Disputed Accounted Settlement Form

What is the Disputed Accounted Settlement

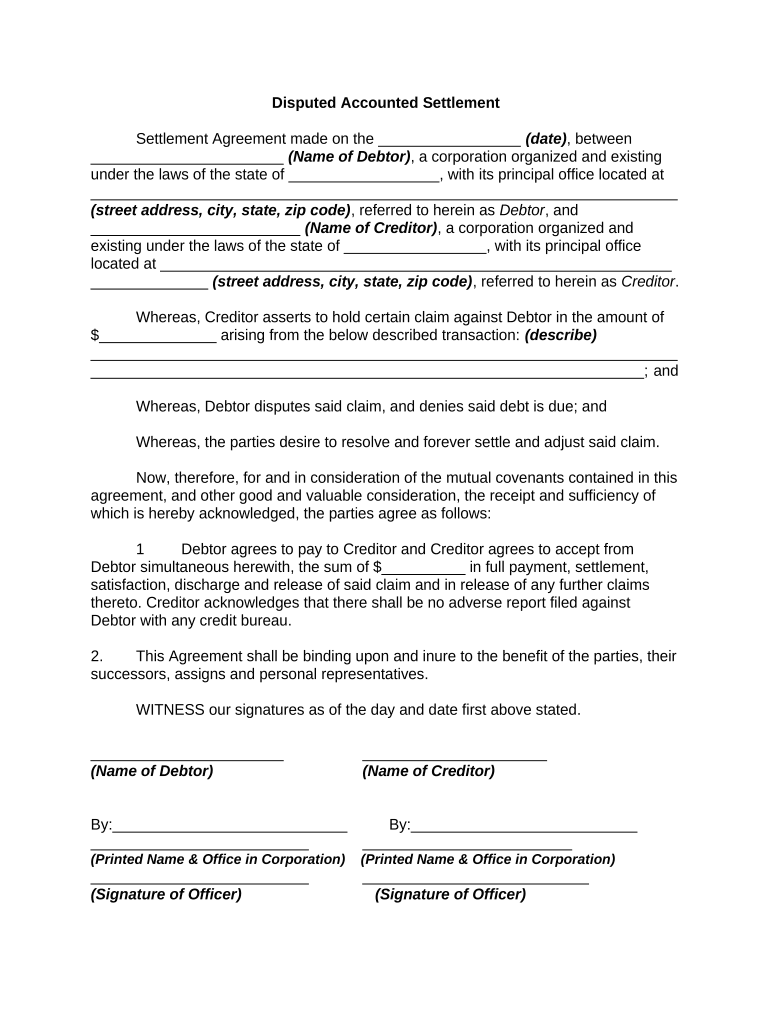

The Disputed Accounted Settlement is a formal document used to resolve disagreements regarding financial transactions or account balances. This form is particularly relevant in situations where parties involved in a financial agreement cannot reach a consensus. It serves as a written record of the dispute and outlines the terms under which the parties agree to settle their differences. Utilizing this form ensures that all parties have a clear understanding of their obligations and rights, which can help prevent future misunderstandings.

How to use the Disputed Accounted Settlement

Using the Disputed Accounted Settlement involves several steps to ensure that the document is completed accurately and effectively. First, gather all relevant information about the dispute, including account details and any correspondence related to the disagreement. Next, fill out the form with precise information, ensuring that all parties involved are clearly identified. Once completed, the form should be signed by all parties to indicate their agreement to the terms outlined in the document. It is advisable to keep copies of the signed form for personal records and future reference.

Steps to complete the Disputed Accounted Settlement

Completing the Disputed Accounted Settlement involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documentation related to the dispute.

- Clearly identify all parties involved in the settlement.

- Fill out the form with detailed information about the dispute.

- Review the completed form for accuracy.

- Ensure all parties sign the form to validate the agreement.

- Distribute copies of the signed form to all parties involved.

Legal use of the Disputed Accounted Settlement

The legal use of the Disputed Accounted Settlement is crucial for ensuring that the document holds up in a court of law if necessary. For the form to be considered legally binding, it must comply with relevant laws and regulations governing contracts and agreements. This includes ensuring that all parties have the legal capacity to enter into the agreement and that the terms are clear and mutually agreed upon. Additionally, it is important to retain a copy of the signed document as evidence of the agreement in case of future disputes.

Key elements of the Disputed Accounted Settlement

Several key elements must be included in the Disputed Accounted Settlement to ensure its effectiveness and legality. These include:

- The names and contact information of all parties involved.

- A clear description of the dispute, including relevant dates and amounts.

- The terms of the settlement, detailing how the dispute will be resolved.

- Signatures of all parties, indicating their agreement to the terms.

- The date of signing, which is important for record-keeping.

Examples of using the Disputed Accounted Settlement

Examples of situations where the Disputed Accounted Settlement may be used include disputes over unpaid invoices, disagreements regarding service quality, or conflicts about account balances. For instance, if a contractor disputes an invoice due to perceived overcharges, they can use this form to outline their concerns and propose a settlement. Similarly, businesses may employ this form when resolving discrepancies in financial records, ensuring that all parties agree on the resolution process.

Quick guide on how to complete disputed accounted settlement

Complete Disputed Accounted Settlement seamlessly on any device

Online document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Disputed Accounted Settlement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Disputed Accounted Settlement effortlessly

- Find Disputed Accounted Settlement and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Disputed Accounted Settlement and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Disputed Accounted Settlement?

A Disputed Accounted Settlement refers to an agreement signNowed between parties regarding a financial discrepancy or disagreement. With airSlate SignNow, you can easily manage and automate the process of creating and signing these settlements to ensure clarity and compliance. This not only streamlines communication but also protects all parties involved in the settlement.

-

How can airSlate SignNow help with Disputed Accounted Settlements?

airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign Disputed Accounted Settlements quickly and securely. The platform ensures that all parties can access important documents anytime and anywhere, which simplifies the resolution process. This enhanced efficiency is crucial for timely and accurate dispute resolutions.

-

Is there a cost associated with crafting Disputed Accounted Settlements on airSlate SignNow?

Using airSlate SignNow to create Disputed Accounted Settlements is cost-effective. We offer various pricing plans tailored to meet your needs, providing excellent value for your business. This ensures you can manage your agreements without incurring burdensome fees, allowing you to focus on your core operations.

-

What features does airSlate SignNow offer for managing Disputed Accounted Settlements?

airSlate SignNow offers a range of features to assist with Disputed Accounted Settlements, including document templates, automated workflows, and secure eSigning. Additionally, tools like real-time tracking and reminders help ensure all parties are on the same page throughout the settlement process. Our platform's ease of use enhances productivity and collaboration.

-

Are there any integrations available for managing Disputed Accounted Settlements with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, allowing for the efficient management of Disputed Accounted Settlements. Whether you use CRM software or project management tools, our integrations help streamline your workflow. This ensures you can easily access all relevant information across platforms.

-

Can I customize templates for Disputed Accounted Settlements on airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize templates specifically for Disputed Accounted Settlements. This flexibility ensures that you can include all necessary terms and conditions unique to your agreements, saving time and reducing the risk of errors in documentation.

-

What security measures does airSlate SignNow implement for Disputed Accounted Settlements?

airSlate SignNow prioritizes the security of your Disputed Accounted Settlements with advanced encryption protocols and secure data storage. We ensure that your documents are protected against unauthorized access while still remaining easily accessible to authorized parties. This commitment to security helps you maintain compliance and trust during settlement processes.

Get more for Disputed Accounted Settlement

Find out other Disputed Accounted Settlement

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later