Transfer Stock Form

What is the transfer stock?

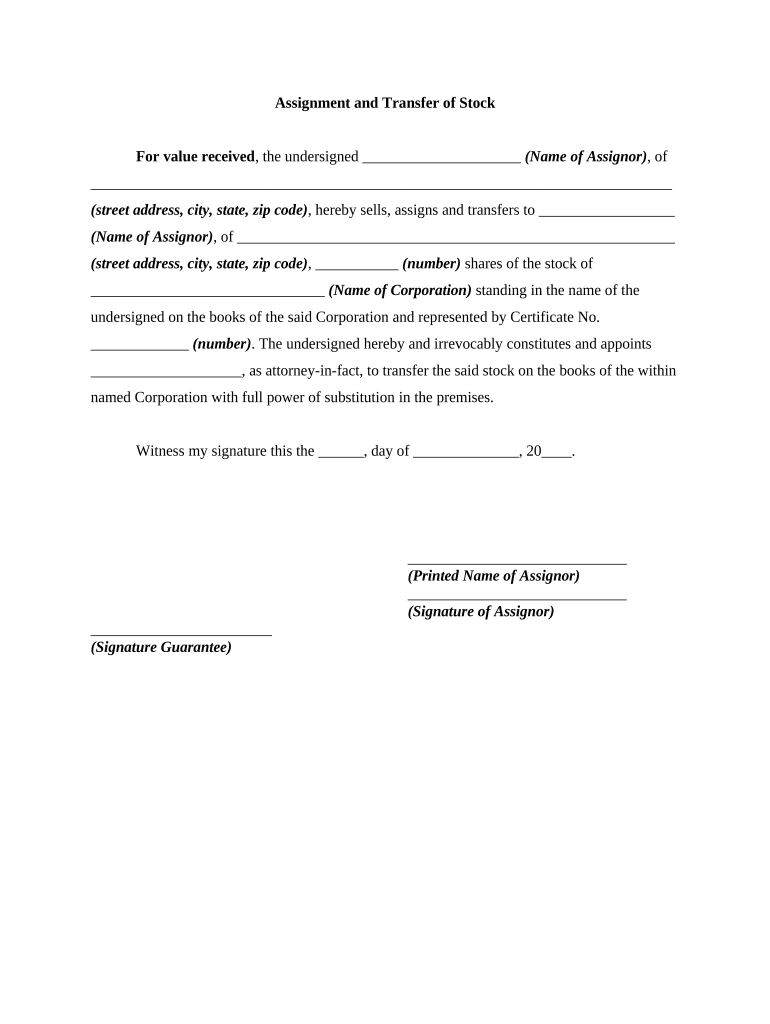

The transfer stock is a legal document used to transfer ownership of shares from one party to another. This form is essential in the context of corporate transactions, as it formalizes the change in ownership and ensures that all parties involved have a clear understanding of the transfer. Typically, it includes details such as the names of the transferor and transferee, the number of shares being transferred, and any relevant terms or conditions associated with the transfer.

Steps to complete the transfer stock

Completing the transfer stock involves several key steps to ensure accuracy and compliance with legal requirements. Here are the steps to follow:

- Gather necessary information, including the names and addresses of both the transferor and transferee.

- Specify the number of shares being transferred and any relevant stock certificate numbers.

- Include the date of the transfer to establish a clear timeline.

- Obtain the required signatures from both parties to validate the transfer.

- Consider having the document notarized for added legal assurance.

Legal use of the transfer stock

The transfer stock must comply with various legal standards to be considered valid. In the United States, it is essential to adhere to state laws governing corporate transactions. This includes ensuring that the transfer is executed in accordance with the company's bylaws and any shareholder agreements. Additionally, the document should meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as legally binding.

Key elements of the transfer stock

Understanding the key elements of the transfer stock is crucial for its effective use. Important components include:

- Transferor and transferee details: Full names and addresses of both parties.

- Number of shares: Clearly state how many shares are being transferred.

- Consideration: If applicable, mention any payment or consideration involved in the transfer.

- Signatures: Ensure both parties sign the document to validate the transfer.

- Date of transfer: Document the date the transfer takes effect.

Examples of using the transfer stock

Transfer stocks can be utilized in various scenarios, including:

- Transferring shares between family members as part of estate planning.

- Facilitating the sale of shares from one investor to another in a private transaction.

- Transferring ownership as part of a merger or acquisition process.

Form submission methods

There are several methods for submitting the transfer stock, depending on the requirements of the issuing company. Common submission methods include:

- Online submission: Many companies allow electronic submission of transfer stocks through secure portals.

- Mail: Physical copies of the transfer stock can be mailed to the corporate office for processing.

- In-person: Some companies may require or allow in-person submissions for verification purposes.

Quick guide on how to complete transfer stock 497331946

Effortlessly Prepare Transfer Stock on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Transfer Stock on any device through the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The simplest method to modify and electronically sign Transfer Stock with ease

- Find Transfer Stock and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose your preferred method of sending your form, such as email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Transfer Stock to maintain excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to transfer stock using airSlate SignNow?

Transferring stock using airSlate SignNow is straightforward. First, upload your stock transfer documents, then use our eSigning features to sign and send them to relevant parties. Once signed, the documents are securely stored, and you receive notifications on the transfer status.

-

How much does it cost to use airSlate SignNow for stock transfers?

airSlate SignNow offers competitive pricing for businesses looking to transfer stock. We provide different pricing tiers based on your needs, allowing you to choose a plan that suits your budget. Check our pricing page for detailed information and potential discounts based on annual subscriptions.

-

Can airSlate SignNow help with compliance during stock transfers?

Yes, compliance is a priority when you transfer stock. airSlate SignNow ensures that all documents are legally binding and compliant with industry standards. Our platform uses secure encryption and audit trails to maintain compliance across all your transactions.

-

What features does airSlate SignNow offer for efficient stock transfers?

To enhance your experience when you transfer stock, airSlate SignNow offers features like customizable templates, bulk sending, and in-person signing. These tools help streamline the process, saving you time and reducing errors during stock transfers.

-

Is it easy to integrate airSlate SignNow with existing systems for stock transfers?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, enabling you to easily incorporate document management and stock transfer functionality into your existing workflows. This flexibility allows you to efficiently manage stocks without disrupting your current processes.

-

What are the benefits of using airSlate SignNow to transfer stock?

Using airSlate SignNow to transfer stock provides numerous benefits, including faster transaction times, enhanced security, and reduced manual paperwork. Our intuitive interface makes it easy for users of all skill levels to complete stock transfers without hassle.

-

Can I track my stock transfer status through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your stock transfers in real time. You will receive notifications when documents are viewed, signed, or completed, ensuring you are always updated on the status of your transactions.

Get more for Transfer Stock

Find out other Transfer Stock

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online