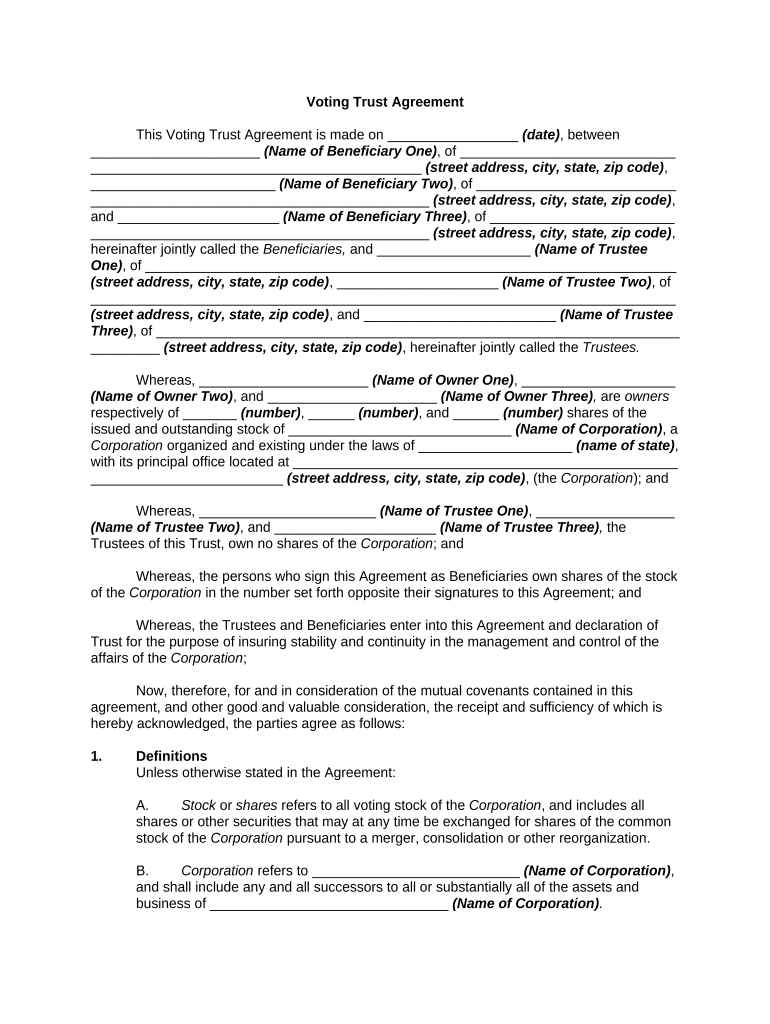

Voting Trust Agreement Form

What is the Voting Trust Agreement

A Voting Trust Agreement is a legal document that allows shareholders to transfer their voting rights to a trustee. This arrangement enables the trustee to vote on behalf of the shareholders, often used to maintain control over a corporation or manage voting in a structured manner. The agreement outlines the terms under which the voting rights are transferred, the duration of the trust, and the responsibilities of the trustee. This type of agreement is commonly utilized in corporate governance to ensure that decisions reflect the interests of the shareholders while providing a mechanism for collective decision-making.

How to use the Voting Trust Agreement

Using a Voting Trust Agreement involves several key steps. First, shareholders must agree to enter into the trust and select a trustee who will represent their interests. Next, the shareholders will draft the agreement, detailing the terms of the trust, including the duration and specific voting powers granted to the trustee. Once the document is executed, the trustee can begin to exercise the voting rights on behalf of the shareholders. It is essential to ensure that all parties understand their roles and responsibilities as outlined in the agreement to avoid any potential disputes.

Steps to complete the Voting Trust Agreement

Completing a Voting Trust Agreement requires careful attention to detail. The following steps outline the process:

- Identify the shareholders who will participate in the trust.

- Select a trustworthy individual or entity to serve as the trustee.

- Draft the Voting Trust Agreement, including terms such as duration, voting powers, and any limitations.

- Have all participating shareholders sign the agreement to formalize their consent.

- Ensure that the agreement complies with relevant state laws and corporate governance regulations.

Key elements of the Voting Trust Agreement

Several key elements must be included in a Voting Trust Agreement to ensure its effectiveness and legality:

- Parties involved: Clearly identify the shareholders and the trustee.

- Duration: Specify how long the trust will remain in effect.

- Voting rights: Detail the extent of the voting powers granted to the trustee.

- Trustee responsibilities: Outline the duties and obligations of the trustee.

- Amendment and termination provisions: Include terms for modifying or dissolving the agreement.

Legal use of the Voting Trust Agreement

The legal use of a Voting Trust Agreement is governed by state laws and corporate regulations. It is important to ensure that the agreement complies with the applicable legal framework to be enforceable. The agreement should be executed in accordance with state requirements, which may include notarization or filing with relevant authorities. Additionally, the trust must be structured in a way that does not violate any corporate governance rules or shareholder rights. Consulting with a legal professional can help ensure that the agreement is valid and effectively protects the interests of all parties involved.

Examples of using the Voting Trust Agreement

Voting Trust Agreements are often employed in various scenarios, such as:

- When a group of shareholders wants to consolidate their voting power to influence corporate decisions.

- In family-owned businesses, where family members may want to maintain control over the company while allowing non-family members to hold shares.

- During mergers or acquisitions, to manage the voting process and align shareholder interests.

Quick guide on how to complete voting trust agreement

Complete Voting Trust Agreement effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Voting Trust Agreement on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Voting Trust Agreement with ease

- Obtain Voting Trust Agreement and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the information and click on the Done button to store your changes.

- Choose how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Voting Trust Agreement while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Voting Trust Agreement?

A Voting Trust Agreement is a legal document that allows shareholders to transfer their voting rights to a designated trustee. This agreement helps in managing corporate governance and decision-making effectively, especially in complex business structures.

-

How does airSlate SignNow support Voting Trust Agreements?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning Voting Trust Agreements. With its user-friendly interface, businesses can efficiently manage their voting trust documents and ensure compliance with legal standards.

-

What are the benefits of using airSlate SignNow for Voting Trust Agreements?

Using airSlate SignNow for your Voting Trust Agreement helps in saving time and reducing paperwork. Its electronic signature capabilities expedite the signing process, while secure cloud storage ensures that your documents are accessible and protected.

-

What pricing plans does airSlate SignNow offer for managing Voting Trust Agreements?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses, regardless of their size. You can choose a plan that fits your requirements for managing Voting Trust Agreements and enjoy a cost-effective solution.

-

Can I customize my Voting Trust Agreement templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their Voting Trust Agreement templates to meet specific business needs. You can modify text, fields, and other elements to create a document that suits your requirements.

-

Are there integrations available for airSlate SignNow to enhance Voting Trust Agreement management?

airSlate SignNow offers numerous integrations with popular productivity tools, allowing easy access and management of your Voting Trust Agreements. This connectivity streamlines your workflow and enhances collaboration across departments.

-

Is airSlate SignNow compliant with legal standards for Voting Trust Agreements?

Absolutely! airSlate SignNow is designed to comply with legal regulations regarding eSignatures and document management. This compliance gives users confidence that their Voting Trust Agreements are valid and legally binding.

Get more for Voting Trust Agreement

- New york state e file signature authorization for tax year 2020 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

- Sc1120s scgov form

- Sc1065 k 1 form

- It 2664 department of taxation and finance form

- Wformstestdevelopmentsc990t3315sc990t331502xft

- Due by the 15th day of the fourth month following the close of the taxable year form

- Statutory required 6 month filing window for cagov form

- Fiduciary declaration of estimated tax form

Find out other Voting Trust Agreement

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free