Auto Expense Travel Form

What is the Auto Expense Travel

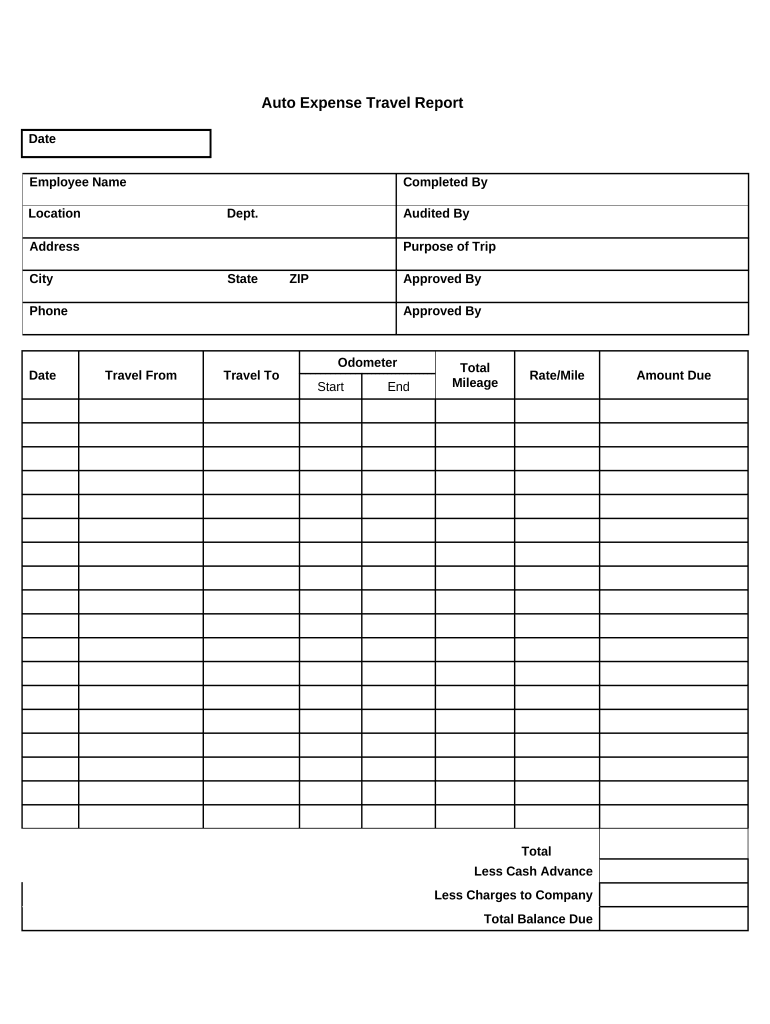

The auto expense travel form is a crucial document used by individuals and businesses to report vehicle-related expenses incurred during travel for business purposes. This form helps in tracking costs associated with fuel, maintenance, insurance, and depreciation, ensuring that all relevant expenses are accounted for when filing taxes. Understanding this form is essential for anyone looking to maximize their deductions and maintain compliance with IRS regulations.

How to use the Auto Expense Travel

Using the auto expense travel form involves several steps to ensure accurate reporting. First, gather all receipts and documentation related to vehicle expenses. This includes fuel purchases, maintenance records, and any other relevant costs. Next, calculate the total expenses incurred during the travel period. Finally, fill out the form with the necessary details, including the purpose of travel, dates, and the total amount spent. It is important to keep a copy of the completed form and all supporting documents for your records.

Steps to complete the Auto Expense Travel

Completing the auto expense travel form requires attention to detail. Follow these steps:

- Collect all necessary receipts and documentation.

- Determine the total miles driven for business purposes.

- Calculate the total expenses, including fuel, maintenance, and insurance.

- Fill out the form accurately, providing all required information.

- Review the form for completeness and accuracy.

- Submit the form along with any required supporting documents.

Legal use of the Auto Expense Travel

To ensure the legal validity of the auto expense travel form, it must comply with IRS guidelines. This includes accurately reporting all expenses and maintaining proper documentation. The form should be filled out truthfully, reflecting actual expenses incurred during business travel. Failure to comply with these regulations may result in penalties or disallowance of deductions. It is advisable to consult a tax professional if there are any uncertainties regarding the legal implications of the form.

IRS Guidelines

The IRS has specific guidelines regarding the use of the auto expense travel form. Taxpayers must adhere to the standard mileage rate or actual expense method when reporting vehicle expenses. The standard mileage rate is updated annually, so it is essential to check the current rate for accurate calculations. Additionally, taxpayers must keep detailed records of all expenses and mileage to substantiate their claims. Understanding these guidelines helps ensure compliance and maximizes potential deductions.

Required Documents

When completing the auto expense travel form, certain documents are required to support the reported expenses. These include:

- Receipts for fuel purchases.

- Maintenance and repair invoices.

- Insurance documents.

- Records of mileage driven for business purposes.

- Any other relevant financial records related to vehicle expenses.

Penalties for Non-Compliance

Failure to comply with the IRS regulations regarding the auto expense travel form can lead to significant penalties. These may include fines, disallowance of deductions, and potential audits. It is crucial to ensure that all information reported is accurate and that proper documentation is maintained. Being proactive in understanding and adhering to these regulations can prevent costly repercussions.

Quick guide on how to complete auto expense travel

Complete Auto Expense Travel effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Auto Expense Travel on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Auto Expense Travel without stress

- Locate Auto Expense Travel and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Auto Expense Travel and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is auto expense travel, and how does it relate to airSlate SignNow?

Auto expense travel refers to the costs associated with using a vehicle for business purposes, including fuel, maintenance, and other related expenses. With airSlate SignNow, businesses can streamline the process of documenting and signing travel expense reports, making it easier to manage auto expense travel efficiently and effectively.

-

How can airSlate SignNow help manage auto expense travel documentation?

airSlate SignNow provides a user-friendly platform to create, sign, and store travel expense documents electronically. By digitizing these processes, businesses can reduce paperwork, minimize errors, and speed up reimbursements associated with auto expense travel.

-

Is airSlate SignNow cost-effective for tracking auto expense travel?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By automating the signing process and reducing the time spent on manual documentation, companies can save money and resources when tracking auto expense travel.

-

What features does airSlate SignNow offer for auto expense travel?

airSlate SignNow includes features such as electronic signatures, custom templates for expense reports, and mobile access for on-the-go documentation. These tools make managing auto expense travel simpler and more efficient for both employees and finance teams.

-

Does airSlate SignNow integrate with other tools for managing auto expense travel?

Absolutely! airSlate SignNow offers integrations with various accounting and travel management software, allowing for seamless management of auto expense travel documentation. These integrations help ensure all information is easily synced and accessible.

-

What are the benefits of using airSlate SignNow for auto expense travel?

Using airSlate SignNow for auto expense travel is beneficial as it enhances accuracy, speeds up the approval process, and mitigates the risk of lost documents. These features contribute to more effective expense management and facilitate better financial oversight.

-

How does airSlate SignNow ensure the security of auto expense travel documents?

airSlate SignNow is committed to data security, utilizing encryption and secure cloud storage to protect sensitive auto expense travel documents. This ensures that all signatures and financial data are kept safe and compliant with industry standards.

Get more for Auto Expense Travel

Find out other Auto Expense Travel

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney