Agreement Compromise Form

What is the Agreement Compromise

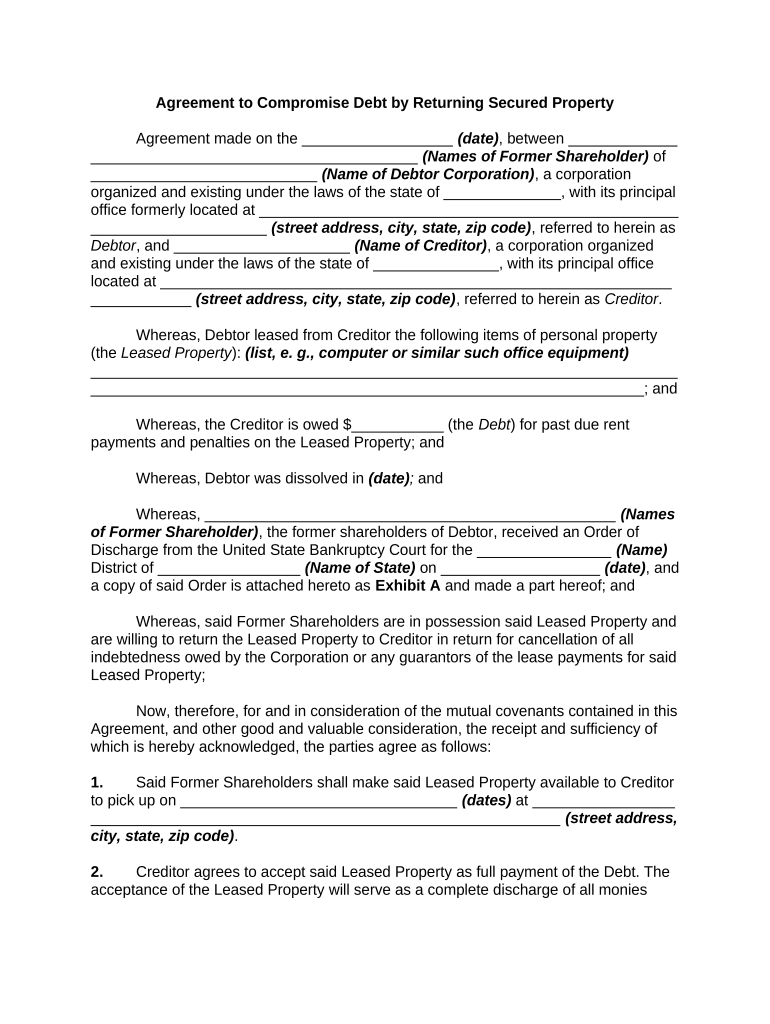

The agreement compromise is a legally binding document that outlines the terms under which a debtor and creditor come to a mutual understanding regarding a debt secured by property. This form is essential for individuals or businesses looking to negotiate the terms of their debt obligations. It can help prevent foreclosure or repossession by establishing a clear plan for repayment or settlement. Understanding the specifics of the agreement compromise is crucial for both parties to ensure that their rights and responsibilities are clearly defined.

Steps to complete the Agreement Compromise

Completing the agreement compromise involves several important steps to ensure that the document is valid and enforceable. First, both parties should gather all relevant financial information and documentation related to the debt secured. Next, they should negotiate the terms of the compromise, including the amount to be paid and the timeline for repayment. Once an agreement is reached, the terms should be clearly documented in the form. Both parties must then sign the agreement, ideally in the presence of a witness or notary to enhance its legal standing. Finally, it is advisable to keep a copy of the signed agreement for future reference.

Key elements of the Agreement Compromise

Several key elements must be included in the agreement compromise to ensure its effectiveness. These include:

- Identification of parties: Clearly state the names and contact information of both the debtor and creditor.

- Description of the debt: Provide details about the debt secured, including the original amount, interest rate, and current balance.

- Terms of the compromise: Outline the agreed-upon terms, such as the settlement amount and payment schedule.

- Signatures: Both parties must sign the document to indicate their acceptance of the terms.

Legal use of the Agreement Compromise

The legal use of the agreement compromise is governed by various laws and regulations. In the United States, it is important for the document to comply with state and federal laws regarding debt settlements. This includes ensuring that the agreement is fair and that both parties fully understand their rights and obligations. Additionally, the agreement should be executed in a manner that meets the legal requirements for enforceability, such as obtaining signatures and, if necessary, notarization. Consulting with a legal professional can help ensure compliance with applicable laws.

How to obtain the Agreement Compromise

Obtaining the agreement compromise typically involves drafting the document based on the negotiations between the debtor and creditor. While templates may be available online, it is often beneficial to customize the agreement to reflect the specific circumstances of the debt secured. Parties can also seek assistance from legal professionals to create a tailored agreement that meets their needs. Once the document is prepared, both parties should review it carefully before signing to ensure that all terms are accurately represented.

Examples of using the Agreement Compromise

Examples of using the agreement compromise can vary widely depending on the context of the debt secured. For instance, a homeowner facing foreclosure may negotiate a compromise with their mortgage lender to reduce the total amount owed and establish a new payment schedule. Similarly, a business may reach a compromise with a supplier to settle outstanding invoices for less than the full amount. These examples illustrate how the agreement compromise can provide a pathway to financial relief and help maintain relationships between debtors and creditors.

Quick guide on how to complete agreement compromise 497331642

Complete Agreement Compromise effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without holdups. Handle Agreement Compromise on any device with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to adjust and eSign Agreement Compromise with ease

- Locate Agreement Compromise and then click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Agreement Compromise and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the concept of 'debt secured' in relation to airSlate SignNow?

The term 'debt secured' refers to loans backed by collateral, which can be managed efficiently using airSlate SignNow. With our platform, you can easily send, eSign, and store documents related to secured debts, ensuring that everything is handled in a professional and organized manner.

-

How can airSlate SignNow assist in managing debt secured agreements?

airSlate SignNow simplifies the process of creating and managing debt secured agreements through its intuitive interface. You can draft, send, and obtain electronic signatures on these agreements quickly, streamlining your document workflows and reducing delays associated with traditional methods.

-

Are there any costs involved in using airSlate SignNow for debt secured documents?

Yes, airSlate SignNow offers affordable pricing plans designed to cater to businesses of all sizes, including those handling debt secured documents. Our plans provide access to a range of features that enhance document management while keeping costs low, making it an excellent value for your business.

-

What features does airSlate SignNow offer for debt secured transactions?

Our platform includes multiple features that are beneficial for debt secured transactions, such as customizable templates, real-time tracking, and automated reminders. These tools help ensure that your documents are processed efficiently and that stakeholders are kept informed throughout the signing process.

-

Can airSlate SignNow integrate with my existing systems for managing debt secured transactions?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various applications, including CRM and accounting software. This means you can connect your existing systems to automate and simplify the management of your debt secured documents effectively.

-

What are the benefits of using airSlate SignNow for debt secured documents?

The primary benefits of using airSlate SignNow for debt secured documents include increased efficiency, reduced paperwork, and improved security. Our electronic signing process accelerates transaction times and enhances document protection, ensuring that sensitive information remains confidential.

-

Is airSlate SignNow compliant with regulations regarding debt secured documents?

Yes, airSlate SignNow complies with all relevant regulations concerning electronic signatures and debt secured documentation. Our commitment to security and compliance ensures that your documents are legally binding and meet industry standards.

Get more for Agreement Compromise

Find out other Agreement Compromise

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast