Notice Car Form

What is the Notice Car?

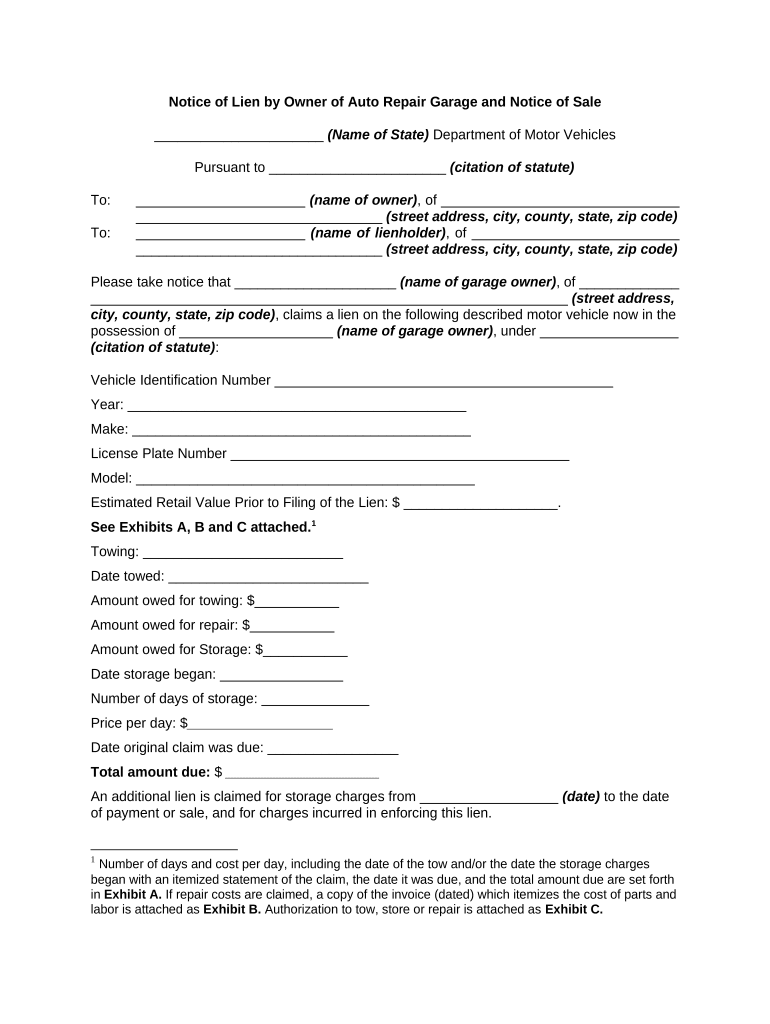

The Notice Car is a legal document that serves as a notification regarding a lien on a vehicle. This document is crucial for lien owners, as it formally establishes their claim over the vehicle in question. The Notice Car typically includes essential details such as the vehicle identification number (VIN), the owner's name, and the specific nature of the lien. It is often used in situations where the vehicle has been repaired, and the repair shop is seeking payment for services rendered. Understanding the Notice Car is vital for both vehicle owners and repair shops to ensure compliance with legal obligations.

How to Use the Notice Car

Using the Notice Car involves several steps to ensure that it is completed correctly and serves its intended purpose. First, the lien owner must fill out the form with accurate information regarding the vehicle and the lien. This includes providing the VIN, the owner's contact information, and details about the repair services performed. Once completed, the Notice Car should be delivered to the vehicle owner and, if necessary, filed with the appropriate state agency to formalize the lien. Proper usage of the Notice Car helps protect the rights of the lien owner while informing the vehicle owner of their obligations.

Steps to Complete the Notice Car

Completing the Notice Car requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the vehicle's VIN and owner details.

- Clearly state the nature of the lien and the amount owed for repairs.

- Fill out the Notice Car form accurately, ensuring all fields are completed.

- Sign and date the document to validate it.

- Provide a copy to the vehicle owner and retain one for your records.

- If required, file the Notice Car with your state’s department of motor vehicles or relevant agency.

Following these steps helps ensure that the Notice Car is legally binding and effectively communicates the lien to the vehicle owner.

Legal Use of the Notice Car

The legal use of the Notice Car is governed by state laws, which can vary significantly. Generally, the document must comply with the Uniform Commercial Code (UCC) and any relevant state-specific regulations. It is essential for lien owners to understand their rights and responsibilities under the law when using the Notice Car. This includes ensuring that the lien is valid, properly documented, and filed within the required timeframes. Legal compliance not only protects the lien owner's interests but also helps avoid potential disputes with vehicle owners.

Key Elements of the Notice Car

Several key elements must be included in the Notice Car to ensure its effectiveness and legal standing:

- Vehicle Identification Number (VIN): This unique identifier is crucial for accurately identifying the vehicle.

- Owner Information: The name and contact details of the vehicle owner must be clearly stated.

- Details of the Lien: A description of the services provided and the amount owed should be included.

- Date of Service: The date when the repairs were completed is important for establishing the timeline of the lien.

- Signature: The lien owner's signature is necessary to validate the document.

Including these elements helps ensure that the Notice Car is comprehensive and legally enforceable.

State-Specific Rules for the Notice Car

Each state in the U.S. has its own regulations regarding the Notice Car, which can affect how it is used and filed. It is important for lien owners to familiarize themselves with their state's specific requirements, including any forms that must be submitted alongside the Notice Car. Some states may require additional documentation or have different filing procedures. Understanding these state-specific rules can help prevent legal issues and ensure that the lien is enforceable.

Quick guide on how to complete notice car 497331229

Prepare Notice Car effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage Notice Car on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Notice Car without hassle

- Find Notice Car and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or shield sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign Notice Car and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is lien auto repair and how does it work?

Lien auto repair refers to the process of fixing issues related to car liens, ensuring that the vehicle can be legally sold or transferred. airSlate SignNow provides an efficient platform for managing lien documents, allowing users to eSign and share necessary paperwork swiftly. This ensures clarity in transactions and helps avoid legal complications.

-

How can airSlate SignNow help with lien auto repair documentation?

airSlate SignNow streamlines the lien auto repair documentation process by allowing users to create, send, and eSign necessary forms quickly. This digital solution minimizes the risk of errors and improves the overall efficiency of handling lien-related documents. Users can access templates specifically designed for lien auto repair to simplify their workflow.

-

Is airSlate SignNow cost-effective for businesses dealing with lien auto repair?

Yes, airSlate SignNow is a cost-effective solution for businesses involved in lien auto repair. It offers various pricing plans designed to fit different business needs, helping companies save money while ensuring compliance and efficiency in document management. Investing in airSlate SignNow can lead to signNow time and cost savings in the lien resolution process.

-

What features does airSlate SignNow offer for lien auto repair?

airSlate SignNow provides several features tailored for lien auto repair, such as customizable templates, electronic signatures, and secure document storage. The platform also includes tracking options that allow users to monitor the status of their lien documents. These features enhance efficiency and ensure that all necessary steps are completed accurately.

-

Can airSlate SignNow be integrated with other software for lien auto repair?

Absolutely! airSlate SignNow offers integration capabilities with popular software systems that are commonly used in the lien auto repair industry. This ensures that your document management process is seamless, allowing for easy data transfer and enhanced collaboration across different platforms. Integrating airSlate SignNow can help streamline operations and improve productivity.

-

What benefits does airSlate SignNow provide for lien auto repair professionals?

The primary benefits of using airSlate SignNow within the lien auto repair sector include increased efficiency, reduced turnaround times, and improved compliance with legal requirements. By digitizing the paperwork, professionals can spend less time on administrative tasks and more time focusing on repairs. This leads to better customer satisfaction and enhances overall business operations.

-

Is the electronic signature process secure for lien auto repair documents?

Yes, airSlate SignNow prioritizes the security of electronic signatures for lien auto repair documents. The platform employs advanced encryption protocols to protect sensitive information, ensuring that all signed documents are safe and legally binding. Users can have peace of mind knowing that their transactions are secure throughout the lien resolution process.

Get more for Notice Car

Find out other Notice Car

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF