Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

What is the Form N 35, Rev 2013, S Corporation Income Tax Return?

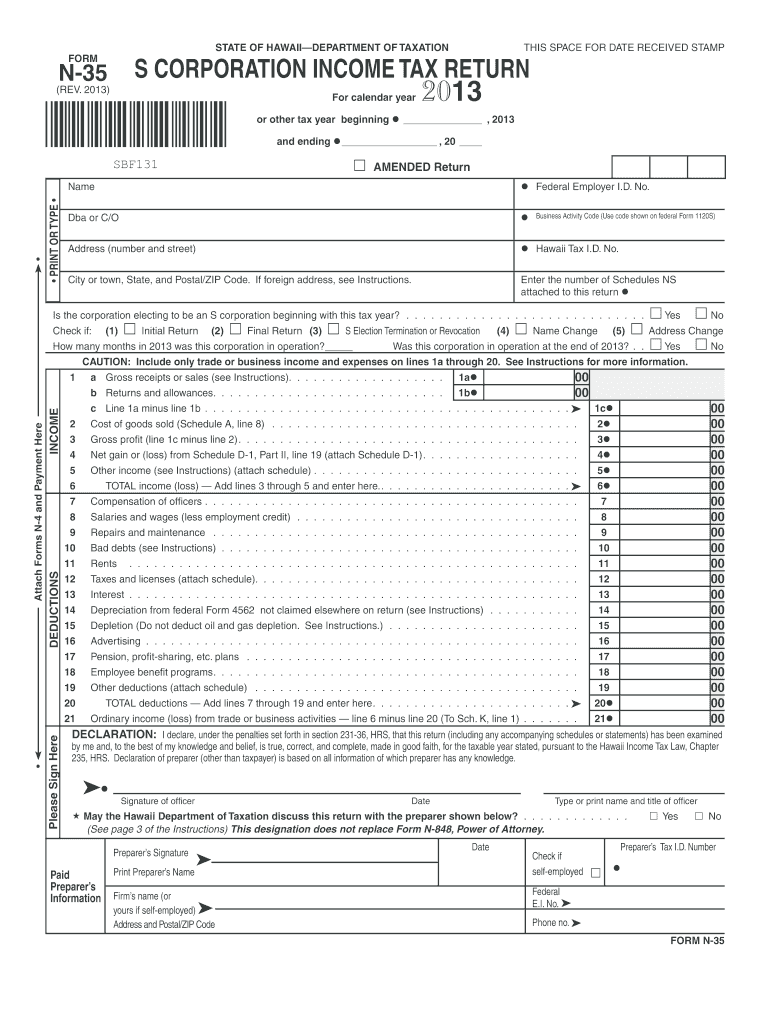

The Form N 35, Rev 2013, is a crucial document used by S Corporations in Hawaii to report income, deductions, and credits to the state. This form allows S Corporations to calculate their state tax liabilities accurately. It is specifically designed for entities that have elected to be taxed as S Corporations under federal law, which means they pass income, losses, and deductions through to their shareholders. Understanding the purpose and requirements of this form is essential for compliance with state tax regulations.

Steps to Complete the Form N 35, Rev 2013

Completing the Form N 35 requires careful attention to detail. Here are the key steps involved:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the identification section, including the corporation's name, address, and federal employer identification number.

- Report the corporation's income, deductions, and credits in the appropriate sections of the form.

- Calculate the total tax due, ensuring all figures are accurate and consistent with supporting documentation.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Form N 35, Rev 2013

The Form N 35 is legally binding when completed and submitted in accordance with Hawaii tax laws. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. The form must be signed by an authorized representative of the corporation, affirming that the information is correct to the best of their knowledge. Compliance with both state and federal regulations is crucial for the legal validity of this document.

Filing Deadlines / Important Dates

Timely filing of the Form N 35 is critical to avoid penalties. The deadline for submitting this form typically aligns with the federal tax return due date for S Corporations, which is usually the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is advisable to check for any changes to deadlines or extensions that may apply.

How to Obtain the Form N 35, Rev 2013

The Form N 35 can be obtained from the Hawaii Department of Taxation's website or directly from tax offices across the state. It is available in a fillable PDF format, allowing for easy digital completion. Additionally, businesses may choose to consult with tax professionals who can provide guidance and ensure that the form is filled out correctly.

Key Elements of the Form N 35, Rev 2013

Understanding the key elements of the Form N 35 is vital for accurate completion. Important sections include:

- Income Reporting: Details regarding total income earned by the S Corporation.

- Deductions: Information on allowable deductions that can reduce taxable income.

- Tax Credits: Any credits that the corporation is eligible for, which can lower the overall tax liability.

- Signature Section: A declaration that the information provided is accurate, requiring a signature from an authorized officer.

Quick guide on how to complete form n 35 rev 2013 s corporation income tax return forms 2013 fillable

Complete Form N 35, Rev , S Corporation Income Tax Return Forms Fillable effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form N 35, Rev , S Corporation Income Tax Return Forms Fillable across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Form N 35, Rev , S Corporation Income Tax Return Forms Fillable with ease

- Locate Form N 35, Rev , S Corporation Income Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, the hassle of searching for forms, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form N 35, Rev , S Corporation Income Tax Return Forms Fillable and ensure clear communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 35 rev 2013 s corporation income tax return forms 2013 fillable

How to create an eSignature for your Form N 35 Rev 2013 S Corporation Income Tax Return Forms 2013 Fillable online

How to create an eSignature for the Form N 35 Rev 2013 S Corporation Income Tax Return Forms 2013 Fillable in Chrome

How to generate an electronic signature for putting it on the Form N 35 Rev 2013 S Corporation Income Tax Return Forms 2013 Fillable in Gmail

How to make an eSignature for the Form N 35 Rev 2013 S Corporation Income Tax Return Forms 2013 Fillable right from your smart phone

How to generate an electronic signature for the Form N 35 Rev 2013 S Corporation Income Tax Return Forms 2013 Fillable on iOS devices

How to make an eSignature for the Form N 35 Rev 2013 S Corporation Income Tax Return Forms 2013 Fillable on Android

People also ask

-

What is the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable?

The Form N 35, Rev , S Corporation Income Tax Return Forms Fillable is a tax form used by S corporations in Hawaii to report income, deductions, and credits. It is designed to simplify the filing process for businesses by allowing them to complete and submit their tax forms electronically. This fillable version ensures that all necessary information is easily entered and calculated.

-

How does airSlate SignNow support the completion of Form N 35, Rev , S Corporation Income Tax Return Forms Fillable?

airSlate SignNow provides an intuitive platform that allows users to easily fill out the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable. With features like eSignature capabilities and document management, businesses can streamline their tax filing process, ensuring compliance and efficiency. Users can also save their progress and access their forms anytime.

-

Are there any costs associated with using airSlate SignNow for Form N 35, Rev , S Corporation Income Tax Return Forms Fillable?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs, including options for using the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable. While there may be a subscription fee, the platform is recognized for providing cost-effective solutions that can save businesses time and resources during tax season.

-

What features does airSlate SignNow offer for managing Form N 35, Rev , S Corporation Income Tax Return Forms Fillable?

airSlate SignNow offers several features tailored for managing the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable, including customizable templates, secure cloud storage, and real-time collaboration. These features enable users to efficiently fill out, share, and sign documents, enhancing the overall filing experience.

-

Can I integrate airSlate SignNow with other software for handling Form N 35, Rev , S Corporation Income Tax Return Forms Fillable?

Absolutely! airSlate SignNow easily integrates with various third-party applications such as accounting software and CRM systems, making it easier to manage the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable. This integration ensures that all relevant data is synchronized, reducing manual entry and improving accuracy.

-

Is the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable secure on airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform utilizes advanced encryption protocols to protect sensitive information submitted through the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable. Additionally, user access controls and audit trails ensure that only authorized individuals can view or edit the documents.

-

What are the benefits of using airSlate SignNow for Form N 35, Rev , S Corporation Income Tax Return Forms Fillable?

Using airSlate SignNow for the Form N 35, Rev , S Corporation Income Tax Return Forms Fillable offers numerous benefits, including efficiency, reduced paperwork, and enhanced organization. The eSigning feature allows for faster approvals, which can expedite the filing process. Plus, the fillable form format minimizes errors, ensuring compliance and accuracy.

Get more for Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

- Letter tenant landlord demand 497310227 form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497310228 form

- Maryland tenant landlord agreement form

- Letter landlord demand sample form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises maryland form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles maryland form

- Letter from tenant to landlord about landlords failure to make repairs maryland form

- Maryland notice rent form

Find out other Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim