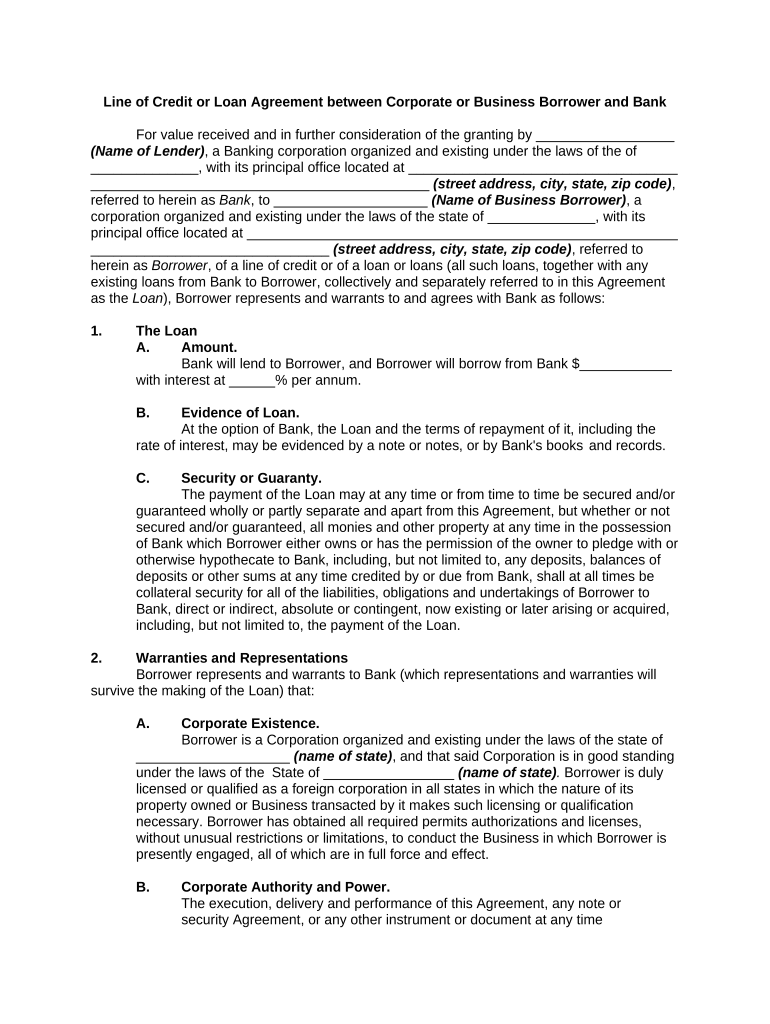

Line Credit Agreement Form

What is the Loan Agreement Bank?

A loan agreement bank is a formal document that outlines the terms and conditions of a loan between a borrower and a lender, typically a financial institution. This agreement serves as a legal contract that specifies the amount borrowed, interest rates, repayment schedules, and any collateral involved. It is crucial for both parties to understand the obligations and rights detailed within the agreement to ensure a smooth lending process. The loan agreement also includes provisions for default, which can protect the lender's interests in case the borrower fails to meet their repayment obligations.

Key Elements of the Loan Agreement Bank

Understanding the key elements of a loan agreement is essential for both borrowers and lenders. The main components typically include:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: The schedule for repayments, including the frequency and duration of payments.

- Collateral: Any asset pledged as security for the loan, which the lender can claim if the borrower defaults.

- Default Provisions: Conditions that define what constitutes a default and the consequences that follow.

Steps to Complete the Loan Agreement Bank

Completing a loan agreement requires careful attention to detail. Here are the steps to follow:

- Gather Necessary Information: Collect all required personal and financial information, including income, credit history, and identification.

- Review Loan Terms: Understand the terms offered by the lender, including interest rates and repayment schedules.

- Fill Out the Agreement: Complete the loan agreement form with accurate information, ensuring all sections are filled out correctly.

- Sign the Document: Both parties must sign the agreement to make it legally binding. Consider using an electronic signature for convenience.

- Keep a Copy: Retain a copy of the signed agreement for your records.

Legal Use of the Loan Agreement Bank

The legal use of a loan agreement is governed by various laws and regulations that ensure the protection of both parties. In the United States, loan agreements must comply with federal and state laws, including the Truth in Lending Act, which mandates clear disclosure of terms and costs. Additionally, electronic signatures are recognized under the ESIGN Act and UETA, making digital loan agreements legally valid. It is important for borrowers to read and understand the legal implications of the agreement before signing, as it may affect their financial future.

How to Obtain the Loan Agreement Bank

Obtaining a loan agreement typically involves applying for a loan through a bank or financial institution. The process generally includes:

- Researching Lenders: Compare different banks and their loan offerings to find the best terms.

- Submitting an Application: Fill out a loan application form, providing necessary documentation such as proof of income and credit history.

- Receiving Approval: Once the lender reviews your application, they will issue a loan agreement if approved.

- Reviewing the Agreement: Carefully read the loan agreement before signing to ensure all terms are acceptable.

Examples of Using the Loan Agreement Bank

Loan agreements can be used in various scenarios, including:

- Personal Loans: Individuals may use loan agreements for personal expenses such as medical bills or home improvements.

- Business Loans: Entrepreneurs often require loan agreements to secure funding for starting or expanding their businesses.

- Mortgages: Homebuyers use loan agreements to finance the purchase of real estate.

Quick guide on how to complete line credit agreement

Easily Prepare Line Credit Agreement on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Line Credit Agreement on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The Simplest Way to Modify and eSign Line Credit Agreement Effortlessly

- Find Line Credit Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just moments and has the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to store your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Line Credit Agreement and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement bank?

A loan agreement bank is a formal document that outlines the terms and conditions of a loan between a borrower and a lender. It includes details such as the loan amount, interest rate, repayment schedule, and penalties for defaulting. Using airSlate SignNow, you can easily create and manage your loan agreement bank documents with eSignature features.

-

How does airSlate SignNow help with loan agreements?

airSlate SignNow simplifies the creation and management of loan agreements by providing ready-made templates and easy editing options. With our platform, you can draft, send, and eSign your loan agreement bank documents in minutes. This streamlines the entire loan process, making it more efficient for both lenders and borrowers.

-

Are there any costs associated with using airSlate SignNow for loan agreements?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs. Each plan provides access to features that facilitate the creation and signing of loan agreement bank documents. You can start with a free trial to explore our offerings before committing to a paid plan.

-

What features does airSlate SignNow offer for loan agreements?

airSlate SignNow provides several key features for managing loan agreements, including customizable templates, real-time tracking, and advanced security measures for document integrity. Additionally, you can integrate with your favorite applications to enhance your workflow related to loan agreement bank processing.

-

Can I store my loan agreements securely with airSlate SignNow?

Absolutely! airSlate SignNow ensures that your loan agreement bank documents are stored securely in a cloud-based environment. We implement advanced encryption and security protocols to protect your sensitive information, giving you peace of mind regarding document confidentiality.

-

Is it easy to eSign loan agreements with airSlate SignNow?

Yes, eSigning loan agreements with airSlate SignNow is quick and user-friendly. The platform allows all parties involved to sign the loan agreement bank electronically from any device, which saves time and eliminates the need for physical paperwork.

-

Can I customize my loan agreement using airSlate SignNow?

Certainly! airSlate SignNow allows you to fully customize your loan agreement bank templates to suit your specific requirements. You can modify terms, add clauses, and incorporate branding elements to create a personalized document that reflects your organization's identity.

Get more for Line Credit Agreement

- Replacement affidavit form

- Advantage resourcing w2 form

- Milsim west parental permission form release of liability

- Hull and liability insurance form

- Welding procedure specification pdf form

- Collective letter 11 preferential etsi conditions for accommodation and other services in the sophia antipolis aarea edition form

- Zusatzblatt fr familienangehrige zum antrag auf form

- Certegy vip enrollment form

Find out other Line Credit Agreement

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document