Registered Charity Information Return T3010 Fill 24e 2 PDF 2024-2026

Understanding the Registered Charity Information Return T3010

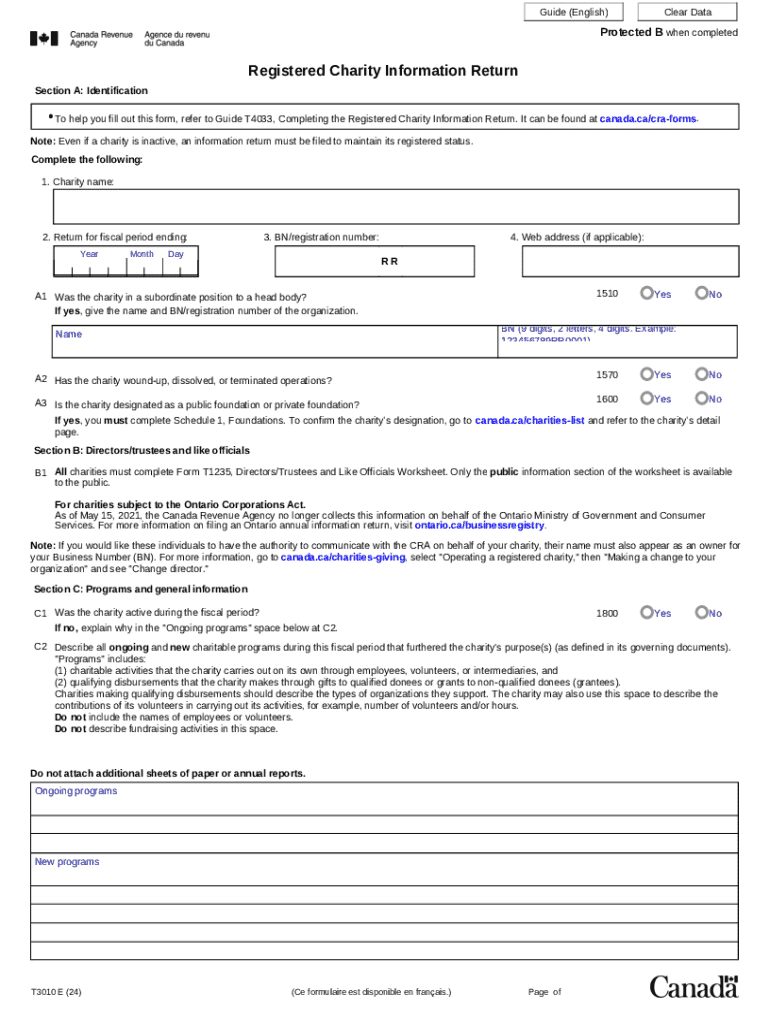

The Registered Charity Information Return T3010 is a crucial document for charities operating in Canada. It serves as a comprehensive report that charities must submit annually to the Canada Revenue Agency (CRA). This form provides essential information about the charity's activities, financial status, and compliance with the Income Tax Act. Charities must ensure that their T3010 is filled out accurately to maintain their registered status and fulfill legal obligations.

Steps to Complete the Registered Charity Information Return T3010

Completing the T3010 involves several key steps:

- Gather necessary financial information, including income statements and balance sheets.

- Review the charity's activities over the past year to ensure all relevant information is included.

- Access the T3010 form, which can be downloaded from the CRA website.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check the information for accuracy and completeness before submission.

Legal Use of the Registered Charity Information Return T3010

The T3010 is not just a formality; it is a legal requirement for registered charities in Canada. Failure to submit the T3010 can lead to penalties, including the loss of registered status. Charities must be aware of the legal implications of their reporting and ensure compliance with all CRA regulations. This form helps maintain transparency and accountability in the charitable sector.

Filing Deadlines for the Registered Charity Information Return T3010

Charities must adhere to specific filing deadlines for the T3010. Generally, the return is due six months after the end of the charity's fiscal year. For example, if a charity's fiscal year ends on December 31, the T3010 must be submitted by June 30 of the following year. It is essential for charities to mark these deadlines to avoid late fees and compliance issues.

Required Documents for Completing the Registered Charity Information Return T3010

To complete the T3010 accurately, charities need to gather several documents:

- Financial statements for the reporting period.

- Details of charitable activities undertaken during the year.

- Information about the charity's governance structure.

- Any additional documentation that supports the information provided in the return.

Examples of Using the Registered Charity Information Return T3010

Charities can use the T3010 to report various activities, such as:

- Fundraising events and their financial outcomes.

- Grants and donations received from other organizations.

- Community programs and services offered throughout the year.

These examples illustrate how the T3010 serves as a tool for accountability and transparency, helping charities communicate their impact to stakeholders.

Quick guide on how to complete registered charity information return t3010 fill 24e 2 pdf

Complete Registered Charity Information Return T3010 fill 24e 2 pdf effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, adjust, and electronically sign your documents quickly and without issues. Manage Registered Charity Information Return T3010 fill 24e 2 pdf on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to alter and electronically sign Registered Charity Information Return T3010 fill 24e 2 pdf seamlessly

- Locate Registered Charity Information Return T3010 fill 24e 2 pdf and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Decide how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Registered Charity Information Return T3010 fill 24e 2 pdf and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct registered charity information return t3010 fill 24e 2 pdf

Create this form in 5 minutes!

How to create an eSignature for the registered charity information return t3010 fill 24e 2 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a completed t3010 note print?

A completed t3010 note print is a finalized version of the T3010 form, which is essential for Canadian charities to report their financial information. This document provides transparency and accountability, ensuring compliance with the Canada Revenue Agency's requirements.

-

How can airSlate SignNow help with completed t3010 note print?

airSlate SignNow simplifies the process of creating and managing your completed t3010 note print. With our platform, you can easily fill out, sign, and store your T3010 forms securely, ensuring that you meet all regulatory deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for completed t3010 note print?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you can manage your completed t3010 note print efficiently while staying within your budget.

-

What features does airSlate SignNow offer for completed t3010 note print?

Our platform includes features such as customizable templates, electronic signatures, and secure cloud storage, all designed to streamline the process of managing your completed t3010 note print. These tools enhance productivity and ensure compliance with ease.

-

Can I integrate airSlate SignNow with other software for completed t3010 note print?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to connect your existing tools for a more efficient workflow. This means you can easily manage your completed t3010 note print alongside other essential business processes.

-

What are the benefits of using airSlate SignNow for completed t3010 note print?

Using airSlate SignNow for your completed t3010 note print provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally and are easily accessible whenever needed.

-

How secure is my completed t3010 note print with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your completed t3010 note print and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

Get more for Registered Charity Information Return T3010 fill 24e 2 pdf

- Self perception inventory questions pdf document form

- Form 8880 10004913

- Hrtreasuries form

- Texas employees group benefits program gbp supplemental form

- Texas employees group benefits program gbp supplemental depts ttu form

- Form np 1 398780865

- Phone 802 828 6820 form

- Florida residency declaration for tuition purposes eastern form

Find out other Registered Charity Information Return T3010 fill 24e 2 pdf

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney