Silent Partner Form

What is the Silent Partner

A silent partner is an individual or entity that invests capital into a partnership business but does not participate in its day-to-day operations or management. This type of partner typically provides financial support in exchange for a share of the profits, while remaining uninvolved in decision-making processes. Silent partners can be beneficial for businesses seeking funding without relinquishing control to their investors.

Key elements of the Silent Partner

Understanding the key elements of a silent partner is essential for establishing a successful partnership. These elements include:

- Investment: Silent partners contribute capital to the business, which can be used for various purposes such as expansion or operational costs.

- Profit Sharing: In return for their investment, silent partners receive a percentage of the profits, usually outlined in the partnership agreement.

- Limited Liability: Silent partners typically enjoy limited liability, meaning their financial risk is confined to their investment in the partnership.

- No Management Role: They do not have a say in daily operations or decision-making, allowing them to remain passive investors.

Steps to complete the Silent Partner

Completing the silent partner agreement involves several steps to ensure clarity and legal compliance:

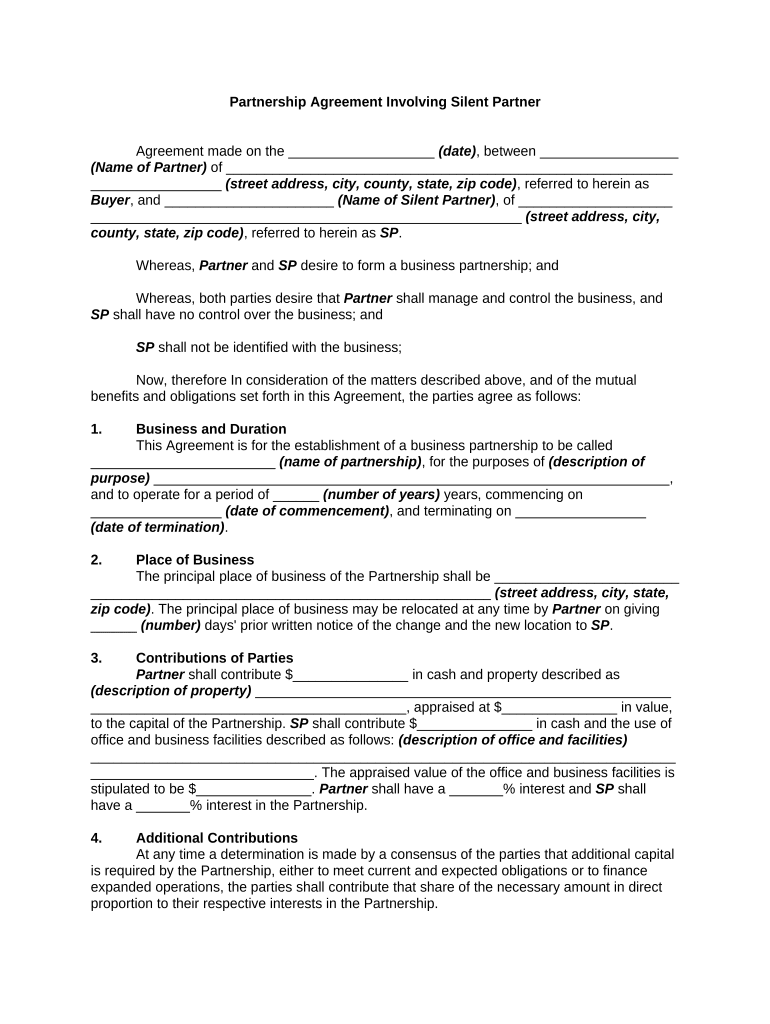

- Draft the Agreement: Outline the terms of the partnership, including investment amount, profit sharing, and roles.

- Review Legal Requirements: Ensure compliance with state laws regarding partnerships and investments.

- Sign the Agreement: Both parties should sign the agreement to make it legally binding, ideally using an electronic signature solution for convenience.

- Maintain Records: Keep detailed records of all transactions and communications related to the partnership.

Legal use of the Silent Partner

The legal use of a silent partner is governed by partnership laws, which can vary by state. Key considerations include:

- Partnership Agreement: A clearly defined agreement is crucial for outlining the rights and responsibilities of all partners.

- Compliance with Regulations: Ensure adherence to federal and state regulations regarding business partnerships, including tax obligations.

- Protection of Interests: Silent partners should understand their rights to protect their investment and ensure they receive their share of profits.

IRS Guidelines

Silent partners must adhere to IRS guidelines regarding taxation and reporting. Key points include:

- Tax Reporting: Silent partners must report their share of partnership income on their personal tax returns, typically using Schedule E.

- Self-Employment Tax: Depending on the partnership structure, silent partners may not be subject to self-employment tax on their earnings.

- Partnership Returns: The partnership itself must file an annual information return (Form 1065) to report income, deductions, and other financial details.

Examples of using the Silent Partner

Silent partners can be utilized in various business scenarios, such as:

- Startups: A silent partner may provide initial funding to a startup in exchange for equity without being involved in daily operations.

- Franchise Businesses: An investor may act as a silent partner in a franchise, providing capital while the franchisee manages operations.

- Real Estate Ventures: Silent partners often invest in real estate projects, contributing funds while the managing partner handles property management.

Quick guide on how to complete silent partner 497331151

Finalize Silent Partner seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to locate the appropriate template and safely store it online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents quickly without issues. Manage Silent Partner on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign Silent Partner with ease

- Locate Silent Partner and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click on the Done button to save your modifications.

- Choose how you wish to send your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Silent Partner and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the concept of a 'silent partner'?

airSlate SignNow is an innovative eSignature solution that allows businesses to send and sign documents effortlessly. In a business context, a 'silent partner' often refers to individuals who invest or provide resources without being involved in day-to-day operations. Using airSlate SignNow can simplify document handling for silent partners, ensuring efficiencies in workflows without requiring their direct involvement.

-

How can I use airSlate SignNow to streamline agreements with my silent partner?

With airSlate SignNow, you can quickly prepare, send, and track documents for signature, facilitating clear communication with your silent partner. The platform's user-friendly interface means both you and your silent partner can easily navigate the signing process. Streamlining agreements through airSlate SignNow helps save time and keep stakeholders informed.

-

What are the pricing options for airSlate SignNow for businesses with silent partners?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including those with silent partners. By choosing the plan that best fits your workflow, you can maximize efficiency without overspending. Each pricing tier includes access to essential features, making it an ideal choice for businesses looking to collaborate with silent partners.

-

What features does airSlate SignNow offer that benefit businesses with a silent partner?

airSlate SignNow includes features such as template creation, real-time notifications, and customizable workflows, all of which benefit businesses and their silent partners. These features facilitate effective communication and document management, making it easier to keep silent partners in the loop without excessive back-and-forth. This ensures that all parties can efficiently collaborate on agreements.

-

Can airSlate SignNow integrate with other platforms for businesses involving a silent partner?

Yes, airSlate SignNow supports integrations with popular business tools, which can enhance collaboration with your silent partner. Integrating systems like CRMs or project management software allows for seamless data transfer and document handling. This capability helps maintain transparency and operational efficiency while working alongside a silent partner.

-

Is airSlate SignNow secure for dealing with documents related to silent partners?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents shared with your silent partner are protected with industry-standard encryption. This security allows you to handle sensitive information confidently while keeping your silent partner informed. Trust in airSlate SignNow’s security features means both parties can focus on business growth and strategy.

-

How does airSlate SignNow improve communication with stakeholders, including silent partners?

airSlate SignNow enhances communication by providing clear documentation and automated updates to all stakeholders, including silent partners. The platform’s tracking features allow both you and your silent partner to stay informed about document status. This openness aids in building trust and maintaining smooth operations among all involved parties.

Get more for Silent Partner

Find out other Silent Partner

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA