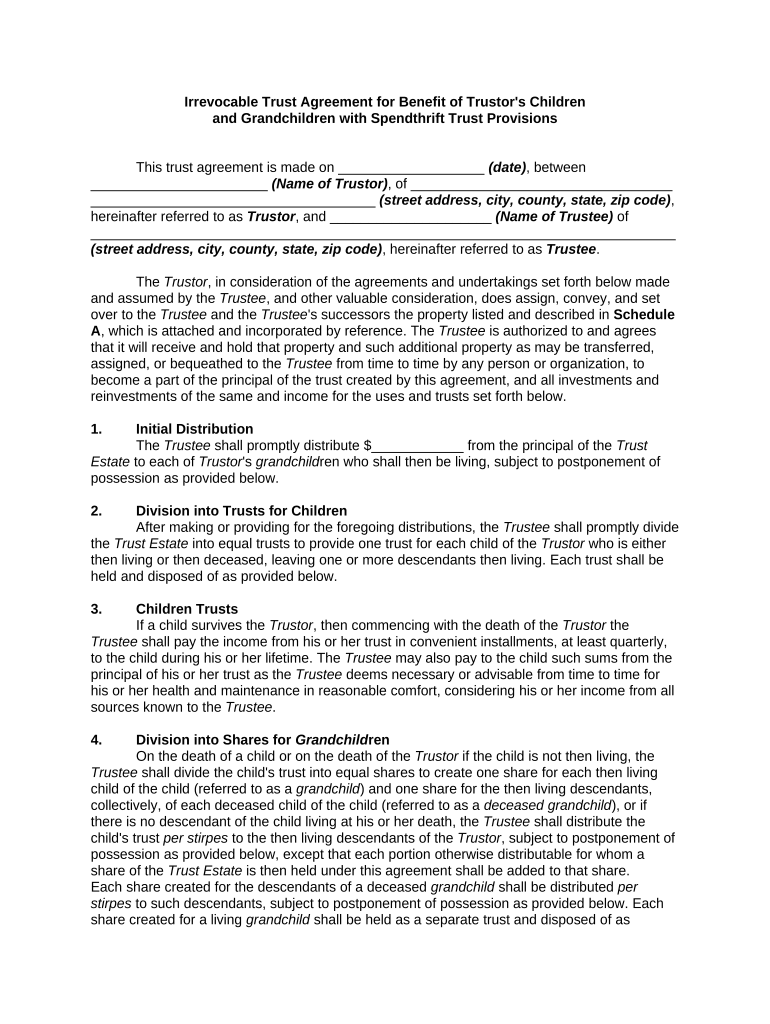

Irrevocable Trust Spendthrift Form

What is the irrevocable trust spendthrift?

An irrevocable trust spendthrift is a specific type of trust designed to protect the assets placed within it from creditors while providing for the beneficiaries. Once established, the grantor cannot modify or revoke the trust, ensuring that the assets are managed according to the terms set forth in the trust document. This type of trust is particularly useful for individuals who wish to safeguard their beneficiaries from poor financial decisions or external claims against their assets.

Key elements of the irrevocable trust spendthrift

Several key elements define an irrevocable trust spendthrift, making it distinct from other trust types. These include:

- Asset Protection: The assets within the trust are shielded from creditors, ensuring that beneficiaries cannot access them directly, which helps prevent financial mismanagement.

- Beneficiary Restrictions: The trust document can specify conditions under which beneficiaries receive distributions, allowing for controlled access to funds.

- Trustee Authority: A designated trustee manages the trust assets and is responsible for making distributions according to the trust's terms, ensuring proper oversight.

- Irrevocability: Once the trust is established, the grantor relinquishes control over the assets, making it difficult to alter the trust's terms or withdraw assets.

Steps to complete the irrevocable trust spendthrift

Completing an irrevocable trust spendthrift involves several important steps to ensure legal validity and proper execution. The process typically includes:

- Consultation with a Legal Professional: Engaging an attorney experienced in trusts and estates can provide guidance on the specific requirements and implications of creating a spendthrift trust.

- Drafting the Trust Document: The trust document must outline the terms, including the trustee's powers, beneficiary rights, and asset management strategies.

- Funding the Trust: Transferring assets into the trust is essential. This may involve changing titles or designating the trust as the beneficiary of certain accounts.

- Signing and Notarizing the Document: The trust document typically requires signatures from the grantor and trustee, and notarization may be necessary to enhance its legal standing.

Legal use of the irrevocable trust spendthrift

The legal use of an irrevocable trust spendthrift is governed by state laws, which can vary significantly. Generally, these trusts are utilized to protect assets from creditors, manage wealth for beneficiaries, and ensure that the grantor's wishes are fulfilled even after their passing. Compliance with state-specific regulations is crucial to maintain the trust's validity and effectiveness.

Examples of using the irrevocable trust spendthrift

There are various scenarios in which an irrevocable trust spendthrift can be beneficial. Examples include:

- Protecting Inheritance: Parents may establish a spendthrift trust for their children to ensure that the assets are managed responsibly and not squandered.

- Special Needs Planning: A spendthrift trust can provide for a beneficiary with special needs without jeopardizing their eligibility for government assistance.

- Asset Preservation: Individuals facing potential lawsuits may use this trust to protect their assets from being claimed by creditors.

Who issues the form?

The form for establishing an irrevocable trust spendthrift is typically created by the grantor or their legal representative. While there is no official government agency that issues this specific form, it is essential that the document complies with state laws and regulations. Legal professionals often assist in drafting the trust document to ensure it meets all necessary legal requirements.

Quick guide on how to complete irrevocable trust spendthrift

Accomplish Irrevocable Trust Spendthrift effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irrevocable Trust Spendthrift on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Irrevocable Trust Spendthrift with ease

- Find Irrevocable Trust Spendthrift and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Irrevocable Trust Spendthrift and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a spendthrift trust template?

A spendthrift trust template is a legal document designed to protect assets from being misused by beneficiaries. It allows you to set terms on how the funds can be used, ensuring that the trust's assets are managed prudently. With airSlate SignNow, you can easily customize a spendthrift trust template to fit your specific needs.

-

How can I create a spendthrift trust template with airSlate SignNow?

Creating a spendthrift trust template with airSlate SignNow is straightforward. Simply choose a pre-built template from our library, modify it to reflect your requirements, and you’re ready to go. Our platform provides an intuitive interface that guides you through the customization process.

-

What features does the spendthrift trust template include?

The spendthrift trust template includes essential features such as customizable clauses, provisions for asset management, and conditions for distribution. You can also specify trustee powers and limitations to ensure proper oversight. These features help you tailor the trust to your specific intentions.

-

Is the spendthrift trust template compliant with legal standards?

Yes, the spendthrift trust template provided by airSlate SignNow is designed to comply with applicable state laws and regulations. We ensure that the template is updated regularly so that you can create legally binding documents with confidence. Always consult with a legal professional to verify its compliance in your jurisdiction.

-

What are the benefits of using a spendthrift trust template?

Using a spendthrift trust template can provide peace of mind by protecting your assets from creditors and irresponsible spending by beneficiaries. It allows you to retain control over how and when assets are distributed. Additionally, our template streamlines the documentation process, saving you time and reducing administrative burden.

-

How much does the spendthrift trust template cost?

The spendthrift trust template is available at an affordable price as part of your airSlate SignNow subscription. Pricing plans vary based on features and user needs, ensuring you find a suitable option. Visit our pricing page for more details on costs and any available promotions.

-

Can I integrate the spendthrift trust template with other tools?

Absolutely! airSlate SignNow allows for seamless integration with several popular applications, enhancing your workflow. You can connect your spendthrift trust template with tools like CRM software, storage services, and payment platforms, making document management more efficient.

Get more for Irrevocable Trust Spendthrift

Find out other Irrevocable Trust Spendthrift

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors