Incorporate Partnership Form

What is the incorporate partnership?

An incorporate partnership is a specific legal structure that combines elements of both partnerships and corporations. This form allows two or more individuals to operate a business while enjoying certain benefits typically associated with corporate entities. These benefits include limited liability protection for the partners, which means personal assets are generally protected from business debts and liabilities. The incorporate partnership also allows for pass-through taxation, where profits are taxed at the individual partners' tax rates rather than at the corporate level.

How to use the incorporate partnership

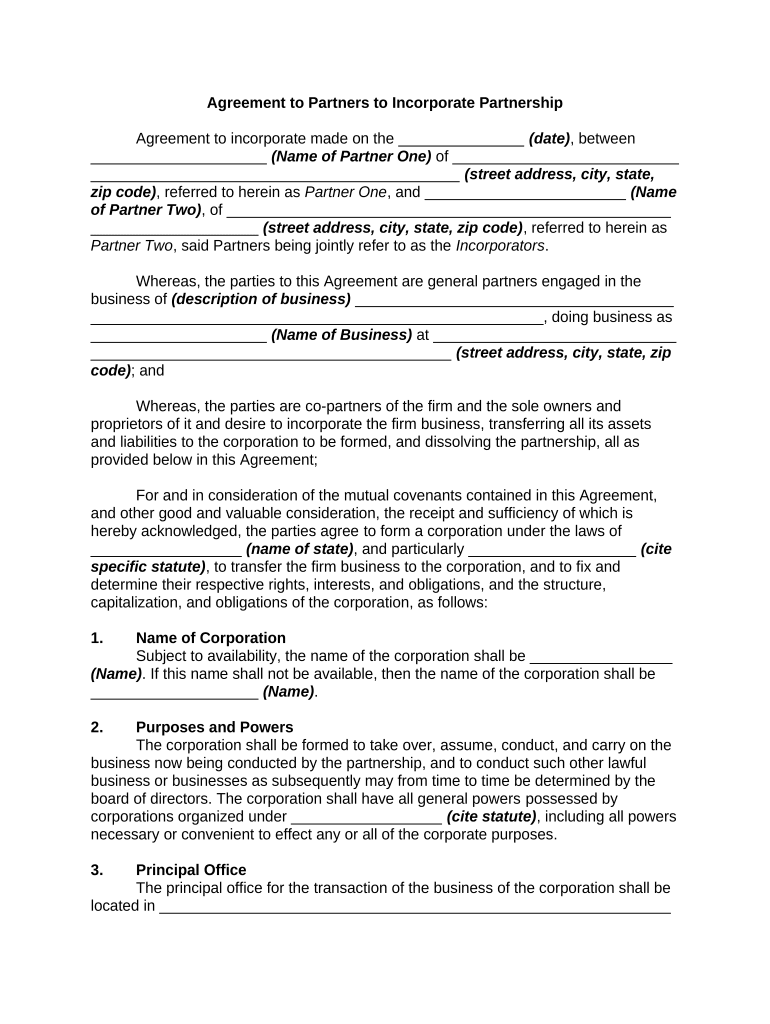

Using the incorporate partnership involves several steps that ensure compliance with state regulations. Initially, partners must draft a partnership agreement that outlines the roles, responsibilities, and profit-sharing arrangements among partners. Once the agreement is established, the partners can file the necessary paperwork with the state to officially incorporate the partnership. This may include submitting articles of incorporation and obtaining any required licenses or permits. After incorporation, the partnership can begin conducting business, entering contracts, and managing finances under its legal structure.

Steps to complete the incorporate partnership

Completing the incorporate partnership involves a series of methodical steps:

- Draft a partnership agreement: This document should detail the terms of the partnership, including each partner's contributions and responsibilities.

- Choose a business name: Ensure the name is unique and complies with state naming regulations.

- File articles of incorporation: Submit the required forms to the state, which may include information about the partnership and its members.

- Obtain necessary licenses: Depending on the business type and location, various permits may be required.

- Open a business bank account: This helps separate personal and business finances, which is crucial for liability protection.

Legal use of the incorporate partnership

The incorporate partnership must adhere to specific legal requirements to maintain its status. This includes compliance with state laws regarding business operations, tax filings, and annual reporting. Partners should also ensure that they are following any industry-specific regulations that may apply. Maintaining proper records and documentation is essential for legal protection and to avoid potential disputes among partners.

Key elements of the incorporate partnership

Several key elements define an incorporate partnership:

- Limited liability: Protects personal assets from business debts.

- Pass-through taxation: Allows profits to be taxed at individual rates instead of at the corporate level.

- Partnership agreement: A crucial document that outlines the operational framework and responsibilities of each partner.

- Compliance with state laws: Ensures that the partnership operates within legal boundaries.

Required documents

To successfully establish an incorporate partnership, several documents are typically required:

- Partnership agreement: Outlines the terms of the partnership.

- Articles of incorporation: Officially registers the partnership with the state.

- Business licenses: Varies by industry and location, necessary for legal operation.

- Tax identification number: Required for tax purposes and to open a business bank account.

Quick guide on how to complete incorporate partnership

Prepare Incorporate Partnership seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Incorporate Partnership on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to amend and eSign Incorporate Partnership with ease

- Obtain Incorporate Partnership and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Adjust and eSign Incorporate Partnership and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an incorporate partnership?

An incorporate partnership is a business structure where two or more individuals share ownership and responsibilities, typically offering limited liability protection. This setup allows partners to incorporate their business while enjoying the flexibility of partnership arrangements. Understanding this concept is crucial for anyone looking to start a cooperative venture.

-

How can airSlate SignNow help with incorporating my partnership?

airSlate SignNow streamlines the process of incorporating partnerships by enabling users to securely sign and manage documents digitally. Our platform makes it easy to gather signatures from all partners, ensuring a smooth and efficient incorporation process. With reliable tools in place, transitioning to an incorporated partnership has never been simpler.

-

What are the benefits of using airSlate SignNow for my incorporate partnership?

Using airSlate SignNow for your incorporate partnership provides signNow advantages, including cost-effective eSigning, customizable document templates, and enhanced security features. These tools allow partners to collaborate quickly and effectively, ensuring compliance and reducing paperwork. Ultimately, the platform improves operational efficiency for your incorporated partnership.

-

What features does airSlate SignNow offer for managing incorporate partnerships?

airSlate SignNow offers essential features for managing incorporate partnerships, such as automated workflows, multi-signature capabilities, and real-time tracking of document status. These tools help ensure that all partnership documents are handled promptly and correctly. Additionally, the user-friendly interface simplifies the management of all partnership-related paperwork.

-

Is airSlate SignNow affordable for small businesses looking to incorporate partnerships?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses wanting to incorporate partnerships. With flexible pricing plans, you can choose a package that best suits your business needs without sacrificing essential features. Our service helps small businesses streamline their operations and budget effectively.

-

Can airSlate SignNow integrate with other tools for my incorporate partnership?

Absolutely! airSlate SignNow integrates seamlessly with various business tools like CRM and project management systems, enhancing your workflow for incorporate partnerships. This integration capability allows for smooth data transfer and improved collaboration among partners. Connecting all your tools ensures that your incorporated partnership operates efficiently.

-

What types of documents can I manage for my incorporate partnership with airSlate SignNow?

You can manage a wide range of documents for your incorporate partnership using airSlate SignNow, including partnership agreements, incorporation documents, and operational contracts. Our platform supports all types of legally binding documents that require signatures. This versatility is crucial for maintaining organized documentation within your incorporated partnership.

Get more for Incorporate Partnership

- Rfp kci2015001 afterschool programs request for proposals for after school programs rfp kci2015001 kids central 2117 sw highway form

- Florida anti coercion form

- Aws renewal form

- Online cooking competition form

- Non conforming lot letter

- Volunteer confirmation letter form

- Non parental affidavit form

- Weekly homework for fifth grade form

Find out other Incorporate Partnership

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online