Ad Valorem Tax Form

What is the Ad Valorem Tax

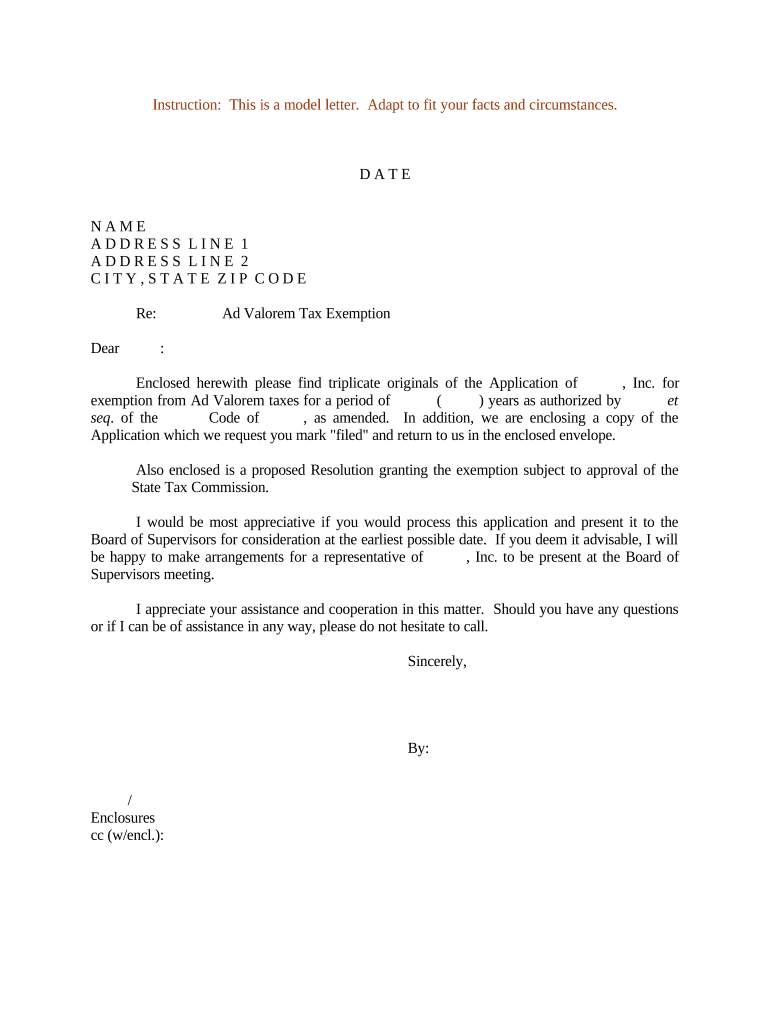

The ad valorem tax is a property tax based on the assessed value of real estate or personal property. This type of tax is commonly used by local governments in the United States to fund public services such as schools, infrastructure, and emergency services. The term "ad valorem" is derived from Latin, meaning "according to value," which reflects the principle that the tax amount is proportionate to the value of the property. For example, if a property is valued at $200,000 and the local tax rate is one percent, the annual ad valorem tax owed would be $2,000.

Steps to Complete the Ad Valorem Tax

Completing the ad valorem tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including property deeds and previous tax assessments. Next, determine the assessed value of the property, which may require an appraisal if not already provided by the local tax authority. After determining the value, fill out the ad valorem tax form, ensuring that all information is accurate and complete. Finally, submit the form to the appropriate local tax office, either online, by mail, or in person, depending on local regulations.

Key Elements of the Ad Valorem Tax

Understanding the key elements of the ad valorem tax is essential for property owners. These elements include the assessed value of the property, the local tax rate, and any exemptions that may apply. The assessed value is determined by local assessors and can vary based on property improvements or market conditions. The tax rate is set by local governments and can differ significantly between jurisdictions. Additionally, certain exemptions, such as those for senior citizens or veterans, may reduce the taxable amount, impacting the total tax owed.

Examples of Using the Ad Valorem Tax

Ad valorem taxes are applied in various scenarios across the United States. For instance, a homeowner may receive an ad valorem tax bill based on the assessed value of their home, which contributes to funding local schools and emergency services. Businesses may also be subject to ad valorem taxes on their equipment and real estate, impacting their overall operating costs. Understanding these examples helps property owners and businesses anticipate their tax obligations and plan accordingly.

Eligibility Criteria

Eligibility for the ad valorem tax varies by state and locality. Generally, all property owners, including residential, commercial, and industrial property owners, are subject to this tax. However, specific exemptions may apply based on individual circumstances, such as age, disability status, or veteran status. It is important for property owners to check with their local tax authority to understand the specific eligibility criteria and any potential exemptions that may reduce their tax liability.

Form Submission Methods

Submitting the ad valorem tax form can be done through various methods, depending on local regulations. Many jurisdictions offer online submission options, allowing property owners to complete and submit their forms electronically. Alternatively, forms can often be mailed to the local tax office or submitted in person during designated hours. It is crucial to verify the submission method accepted by the local tax authority to ensure timely processing and compliance.

Penalties for Non-Compliance

Failure to comply with ad valorem tax requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action by the local government. In extreme cases, non-payment can lead to property liens or foreclosure. Property owners are encouraged to stay informed about their tax obligations and to seek assistance if they encounter difficulties in meeting their tax responsibilities.

Quick guide on how to complete ad valorem tax 497331420

Effortlessly Prepare Ad Valorem Tax on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Ad Valorem Tax on any platform using airSlate SignNow's Android or iOS applications and simplify your document-centric operations today.

How to Edit and Electronically Sign Ad Valorem Tax with Ease

- Locate Ad Valorem Tax and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Alter and electronically sign Ad Valorem Tax to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ad valorem tax example in relation to document signing?

An ad valorem tax example often refers to property taxes calculated based on value. In the context of airSlate SignNow, it means you can streamline document signing for tax-related documents, ensuring accurate value assessment and compliance with regulations.

-

How does airSlate SignNow help manage ad valorem tax documents?

airSlate SignNow simplifies the management of ad valorem tax documents by providing easy document templates and eSignature features. This allows businesses to quickly prepare and sign essential documents, reducing errors and saving time during tax season.

-

What are the pricing options for using airSlate SignNow for ad valorem tax documents?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, whether you're managing a few documents or scaling operations. Each plan is designed to provide access to essential features ideal for handling ad valorem tax examples.

-

Can I integrate airSlate SignNow with other software for ad valorem tax management?

Yes, airSlate SignNow offers integrations with popular software applications commonly used in tax management. This allows for seamless workflows when handling ad valorem tax examples and enhances your document handling efficiency.

-

What features in airSlate SignNow are especially beneficial for dealing with ad valorem tax?

airSlate SignNow includes features such as document templates, team collaboration tools, and automated workflows, all of which are beneficial for managing ad valorem tax-related documents. These features ensure that the entire process is efficient and compliant with tax laws.

-

How secure is airSlate SignNow for signing ad valorem tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive ad valorem tax documents. The platform employs advanced encryption and authentication methods to ensure that your signed documents are safe and tamper-proof.

-

Can I use airSlate SignNow on mobile devices for ad valorem tax documentation?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to prepare and eSign ad valorem tax documents on the go. This flexibility helps ensure that you can manage your tax documents anytime, anywhere.

Get more for Ad Valorem Tax

- Fire department apparatus checklist form

- Register to vote california form

- Form cd 4001b with instr child development ca dept of education this is cd 4001b form and instructions for the fy 2013 14

- Woodmen of the world life insurance claim forms

- Online second grade reading log form

- Resource evaluation checklist form

- State of colorado mileage reimbursement form

- Smart start incident report form

Find out other Ad Valorem Tax

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now