Dss 4 Form

What is the DSS 4?

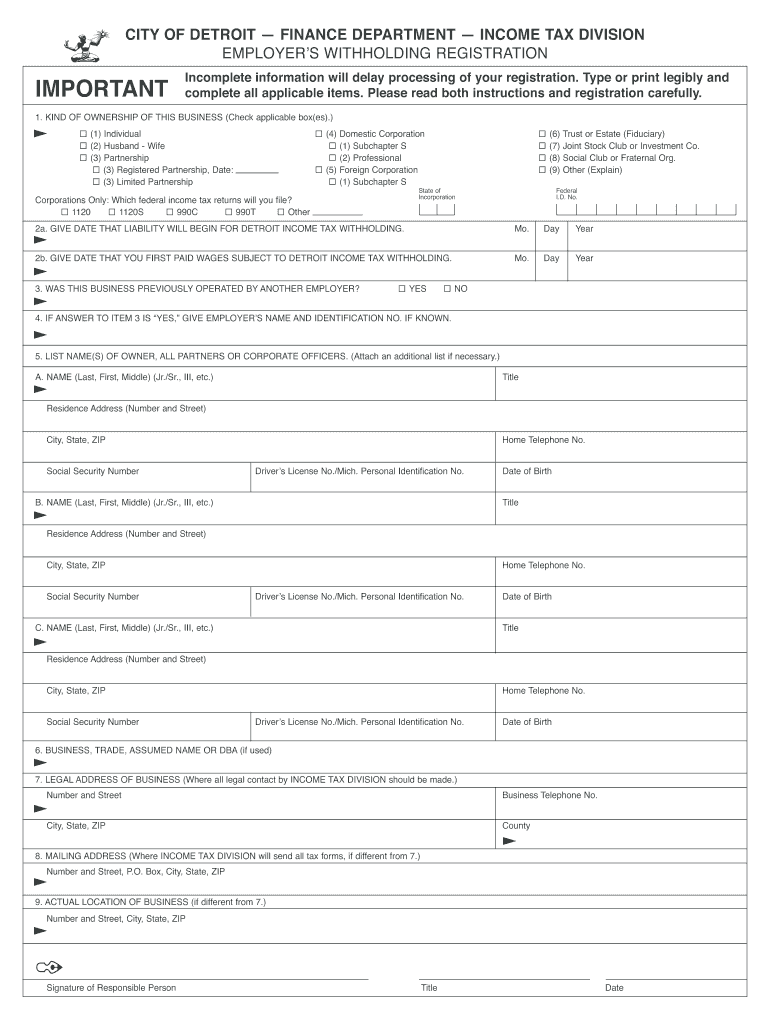

The DSS 4 is a specific form utilized by the City of Detroit for income tax purposes. It is primarily used for employer withholding registration. This form is essential for businesses operating within the city limits to ensure compliance with local tax regulations. By completing the DSS 4, employers can register to withhold city income taxes from their employees' wages, thereby fulfilling their legal obligations under the city’s income tax ordinance.

How to Obtain the DSS 4

To obtain the DSS 4 form, employers can visit the City of Detroit Finance Department's official website. The form is typically available for download in a printable format. Additionally, employers may request a physical copy by contacting the City of Detroit Income Tax Division directly. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to Complete the DSS 4

Completing the DSS 4 involves several key steps:

- Download the Form: Access the form from the City of Detroit Finance Department website.

- Fill in Employer Information: Provide necessary details such as the business name, address, and federal tax identification number.

- Specify Withholding Information: Indicate the type of business entity and the expected number of employees.

- Review and Sign: Ensure all information is accurate before signing the form.

- Submit the Form: Follow the submission guidelines to file the form electronically or via mail.

Legal Use of the DSS 4

The DSS 4 must be used in accordance with the regulations set forth by the City of Detroit. Employers are legally required to file this form to register for withholding city income taxes. Failure to do so may result in penalties or fines. It is crucial for employers to understand their responsibilities under local tax laws to maintain compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Employers should be aware of specific deadlines associated with the DSS 4. Typically, the form must be submitted prior to the start of withholding taxes from employee wages. It is advisable to check the City of Detroit Income Tax Division's website for any updates on filing deadlines, as these can vary based on legislative changes or administrative decisions.

Form Submission Methods

The DSS 4 can be submitted through various methods to accommodate different preferences:

- Online Submission: Employers can submit the form electronically through the City of Detroit's online portal.

- Mail: The completed form can be sent via postal service to the designated address provided by the City of Detroit Income Tax Division.

- In-Person: Employers may also choose to deliver the form in person at the Finance Department's office.

Penalties for Non-Compliance

Failure to file the DSS 4 or to withhold the appropriate city income taxes can lead to significant penalties. Employers may face fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to adhere to all filing requirements to avoid these consequences and ensure smooth operations within the city.

Quick guide on how to complete form dss4 city of detroit detroitmi

Your assistance manual on how to prepare your Dss 4

If you’re curious about how to create and submit your Dss 4, here are a few straightforward instructions on how to make tax submission easier.

To begin, you only need to sign up for your airSlate SignNow account to change how you manage documentation online. airSlate SignNow is a user-friendly and robust document solution that enables you to edit, generate, and complete your tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, and go back to modify responses as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Dss 4 in moments:

- Create your account and start editing PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Select Get form to access your Dss 4 in our editor.

- Populate the essential fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Please remember that paper filing can increase the likelihood of return errors and delay refunds. Naturally, before e-filing your taxes, review the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the form dss4 city of detroit detroitmi

How to make an eSignature for your Form Dss4 City Of Detroit Detroitmi online

How to generate an electronic signature for your Form Dss4 City Of Detroit Detroitmi in Google Chrome

How to generate an eSignature for putting it on the Form Dss4 City Of Detroit Detroitmi in Gmail

How to create an electronic signature for the Form Dss4 City Of Detroit Detroitmi from your smartphone

How to create an eSignature for the Form Dss4 City Of Detroit Detroitmi on iOS devices

How to create an eSignature for the Form Dss4 City Of Detroit Detroitmi on Android devices

People also ask

-

What is employers withholding registration?

Employers withholding registration refers to the process by which employers register with state tax agencies to withhold income tax from employees' wages. airSlate SignNow simplifies this process by allowing businesses to eSign and securely send registration documents, ensuring compliance and ease of management.

-

How does airSlate SignNow assist with employers withholding registration?

airSlate SignNow provides a user-friendly platform for employers to complete and send all necessary documentation for employers withholding registration. Our automated workflows ensure that you meet deadlines efficiently while maintaining compliance with state regulations.

-

What are the costs associated with employers withholding registration using airSlate SignNow?

Using airSlate SignNow for employers withholding registration is cost-effective, with various pricing plans tailored to meet the needs of different businesses. We offer flexible options based on usage, ensuring you only pay for what you need when managing your registration processes.

-

Can airSlate SignNow integrate with my payroll system for employers withholding registration?

Yes, airSlate SignNow seamlessly integrates with various payroll systems to streamline the employers withholding registration process. This integration allows for automatic updates and efficient data transfer, minimizing manual input and reducing errors.

-

What features does airSlate SignNow offer to enhance employers withholding registration?

airSlate SignNow offers features like templates for quick completion of employers withholding registration documents, audit trails for compliance tracking, and secure eSigning options. These features not only simplify the registration process but also enhance overall document management.

-

Is airSlate SignNow secure for handling employers withholding registration documents?

Absolutely! airSlate SignNow prioritizes security by implementing advanced encryption and secure cloud storage for all employers withholding registration documents. You can trust that your sensitive information is protected throughout the eSigning process.

-

What benefits do businesses gain from using airSlate SignNow for employers withholding registration?

By using airSlate SignNow for employers withholding registration, businesses enjoy faster processing times, reduced paperwork, and greater compliance assurance. The intuitive platform also empowers employees to complete documents remotely, enhancing overall productivity.

Get more for Dss 4

- Ma will form 497310022

- Legal last will and testament form for married person with adult and minor children from prior marriage massachusetts

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage massachusetts

- Legal last will and testament form for married person with adult and minor children massachusetts

- Ma legal form

- Mutual wills package with last wills and testaments for married couple with adult and minor children massachusetts form

- Ma widow form

- Legal last will and testament form for widow or widower with minor children massachusetts

Find out other Dss 4

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form