SaveResetPrintAlaskaFishery Resource Landing Form

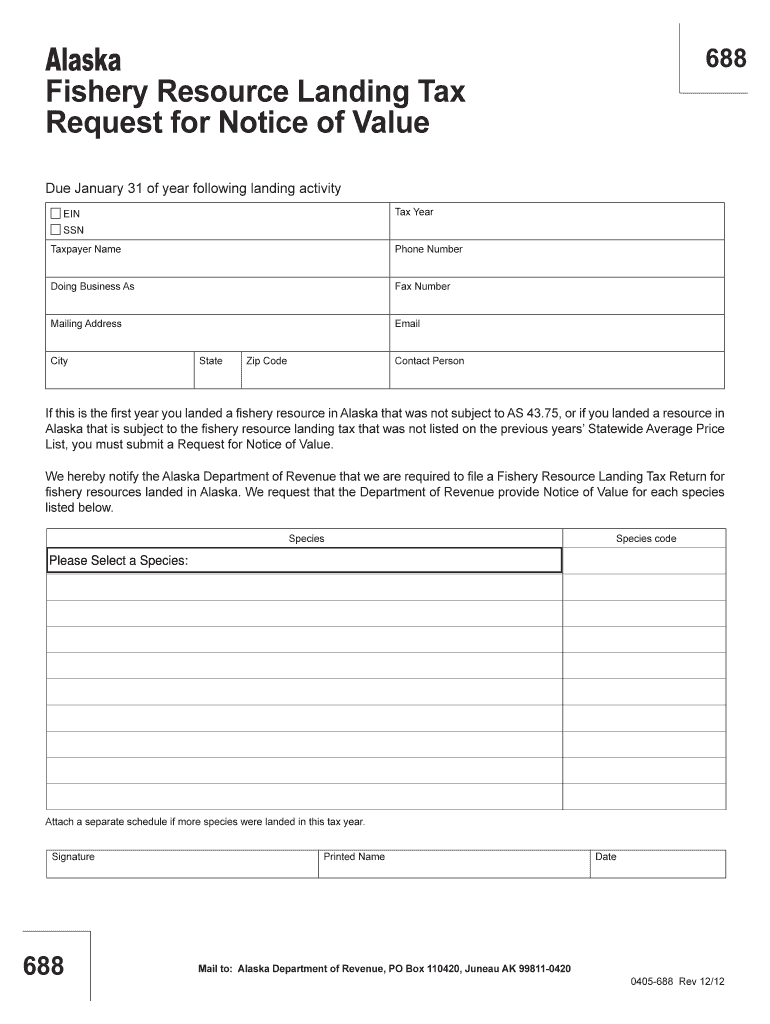

What is the 688 fishery landing tax?

The 688 fishery landing tax is a specific tax form used in the United States for reporting income related to fishery resources. It is designed to help individuals and businesses involved in the fishing industry accurately report their earnings and comply with state regulations. This form is essential for ensuring that fishery-related income is properly documented and taxed according to local laws.

Steps to complete the 688 fishery landing tax

Completing the 688 fishery landing tax involves several key steps. First, gather all necessary financial documents related to your fishing activities, such as income statements and expense receipts. Next, download the form from a reliable source. Fill out the required fields, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it. Finally, keep a copy for your records, as it may be needed for future reference or audits.

Legal use of the 688 fishery landing tax

The legal use of the 688 fishery landing tax is crucial for compliance with state and federal tax regulations. This form must be filled out accurately to avoid penalties or legal issues. It is important to understand the specific requirements set forth by the state where you operate. Utilizing digital tools for completion can enhance the legal validity of the form, especially when electronic signatures are used, provided they comply with relevant eSignature laws.

Filing deadlines for the 688 fishery landing tax

Filing deadlines for the 688 fishery landing tax can vary depending on the state and specific circumstances of the taxpayer. Typically, forms must be submitted by a certain date each year, often coinciding with the end of the tax year. It is important to stay informed about these deadlines to ensure timely submission and avoid any potential penalties for late filing.

Required documents for the 688 fishery landing tax

When completing the 688 fishery landing tax, certain documents are required to support the information provided. These may include income statements from fishing activities, expense receipts, and any relevant permits or licenses. Having these documents ready will facilitate a smoother completion process and help ensure that the information reported is accurate and comprehensive.

Form submission methods for the 688 fishery landing tax

The 688 fishery landing tax can typically be submitted through various methods, including online submission, mail, or in-person delivery to the appropriate state agency. Each method may have its own set of requirements and processing times. Choosing the right submission method can help ensure that the form is received and processed without delay.

Examples of using the 688 fishery landing tax

Examples of using the 688 fishery landing tax include scenarios where individual fishermen or fishing businesses report their earnings from sales at local markets or fish processing plants. For instance, a commercial fisherman may use this form to report income from a successful fishing season, detailing the types and quantities of fish caught. This form helps ensure that all income is accounted for and taxed appropriately, contributing to compliance with state regulations.

Quick guide on how to complete saveresetprintalaskafishery resource landing

Accomplish SaveResetPrintAlaskaFishery Resource Landing effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage SaveResetPrintAlaskaFishery Resource Landing on any device with airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to alter and eSign SaveResetPrintAlaskaFishery Resource Landing with ease

- Find SaveResetPrintAlaskaFishery Resource Landing and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign SaveResetPrintAlaskaFishery Resource Landing and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the saveresetprintalaskafishery resource landing

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is the 688 fishery landing tax download?

The 688 fishery landing tax download is a specialized document that helps fishery businesses manage their tax obligations more effectively. This form provides essential data required by regulatory authorities and simplifies the filing process, ensuring compliance and accuracy.

-

How can airSlate SignNow assist with the 688 fishery landing tax download?

airSlate SignNow allows users to eSign and manage the 688 fishery landing tax download efficiently. Our platform simplifies the signing process, making it easy to send the document for signature and track its status in real-time, thereby increasing productivity.

-

Is there a cost associated with using airSlate SignNow for the 688 fishery landing tax download?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of different businesses, including those needing the 688 fishery landing tax download. We provide competitive pricing options that ensure you receive value for a cost-effective document signing solution.

-

Can I integrate airSlate SignNow with other tools for managing the 688 fishery landing tax download?

Absolutely! airSlate SignNow supports integrations with various business applications, making it easier to manage the 688 fishery landing tax download alongside your other workflows. This versatility allows you to streamline your operations and improve efficiency.

-

What features does airSlate SignNow offer for the 688 fishery landing tax download?

AirSlate SignNow offers features such as document templates, secure eSigning, and automated reminders specifically tailored for the 688 fishery landing tax download. These features help ensure that you never miss a deadline and maintain compliance with fishing industry regulations.

-

How does using airSlate SignNow benefit my business when dealing with the 688 fishery landing tax download?

Using airSlate SignNow can save your business time and reduce errors when handling the 688 fishery landing tax download. Our platform enhances collaboration and facilitates faster document processing, allowing you to focus on growing your business without the stress of tax compliance.

-

Is airSlate SignNow secure for handling the 688 fishery landing tax download?

Yes, airSlate SignNow prioritizes security, ensuring that your 688 fishery landing tax download is protected. We utilize encryption, secure cloud storage, and compliance with data protection regulations to safeguard your documents and sensitive information.

Get more for SaveResetPrintAlaskaFishery Resource Landing

- Indemnity form for school trip 40981224

- Certificate of good conduct florida form

- 1702rt form

- We approved your form i 290b notice of appeal or motion

- Nyssma score sheet form

- Usda household member disclosure form

- Washington department of agriculture pesticide application form

- Multi engine endorsement questionnaire form

Find out other SaveResetPrintAlaskaFishery Resource Landing

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple