Assignment Mortgage Sample Form

What is the Assignment Mortgage Sample

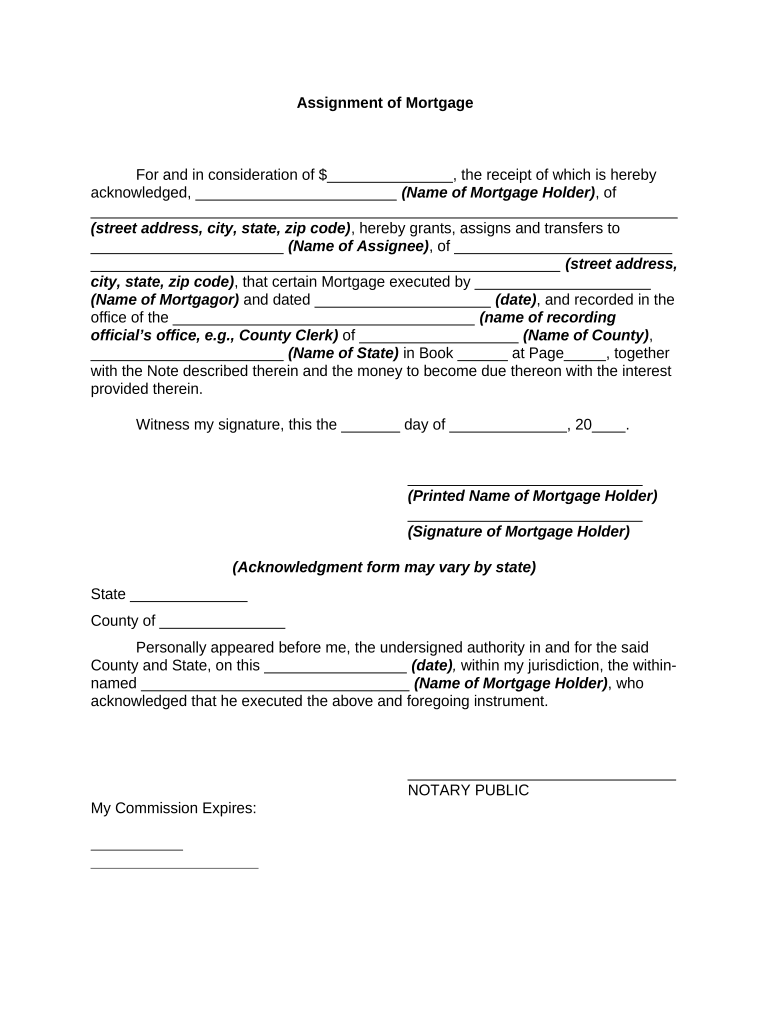

The assignment mortgage sample is a legal document that facilitates the transfer of a mortgage from one lender to another. This form is crucial for individuals or entities looking to assign their mortgage rights to a different party. It outlines the terms of the assignment, including the parties involved, the original mortgage details, and any obligations that may transfer along with the mortgage. The assignment mortgage sample serves as a template to ensure that all necessary information is captured accurately, helping to streamline the process of transferring mortgage responsibilities.

How to Use the Assignment Mortgage Sample

Using the assignment mortgage sample involves filling out the template with specific details relevant to the mortgage being assigned. Start by entering the names and addresses of the assignor (the current mortgage holder) and the assignee (the new mortgage holder). Next, provide information about the original mortgage, including the loan amount, property address, and date of the original mortgage agreement. Ensure that all parties sign the document to validate the assignment. Once completed, the assignment can be filed with the appropriate county recorder’s office to formalize the transfer.

Steps to Complete the Assignment Mortgage Sample

Completing the assignment mortgage sample requires careful attention to detail. Follow these steps:

- Gather necessary information about the original mortgage, including loan details and property information.

- Fill in the names and contact information of both the assignor and assignee.

- Clearly state the terms of the assignment, including any conditions or obligations that transfer.

- Ensure all parties sign the document in the presence of a notary public, if required by state law.

- File the completed assignment with the local county recorder’s office to make it official.

Legal Use of the Assignment Mortgage Sample

The assignment mortgage sample is legally binding when executed correctly. To ensure its legality, it must comply with state laws regarding mortgage assignments. This includes proper signatures, notarization where necessary, and adherence to any specific state requirements. The document must also be filed with the appropriate government office to provide public notice of the assignment. Failing to follow these legal protocols could result in disputes or complications regarding the mortgage transfer.

Key Elements of the Assignment Mortgage Sample

Several key elements must be included in the assignment mortgage sample to ensure its effectiveness:

- Parties Involved: Clearly identify the assignor and assignee.

- Mortgage Details: Include the original mortgage amount, property address, and date of the mortgage.

- Assignment Terms: Specify any conditions or obligations that will transfer with the mortgage.

- Signatures: Ensure all parties sign the document to validate the assignment.

- Notarization: Include a notary section if required by state law.

State-Specific Rules for the Assignment Mortgage Sample

Each state in the U.S. has its own regulations regarding the assignment of mortgages. It is essential to be aware of these state-specific rules to ensure compliance. For instance, some states may require notarization, while others may have specific filing procedures or fees. Additionally, certain states may have unique disclosure requirements that must be included in the assignment document. Consulting with a legal professional familiar with local laws can help ensure that the assignment mortgage sample meets all necessary legal standards.

Quick guide on how to complete assignment mortgage sample

Complete Assignment Mortgage Sample seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Assignment Mortgage Sample on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The optimal way to modify and electronically sign Assignment Mortgage Sample effortlessly

- Obtain Assignment Mortgage Sample and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Assignment Mortgage Sample and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment mortgage?

An assignment mortgage is a financial document that allows a borrower to transfer their mortgage obligations to another party. This can be beneficial for those looking to sell their property while still under a mortgage. Understanding how to navigate the assignment mortgage process can help you manage your finances effectively.

-

How does airSlate SignNow facilitate the assignment mortgage process?

airSlate SignNow simplifies the assignment mortgage process by providing a user-friendly platform to eSign and manage all related documents. With automated workflows and templates, you can easily create, send, and track assignment mortgage agreements. This means faster transactions and improved efficiency for your business.

-

What are the benefits of using airSlate SignNow for assignment mortgages?

Using airSlate SignNow for assignment mortgages offers several benefits, including cost savings, increased speed, and enhanced security. Our platform enables you to sign documents securely from anywhere, reducing the time spent on paperwork. Additionally, electronic signatures are legally binding, giving you peace of mind in your transactions.

-

Are there any fees associated with using airSlate SignNow for assignment mortgages?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, including those dealing with assignment mortgages. We provide different tiers based on features and usage, ensuring you only pay for what you need. It's a cost-effective solution for managing your documents without sacrificing quality.

-

Can I integrate airSlate SignNow with other tools for managing assignment mortgages?

Absolutely! airSlate SignNow integrates seamlessly with various CRM systems, cloud storage services, and other essential tools to streamline your assignment mortgage processes. This connectivity allows for better data management and enhanced workflow efficiency, enabling you to focus on closing deals rather than dealing with manual processes.

-

Is airSlate SignNow compliant with legal regulations for assignment mortgages?

Yes, airSlate SignNow complies with all relevant legal regulations and standards for electronic signatures, making it suitable for assignment mortgage documentation. Our platform follows industry best practices for security and confidentiality, ensuring your documents are handled appropriately and are legally binding.

-

How can I ensure the security of my assignment mortgage documents?

airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your assignment mortgage documents. These features safeguard sensitive information and ensure that only authorized individuals can access your documents. You can trust that your data is in safe hands while using our platform.

Get more for Assignment Mortgage Sample

Find out other Assignment Mortgage Sample

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now