Business Credit Application Form

What is the Business Credit Application

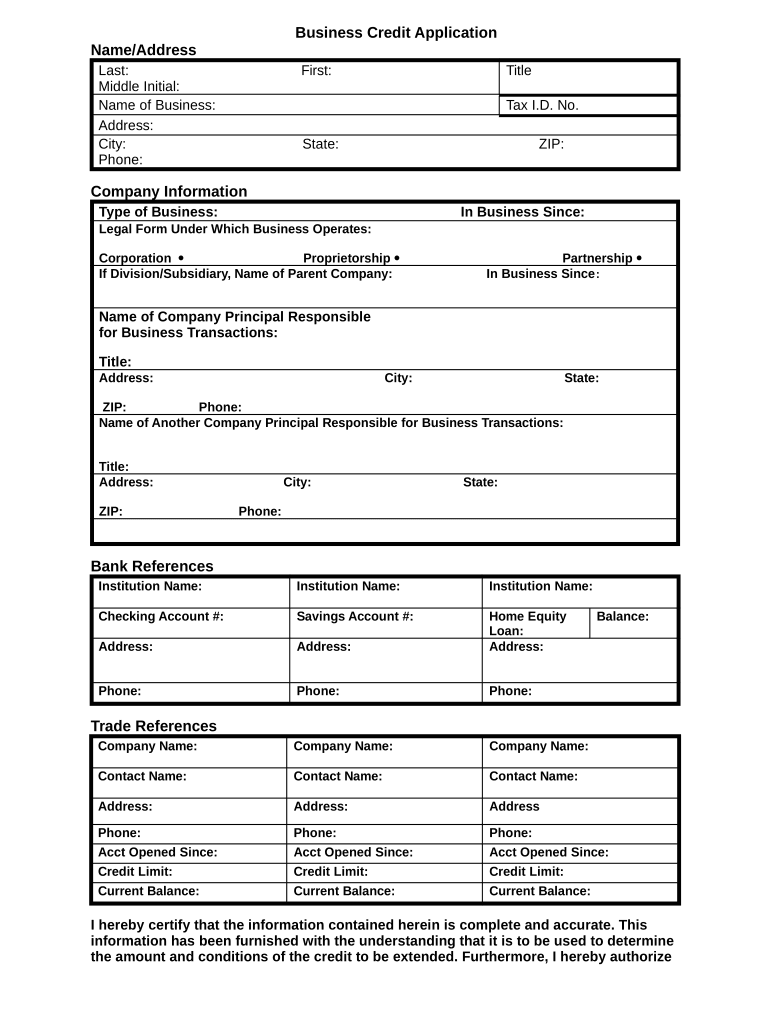

The business credit application is a formal document that allows a company to request credit from a lender or supplier. This form collects essential information about the business, including its legal structure, financial history, and creditworthiness. By filling out this application, businesses can establish or expand their credit lines, which is crucial for managing cash flow and funding operations. The information provided helps lenders assess the risk of extending credit and the likelihood of repayment.

Key elements of the Business Credit Application

When completing a business credit application form, several key elements must be included to ensure it is comprehensive and effective. These elements typically consist of:

- Business Information: Name, address, and contact details of the business.

- Legal Structure: Type of business entity, such as LLC, corporation, or partnership.

- Financial Details: Annual revenue, number of employees, and business bank account information.

- Owner Information: Personal details of the business owner(s), including Social Security numbers and credit history.

- Trade References: Contact information for suppliers or lenders that can vouch for the business's creditworthiness.

Steps to complete the Business Credit Application

Filling out the business credit application form involves several important steps to ensure accuracy and completeness. Here’s a straightforward approach:

- Gather all necessary documents, including financial statements and identification.

- Fill in the business information section with accurate details.

- Provide financial information, including revenue and expenses.

- List trade references, ensuring you have permission to share their contact details.

- Review the application for completeness and accuracy before submission.

Legal use of the Business Credit Application

To ensure the business credit application is legally binding, it must comply with relevant regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided certain criteria are met. This includes ensuring that all parties consent to use electronic documents and that the application is securely signed. Using a reliable platform for eSigning can help maintain compliance and provide a digital certificate as proof of signature.

How to obtain the Business Credit Application

The business credit application form can typically be obtained from various sources, including financial institutions, suppliers, and online platforms. Many lenders provide downloadable versions of their application forms in PDF format. It is advisable to visit the lender’s website or contact their customer service for the most current and relevant version of the application. Additionally, some businesses may offer customizable templates that can be tailored to specific needs.

Form Submission Methods (Online / Mail / In-Person)

Submitting the business credit application can be done through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow applicants to fill out and submit the form directly through their website.

- Mail: Completed forms can often be printed and sent via postal service to the lender's address.

- In-Person: Some businesses may prefer to submit the application in person, allowing for immediate feedback and clarification.

Quick guide on how to complete business credit application

Manage Business Credit Application effortlessly across any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents swiftly without delays. Handle Business Credit Application on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Business Credit Application with ease

- Locate Business Credit Application and click Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from your chosen device. Modify and electronically sign Business Credit Application to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a business credit application form PDF?

A business credit application form PDF is a standardized document that allows businesses to formally apply for credit. This PDF format is easy to fill out and can be electronically signed, streamlining the application process for both lenders and applicants.

-

How can I create a business credit application form PDF using airSlate SignNow?

With airSlate SignNow, you can easily create a business credit application form PDF using customizable templates. Simply input your business details, and you can generate a professional PDF in minutes, ready for distribution to potential clients or lenders.

-

What are the benefits of using an electronic business credit application form PDF?

Using an electronic business credit application form PDF offers numerous benefits, such as faster processing times and reduced paperwork. Additionally, eSigning with airSlate SignNow ensures that all applications are legally binding and securely stored in the cloud.

-

Is airSlate SignNow a cost-effective solution for managing business credit application forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing business credit application forms. You can save on printing and mailing costs by utilizing electronic document handling.

-

Can I integrate airSlate SignNow with other software for handling business credit application forms?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, from CRM systems to accounting software. This integration allows you to manage your business credit application forms more efficiently and keep all information connected.

-

What features does airSlate SignNow offer for business credit application form PDFs?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document statuses. These features enhance the management of business credit application forms PDF, ensuring a smooth and efficient processing experience.

-

Can I track the status of my business credit application form PDF sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your sent business credit application form PDF in real time. You'll receive notifications when the application is opened, signed, or completed, giving you full visibility and control over the process.

Get more for Business Credit Application

Find out other Business Credit Application

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple