Foreclosure After Form

What is the foreclosure after

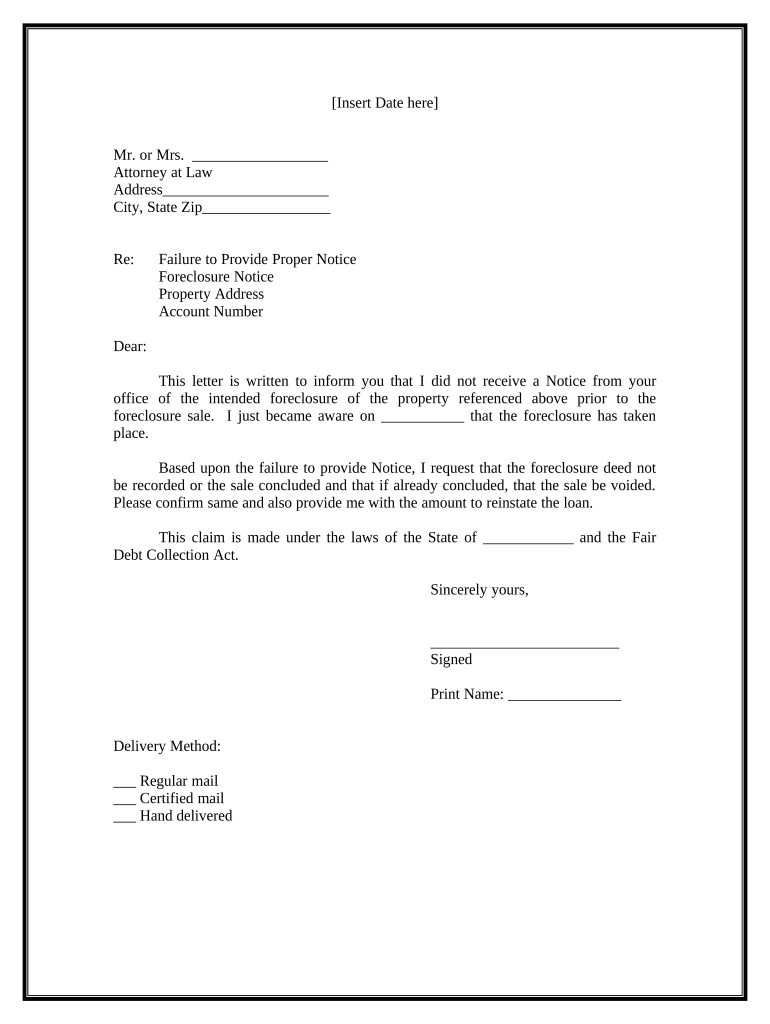

The term "foreclosure after" refers to the legal process that occurs when a lender seeks to recover the balance of a loan from a borrower who has defaulted on their mortgage payments. This process typically involves the sale of the property used as collateral for the loan. The foreclosure can lead to the transfer of ownership from the borrower to the lender or a third party. Understanding this process is crucial for homeowners facing financial difficulties, as it outlines the steps that can be taken to address the situation.

Steps to complete the foreclosure after

Completing the foreclosure process involves several key steps that must be followed to ensure compliance with legal requirements. These steps include:

- Notification: The lender must provide a formal notice to the borrower, informing them of the default and the intent to foreclose.

- Opportunity to Cure: Borrowers may be given a specific time frame to rectify the default by making overdue payments.

- Public Notice: A public notice of the foreclosure must be filed, which typically involves publishing the notice in local newspapers.

- Auction: If the borrower does not cure the default, the property may be sold at a public auction to the highest bidder.

- Transfer of Title: Following the auction, the title of the property is transferred to the new owner, completing the foreclosure process.

Legal use of the foreclosure after

The legal use of the foreclosure process is governed by state laws, which can vary significantly. It is essential for both lenders and borrowers to understand their rights and obligations under these laws. The foreclosure process must adhere to specific legal requirements, including proper notification and the opportunity for the borrower to address the default. Failure to follow these legal protocols can result in delays or even the dismissal of the foreclosure case.

Required documents

To initiate the foreclosure process, several documents are typically required. These may include:

- Mortgage Agreement: The original loan document outlining the terms of the mortgage.

- Notice of Default: A formal document indicating that the borrower has failed to make payments.

- Public Notice: Documentation proving that the foreclosure notice has been published as required by law.

- Title Report: A report that verifies the ownership of the property and any existing liens.

Who issues the form

The foreclosure after process does not typically involve a specific form issued by a single entity. Instead, the necessary documentation is generated by the lender or their legal representatives. It is important for borrowers to be aware of the parties involved in the process, including the lender, the foreclosure attorney, and any court officials, to ensure that all required documents are properly completed and submitted.

Penalties for non-compliance

Failure to comply with the foreclosure process can lead to significant penalties for lenders, including legal repercussions and financial liabilities. Borrowers may also face consequences, such as the loss of their property and a negative impact on their credit score. It is crucial for all parties involved to follow the established legal procedures to avoid these penalties and ensure a fair resolution to the foreclosure situation.

Quick guide on how to complete foreclosure after

Complete Foreclosure After effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct version and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents promptly without delays. Manage Foreclosure After on any device with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to alter and eSign Foreclosure After without hassle

- Obtain Foreclosure After and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your personal computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Foreclosure After and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for submitting an Aetna reconsideration from using airSlate SignNow?

To submit an Aetna reconsideration from, simply upload the necessary documents to airSlate SignNow, add the required signatures, and securely send it for review. Our platform ensures that the process is straightforward, allowing you to track the document's progress in real-time. This efficiency helps in faster resolutions of your Aetna reconsideration requests.

-

Is there a cost associated with using airSlate SignNow for Aetna reconsideration from submissions?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. By choosing our service for your Aetna reconsideration from submissions, you gain access to a cost-effective solution that streamlines the signing process, ultimately saving you time and money. Explore our pricing page for more details.

-

What features does airSlate SignNow offer to aid in Aetna reconsideration from requests?

AirSlate SignNow provides features such as customizable templates, automated reminders, and a user-friendly interface to enhance your Aetna reconsideration from workflow. With our platform, you can ensure that all documents are signed correctly and on time, thus reducing the chances of errors. Our robust security measures further protect your sensitive documents.

-

How does airSlate SignNow integrate with other tools for Aetna reconsideration from processes?

AirSlate SignNow seamlessly integrates with popular business tools like Google Drive, Dropbox, and CRM systems to assist in Aetna reconsideration from processes. This integration enables you to manage documents efficiently and streamlines your workflow, making it easier to access all your files in one place. Our API also allows for customization to meet specific business needs.

-

What are the benefits of using airSlate SignNow for Aetna reconsideration from submissions?

The primary benefit of using airSlate SignNow for Aetna reconsideration from submissions is the increased efficiency it offers. It reduces processing time signNowly, allowing for quicker feedback from Aetna. Additionally, our platform provides a legally binding eSignature solution, ensuring compliance and security throughout the submission process.

-

Can I track the status of my Aetna reconsideration from submissions in airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track the status of your Aetna reconsideration from submissions in real-time. You will receive instant notifications about document status changes, including when it’s viewed, signed, or completed, offering you peace of mind during the reconsideration process.

-

Is airSlate SignNow suitable for large organizations handling multiple Aetna reconsideration from requests?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, including large organizations managing multiple Aetna reconsideration from requests. Our platform supports bulk sending and signing, making it easier to handle multiple cases simultaneously. Furthermore, our admin features allow for efficient user management and streamlined processes across your organization.

Get more for Foreclosure After

- Filing stateterritory form

- Fillable online company contact details cikm2018units form

- Notice to beneficiaryclaimant regarding the information

- Va form 26 4555c veteran servicemembers supplemental application for

- Va form 22 8864 training agreement for apprenticeship and other on the job training programs

- 2007 form va 21 8940 fill online printable fillable

- Expiration date 01312023 form

- Housing assistance referral form 78446279

Find out other Foreclosure After

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF