Expense Report Form

What is the Expense Report

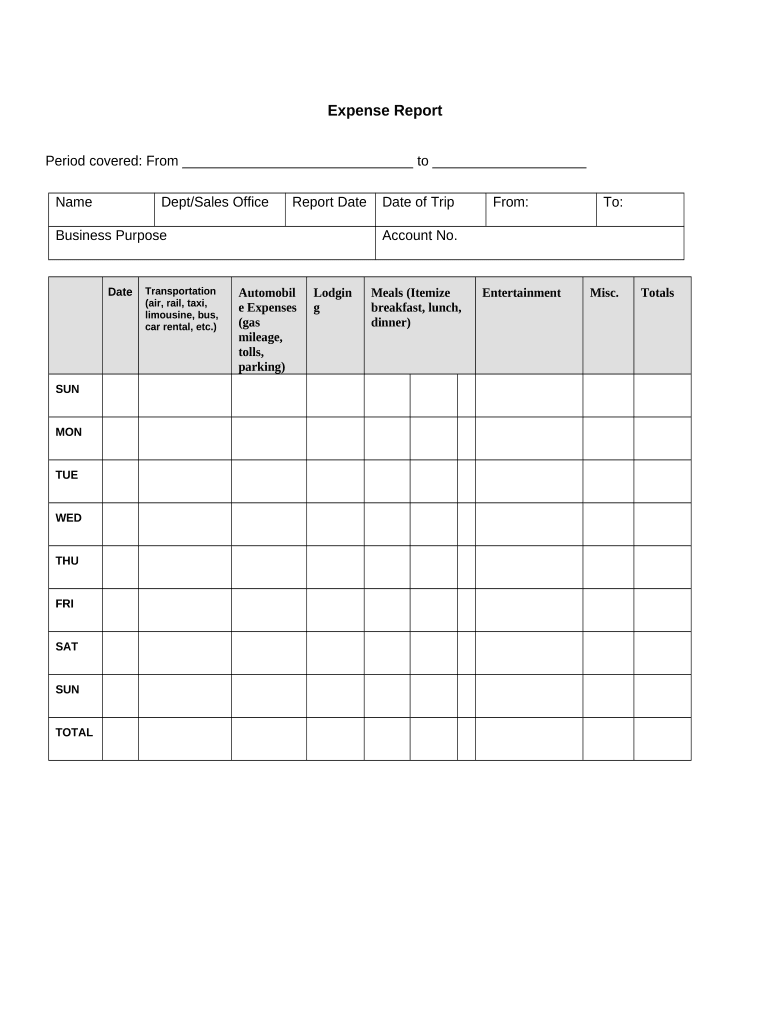

An expense report is a formal document used by employees to itemize and request reimbursement for expenses incurred during business activities. This report typically includes details such as the date of the expense, the type of expense, the amount spent, and any relevant receipts. Expense reports are crucial for maintaining accurate financial records and ensuring that employees are reimbursed in a timely manner.

How to use the Expense Report

To effectively use an expense report, begin by gathering all necessary documentation, including receipts and invoices related to your business expenses. Next, fill out the expense report form, ensuring that all required fields are completed accurately. Be clear and concise in your descriptions to facilitate the review process. Once completed, submit the report to your supervisor or the finance department for approval. Digital tools like signNow can streamline this process, allowing for easy submission and eSigning.

Steps to complete the Expense Report

Completing an expense report involves several key steps:

- Collect all relevant receipts and documentation for expenses incurred.

- Fill in the expense report form, detailing each expense with the date, amount, and purpose.

- Attach copies of receipts to support your claims.

- Review the report for accuracy and completeness.

- Submit the report to the appropriate authority for approval.

Legal use of the Expense Report

The legal use of an expense report requires adherence to specific guidelines and regulations. To ensure compliance, it is important to maintain accurate records and provide legitimate documentation for all expenses claimed. Digital signatures on expense reports can enhance their legal standing, provided they meet the requirements set forth by laws such as ESIGN and UETA. Using a reliable eSignature platform ensures that your expense report is both legally binding and secure.

Key elements of the Expense Report

Key elements of an expense report typically include:

- Date: The date when the expense was incurred.

- Description: A brief explanation of the expense.

- Amount: The total cost of the expense.

- Category: The type of expense, such as travel, meals, or supplies.

- Receipts: Attached documentation that verifies the expense.

Form Submission Methods

Expense reports can be submitted through various methods, including:

- Online: Using digital platforms like signNow for electronic submission and eSigning.

- Mail: Sending a printed copy of the expense report via postal service.

- In-Person: Handing the report directly to the finance department or supervisor.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding the documentation and reporting of business expenses. It is essential to familiarize yourself with these guidelines to ensure compliance and avoid potential issues during audits. Properly completed expense reports that align with IRS standards can support your claims for tax deductions related to business expenses.

Quick guide on how to complete expense report

Facilitate Expense Report effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage Expense Report on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Expense Report without hassle

- Locate Expense Report and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a standard wet ink signature.

- Verify all the details and click on the Done button to confirm your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Expense Report and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Expense Report and why is it important?

An Expense Report is a document used to track business-related expenses incurred by employees. It is important because it allows organizations to manage their expenditures, maintain financial transparency, and ensures that employees are reimbursed promptly. Using airSlate SignNow for Expense Reports simplifies the process, making it easier for employees to submit and approve expenses digitally.

-

How does airSlate SignNow streamline the Expense Report process?

airSlate SignNow streamlines the Expense Report process by enabling users to create, send, and sign expense reports electronically. With its user-friendly interface, employees can quickly fill out expense details and submit them for approval, reducing the time spent on paperwork. This efficiency leads to faster reimbursements and improved workforce satisfaction.

-

What features does airSlate SignNow offer for Expense Reports?

airSlate SignNow offers several features tailored for managing Expense Reports, including customizable templates, real-time tracking, and automated approval workflows. The ability to eSign documents protects the integrity of the reports while ensuring compliance. These features help businesses streamline their expense management and reduce administrative burdens.

-

Is there a mobile app for submitting Expense Reports?

Yes, airSlate SignNow provides a mobile app that allows users to submit Expense Reports on-the-go. Employees can upload receipts, fill out expense details, and eSign documents directly from their smartphones or tablets. This convenience ensures that expenses are reported promptly and reduces delays in submissions.

-

How does airSlate SignNow handle data security for Expense Reports?

Data security is a top priority for airSlate SignNow, especially when dealing with sensitive information in Expense Reports. The platform employs encryption, secure servers, and strict access controls to protect user data. This ensures that all expense information is secure and compliant with industry regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for Expense Reports?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing for seamless data transfer of Expense Reports. This integration helps to automate the accounting process, reducing manual entry errors and ensuring that all financial records are up-to-date.

-

What is the pricing structure for airSlate SignNow for handling Expense Reports?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage Expense Reports effectively. Pricing is competitive and varies based on features and user requirements. Additionally, there are often discounts for annual subscriptions, making it a cost-effective solution for expense management.

Get more for Expense Report

Find out other Expense Report

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy