Letter Foreclosure Notice Form

What is the Letter Foreclosure Notice

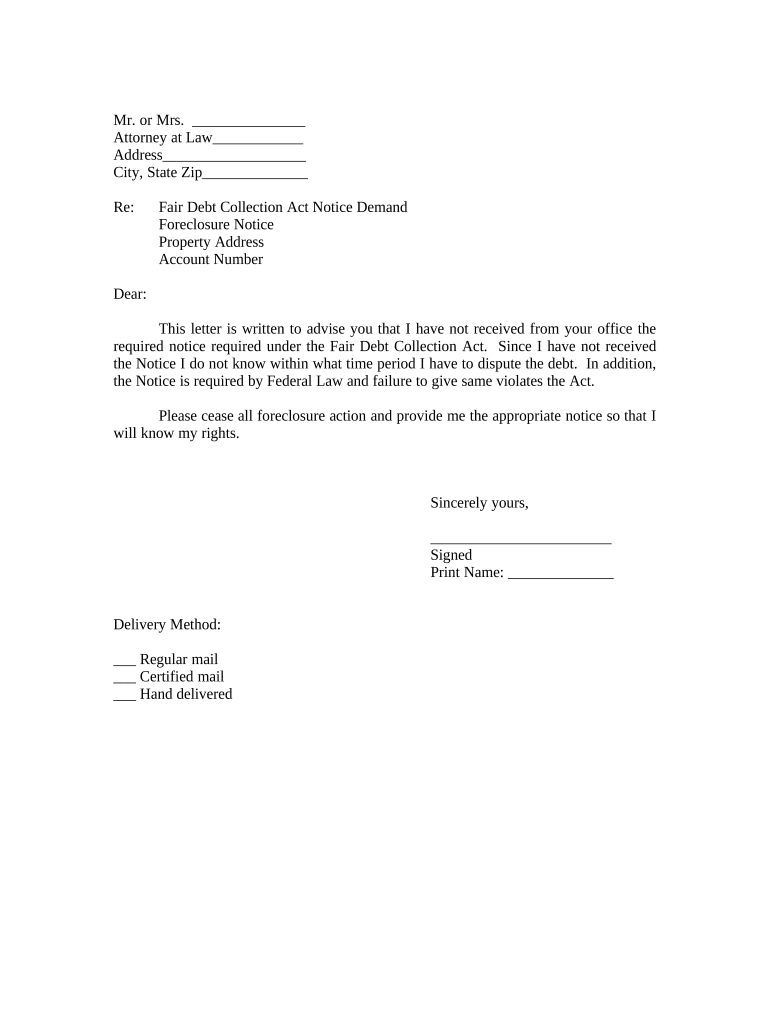

The Letter Foreclosure Notice is a formal document used by lenders to inform borrowers about the initiation of foreclosure proceedings on their property. This letter serves as a crucial communication tool, outlining the reasons for the foreclosure, the outstanding debt, and the borrower's rights. It is typically sent after a borrower has defaulted on their mortgage payments, providing them with a clear understanding of their situation and the next steps they may take.

Key Elements of the Letter Foreclosure Notice

A well-structured Letter Foreclosure Notice includes several key elements that ensure clarity and compliance with legal requirements. These elements typically include:

- Identification of Parties: Clear identification of the lender and borrower involved.

- Property Details: Specific information about the property in question, including the address and any relevant legal descriptions.

- Outstanding Debt: A detailed account of the amount owed, including principal, interest, and any applicable fees.

- Default Explanation: A clear explanation of the reasons for the foreclosure, typically related to missed payments.

- Legal Rights: Information regarding the borrower's rights and options for addressing the foreclosure.

- Contact Information: Details on how the borrower can reach the lender for further discussion or resolution.

Steps to Complete the Letter Foreclosure Notice

Completing the Letter Foreclosure Notice involves several important steps to ensure that it meets legal standards and effectively communicates the necessary information. The process typically includes:

- Gather Information: Collect all relevant details about the borrower, property, and outstanding debt.

- Draft the Notice: Create a clear and concise document that includes all key elements as outlined above.

- Review for Accuracy: Ensure that all information is accurate and complies with state and federal regulations.

- Send the Notice: Deliver the notice to the borrower through a method that provides proof of delivery, such as certified mail.

- Document the Process: Keep a record of the notice and any correspondence related to the foreclosure proceedings.

Legal Use of the Letter Foreclosure Notice

The Letter Foreclosure Notice must adhere to legal guidelines to be considered valid. In the United States, specific laws govern the foreclosure process, including requirements for notice periods and content. Compliance with these laws is essential to avoid potential legal challenges. The notice must be sent within a specified timeframe after defaulting on payments, and it should outline the borrower's rights under state law, including options for reinstatement or loan modification.

How to Obtain the Letter Foreclosure Notice

Obtaining a Letter Foreclosure Notice can be done through various means. Lenders typically have standardized templates that can be customized for individual cases. Additionally, legal professionals can assist in drafting a notice that complies with specific state requirements. Borrowers may also find sample letters online, but it is crucial to ensure that any template used adheres to the applicable laws in their state.

Examples of Using the Letter Foreclosure Notice

Understanding how to effectively use the Letter Foreclosure Notice can help both lenders and borrowers navigate the foreclosure process. For lenders, providing a clear and informative notice can facilitate communication and potentially lead to resolution before the foreclosure proceeds. For borrowers, recognizing the contents of the notice can empower them to take appropriate actions, such as seeking legal counsel or negotiating with the lender to explore alternatives to foreclosure.

Quick guide on how to complete letter foreclosure notice

Complete Letter Foreclosure Notice effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without hassles. Manage Letter Foreclosure Notice on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Letter Foreclosure Notice effortlessly

- Obtain Letter Foreclosure Notice and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document administration needs in just a few clicks from any device you choose. Edit and eSign Letter Foreclosure Notice and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter fair debt and how can airSlate SignNow help?

A letter fair debt is a formal document used to communicate with creditors regarding debt matters. airSlate SignNow streamlines the process of drafting, sending, and eSigning such documents, ensuring that your communication is efficient and legally binding.

-

How much does airSlate SignNow cost for debt-related document management?

airSlate SignNow offers flexible pricing plans that are budget-friendly for businesses handling letter fair debt. Depending on your needs, you can choose from various subscription tiers that accommodate both small enterprises and larger organizations.

-

What are the key features of airSlate SignNow for managing fair debt letters?

airSlate SignNow provides several key features, including customizable templates for letter fair debt, secure eSigning options, and real-time tracking of document status. These features ensure that your debt correspondence is professional and organized.

-

Can I integrate airSlate SignNow with other tools for managing fair debt correspondence?

Yes, airSlate SignNow integrates seamlessly with popular CRMs and document management systems. This allows you to streamline your workflow for handling letter fair debt alongside other business processes.

-

Is airSlate SignNow secure for sending letters related to fair debt issues?

Absolutely. airSlate SignNow prioritizes security, utilizing encryption and compliance features to protect sensitive information in letter fair debt communications. Your documents are secured with industry-leading protocols.

-

How can airSlate SignNow enhance communication with creditors regarding fair debt?

By using airSlate SignNow, you can quickly create and send professional letter fair debt documents via email. The platform allows for immediate responses and ensures that all parties have access to legally binding signatures.

-

Does airSlate SignNow provide customer support for fair debt letter inquiries?

Yes, airSlate SignNow offers robust customer support to assist you with any questions related to your letter fair debt documents. Our team is available via chat, email, and phone to ensure your experience is smooth.

Get more for Letter Foreclosure Notice

Find out other Letter Foreclosure Notice

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe