Convertible Promissory Note Form

What is the Convertible Promissory Note

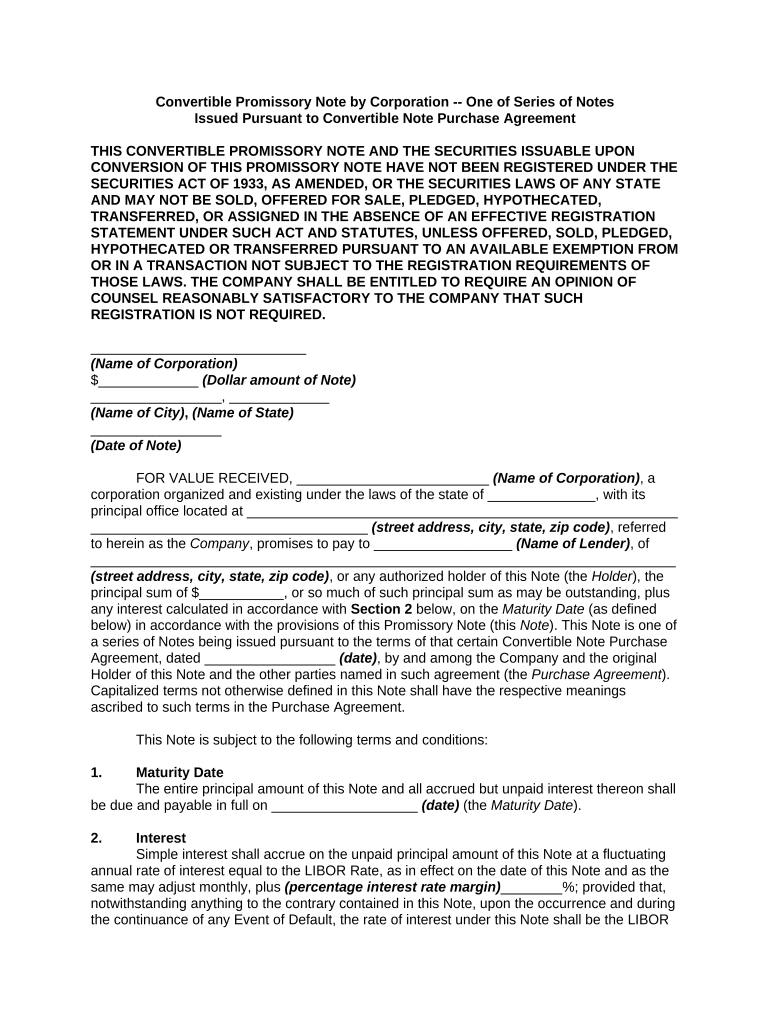

A convertible promissory note is a financial instrument used by businesses to raise capital. This type of note allows investors to loan money to a company with the option to convert the debt into equity at a later date, typically during a future financing round. The convertible promissory note serves as both a loan agreement and a potential investment opportunity, providing flexibility for both the issuer and the investor.

Key elements of the Convertible Promissory Note

Several key elements define a convertible promissory note:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the principal amount.

- Maturity Date: The date by which the note must be repaid or converted into equity.

- Conversion Terms: Conditions under which the note can be converted into equity, including the conversion price and any discounts offered to investors.

- Default Provisions: Terms that outline the consequences if the borrower fails to meet their obligations.

Steps to complete the Convertible Promissory Note

Completing a convertible promissory note involves several steps:

- Determine the principal amount and interest rate.

- Define the maturity date and conversion terms.

- Draft the note, ensuring all key elements are included.

- Review the document for accuracy and legal compliance.

- Have all parties sign the note, either physically or electronically.

Legal use of the Convertible Promissory Note

The legal use of a convertible promissory note requires compliance with relevant laws and regulations. In the United States, these notes must adhere to the Uniform Commercial Code (UCC) and securities laws, which govern the issuance of debt and equity instruments. It is crucial for both parties to understand their rights and obligations under the note to avoid legal disputes.

How to use the Convertible Promissory Note

Using a convertible promissory note effectively involves understanding its purpose and function within a business context. Businesses typically issue these notes to attract investors who are interested in future equity stakes. Investors should evaluate the terms of the note carefully, considering the potential for conversion into equity and the associated risks. Proper documentation and record-keeping are essential for both parties to ensure transparency and compliance.

How to obtain the Convertible Promissory Note

Obtaining a convertible promissory note can be accomplished through various methods. Companies often draft their own notes using templates or legal software tailored for this purpose. Legal professionals can also assist in creating customized notes that meet specific business needs. Additionally, many online platforms provide templates and resources to help businesses generate compliant convertible promissory notes efficiently.

Quick guide on how to complete convertible promissory note

Effortlessly Prepare Convertible Promissory Note on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, edit, and eSign your documents without delays. Handle Convertible Promissory Note on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Convertible Promissory Note with Ease

- Locate Convertible Promissory Note and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight necessary sections of the documents or conceal sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form-finding, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Convertible Promissory Note and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a convertible promissory note?

A convertible promissory note is a financial instrument that allows an investor to convert debt into equity at a future date. This type of note is often used in startup funding and can provide flexibility to both investors and businesses. By utilizing a convertible promissory note, companies can raise capital while postponing the valuation of their company until a later funding round.

-

How does airSlate SignNow assist with creating a convertible promissory note?

airSlate SignNow offers a user-friendly platform that simplifies the process of creating a convertible promissory note. With customizable templates and easy editing features, businesses can generate legally binding documents without the need for extensive legal knowledge. This streamlines the financing process and saves valuable time for startups and investors alike.

-

What are the benefits of using airSlate SignNow for a convertible promissory note?

Using airSlate SignNow for a convertible promissory note offers several benefits, including cost-effectiveness and simplicity. The platform ensures that users can securely send and eSign documents quickly, enabling faster capital access. Furthermore, the built-in compliance features help maintain the integrity of legal documents.

-

Are there any costs associated with using airSlate SignNow for a convertible promissory note?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for creating convertible promissory notes. While many features are affordable, users can choose a plan that best fits their budget and requirements. Overall, the cost is competitive compared to traditional legal services.

-

Can I customize my convertible promissory note in airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of your convertible promissory note. Users can easily edit text, add specific terms and conditions, and integrate personal branding elements. This flexibility ensures that the note meets both regulatory standards and individual business requirements.

-

What integrations does airSlate SignNow offer for managing convertible promissory notes?

airSlate SignNow seamlessly integrates with various applications to enhance the management of convertible promissory notes. It connects with customer relationship management (CRM) tools, cloud storage services, and other productivity apps. This allows users to streamline their workflow and keep all relevant documentation in one accessible place.

-

How secure is using airSlate SignNow for my convertible promissory note?

Security is a top priority for airSlate SignNow when handling convertible promissory notes. The platform utilizes advanced encryption methods to protect sensitive information and ensure compliance with data protection regulations. Users can confidently send and store their documents without the fear of unauthorized access.

Get more for Convertible Promissory Note

Find out other Convertible Promissory Note

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast