What Abouthttpswww Taxhow Netstaticformpdfstates1538366400azf221 PDF

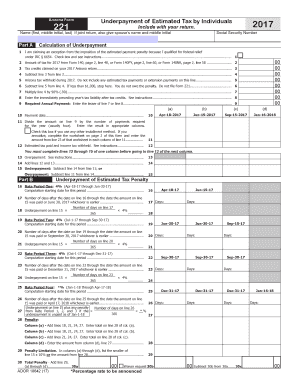

What is the Arizona Form 221?

The Arizona Form 221 is a tax form used by businesses in Arizona to report certain tax information to the state. This form is essential for ensuring compliance with state tax regulations and is typically used for specific tax filings related to income or sales tax. Understanding the purpose of this form is crucial for businesses to maintain accurate records and fulfill their tax obligations.

Steps to Complete the Arizona Form 221

Completing the Arizona Form 221 involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth filing process:

- Gather all necessary financial documents, including income statements and expense records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all figures are correct and correspond to your financial records.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either electronically or by mail, as per the instructions.

Legal Use of the Arizona Form 221

The Arizona Form 221 must be used in accordance with state tax laws to ensure that submissions are legally binding. It is important for businesses to understand the legal implications of filing this form, as inaccuracies or late submissions can lead to penalties. Compliance with the guidelines set forth by the Arizona Department of Revenue is essential for maintaining good standing and avoiding legal issues.

Filing Deadlines and Important Dates

Timely submission of the Arizona Form 221 is crucial for compliance. The specific deadlines may vary depending on the type of tax being reported. Generally, businesses should be aware of the following key dates:

- Annual filing deadline: Typically due on April 15 for most businesses.

- Quarterly filing deadlines: Vary based on the reporting period, usually due within 30 days after the end of each quarter.

Who Issues the Arizona Form 221?

The Arizona Department of Revenue is responsible for issuing and regulating the Arizona Form 221. This state agency provides the necessary guidelines and updates regarding the form, ensuring that businesses have access to the most current information for tax reporting purposes. It is advisable to regularly check their official communications for any changes or updates related to the form.

Penalties for Non-Compliance

Failure to file the Arizona Form 221 on time or inaccuracies in the submission can result in significant penalties. Businesses may face fines, interest on unpaid taxes, or even legal action if they do not comply with state regulations. Understanding these potential consequences underscores the importance of accurate and timely filing.

Quick guide on how to complete arizona form 221

Effortlessly Prepare arizona form 221 on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage arizona form 221 on any device with airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign arizona form 221 effortlessly

- Find arizona form 221 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign arizona form 221 to ensure outstanding communication at any phase of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to arizona form 221

Create this form in 5 minutes!

How to create an eSignature for the arizona form 221

How to create an eSignature for your What Abouthttpswwwtaxhownetstaticformpdfstates1538366400azf221 2017pdf in the online mode

How to generate an electronic signature for the What Abouthttpswwwtaxhownetstaticformpdfstates1538366400azf221 2017pdf in Google Chrome

How to make an electronic signature for signing the What Abouthttpswwwtaxhownetstaticformpdfstates1538366400azf221 2017pdf in Gmail

How to create an electronic signature for the What Abouthttpswwwtaxhownetstaticformpdfstates1538366400azf221 2017pdf straight from your mobile device

How to make an eSignature for the What Abouthttpswwwtaxhownetstaticformpdfstates1538366400azf221 2017pdf on iOS

How to create an eSignature for the What Abouthttpswwwtaxhownetstaticformpdfstates1538366400azf221 2017pdf on Android devices

People also ask arizona form 221

-

What is the Arizona Form 221 and why is it important?

The Arizona Form 221 is a crucial document for businesses and individuals in the state of Arizona, used for specific legal and regulatory purposes. Understanding the importance of this form can streamline your processes and ensure compliance with state laws. airSlate SignNow provides a seamless way to eSign and manage the Arizona Form 221, making transactions faster and more efficient.

-

How can airSlate SignNow help with the Arizona Form 221?

airSlate SignNow offers a user-friendly platform that allows users to create, send, and eSign the Arizona Form 221 with ease. Our solution provides templates and automated workflows that simplify the document management process. This not only saves time but also enhances accuracy in handling the Arizona Form 221.

-

What are the pricing options for using airSlate SignNow for Arizona Form 221?

airSlate SignNow offers flexible pricing plans designed to meet the needs of various users, from individuals to large enterprises. Our pricing is competitive and is structured based on the number of users and features needed for handling documents like the Arizona Form 221. You can choose a plan that best fits your budget and requirements.

-

Is my data secure when eSigning the Arizona Form 221 with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes data security and employs industry-standard encryption to protect your information. When eSigning the Arizona Form 221, you can be confident that your data is secure and compliant with relevant regulations, ensuring peace of mind during your document transactions.

-

Can I customize the Arizona Form 221 in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates that allow you to tailor the Arizona Form 221 to fit your specific needs. You can add fields, adjust formatting, and include any additional information required for your business. This flexibility enhances the usability of the Arizona Form 221 and ensures it meets your requirements.

-

Does airSlate SignNow integrate with other software for managing Arizona Form 221?

Indeed, airSlate SignNow offers extensive integrations with popular software tools, enhancing your workflow for managing the Arizona Form 221. Whether you use CRM systems, project management tools, or cloud storage platforms, our integrations ensure that you can seamlessly connect your document management processes. This optimizes your efficiency and keeps all your assets in sync.

-

What are the advantages of using airSlate SignNow for the Arizona Form 221?

Using airSlate SignNow for the Arizona Form 221 exposes you to several advantages, including enhanced efficiency, reduced paperwork, and the ability to track the signing process in real-time. Our platform is designed to simplify the eSigning experience by providing a user-friendly interface and comprehensive support for all your document needs. These benefits make managing the Arizona Form 221 more effective and convenient.

Get more for arizona form 221

- Texas massage license verification form

- Application to certify marine sanitation device msd issued under authority of 26 tceq texas form

- Hub cmbl application texas 2009 form

- Texas commission on fire protection fire service standards tcfp texas form

- Texas veterans home improvement program credit application glo texas form

- Texas general land office txdot application for state land use sd form

- Retail electric provider fillable contract form

- Txr150000 2008 form

Find out other arizona form 221

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer