Loan Agreement Corporate Form

Understanding the Loan Agreement Corporate

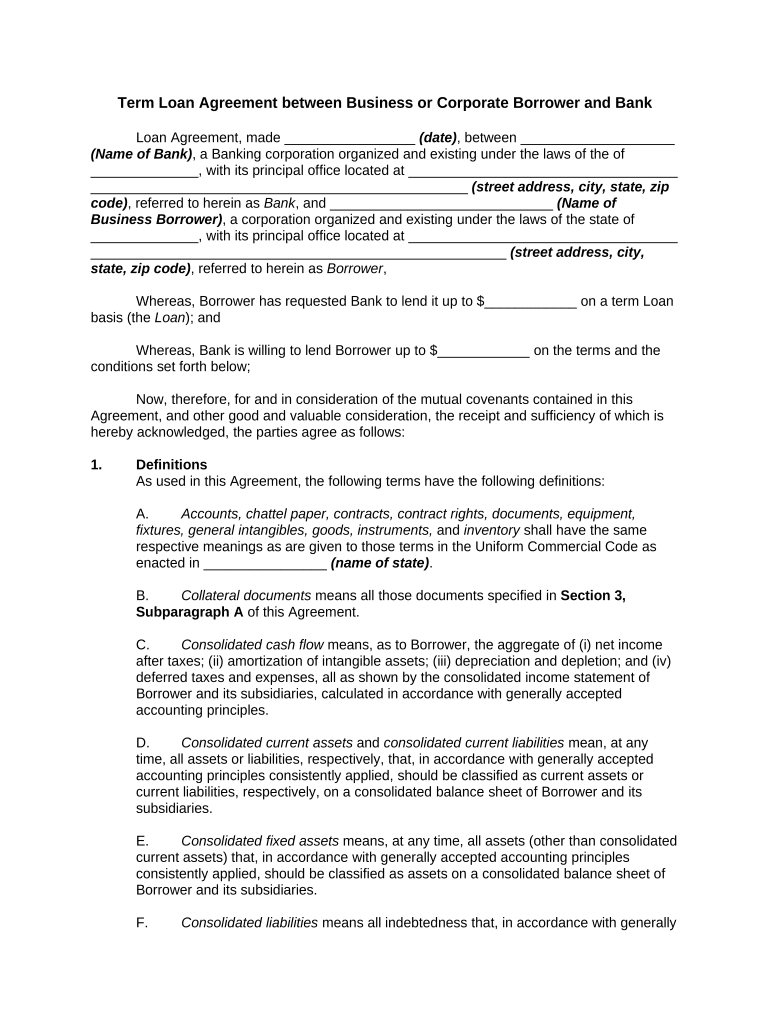

A loan agreement corporate is a formal document that outlines the terms and conditions under which a lender provides funds to a business entity. This type of agreement is essential for establishing clear expectations between the borrower and the lender. Key elements typically include the loan amount, interest rate, repayment schedule, and any collateral required. It serves as a legally binding contract, ensuring that both parties adhere to the agreed-upon terms.

Steps to Complete the Loan Agreement Corporate

Completing a loan agreement corporate involves several important steps to ensure accuracy and compliance. Start by gathering necessary information, including the business's financial details and the lender's requirements. Next, draft the agreement, clearly stating all terms, including the loan amount, interest rate, and repayment schedule. Both parties should review the document thoroughly to avoid misunderstandings. Finally, sign the agreement electronically or in person, ensuring that all signatures are dated and witnessed if required.

Key Elements of the Loan Agreement Corporate

Several key elements must be included in a loan agreement corporate to ensure its validity and enforceability. These elements typically consist of:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Repayment Schedule: A detailed timeline for when payments are due.

- Collateral: Assets pledged by the borrower to secure the loan.

- Default Terms: Conditions under which the lender can demand repayment.

Legal Use of the Loan Agreement Corporate

The legal use of a loan agreement corporate is governed by various laws and regulations. In the United States, it is crucial that the agreement complies with federal and state lending laws. This includes adhering to the Truth in Lending Act, which requires lenders to disclose certain information about the loan terms. Additionally, both parties should retain copies of the signed agreement for their records, as it may be necessary for legal reference in the future.

How to Obtain the Loan Agreement Corporate

Obtaining a loan agreement corporate can be done through several avenues. Businesses can consult with legal professionals to draft a customized agreement that meets their specific needs. Alternatively, many online platforms offer templates for loan agreements that can be tailored to fit various business scenarios. It is important to ensure that any template used complies with applicable laws and is suitable for the specific transaction.

Examples of Using the Loan Agreement Corporate

Loan agreements corporate are commonly used in various business scenarios, such as:

- Securing funds for purchasing equipment or inventory.

- Financing expansion projects or new business ventures.

- Refinancing existing debt to improve cash flow.

These agreements provide a structured approach to borrowing, helping businesses manage their financial obligations effectively.

Quick guide on how to complete loan agreement corporate

Complete Loan Agreement Corporate effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your paperwork swiftly without delays. Manage Loan Agreement Corporate on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Loan Agreement Corporate with ease

- Obtain Loan Agreement Corporate and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Alter and eSign Loan Agreement Corporate while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement between parties?

A loan agreement between parties is a legal document that outlines the terms and conditions of a loan, including the amount borrowed, interest rates, and repayment schedule. Using airSlate SignNow, you can easily create, send, and eSign such agreements, making the process efficient and secure.

-

How does airSlate SignNow simplify the loan agreement between two parties?

airSlate SignNow streamlines the process of creating a loan agreement between two parties by providing user-friendly templates and tools for customization. Users can quickly input necessary details, ensuring that the agreement is professional and tailored to their specific needs.

-

What features does airSlate SignNow offer for loan agreements?

airSlate SignNow offers features such as eSigning, document templates, secure storage, and real-time tracking for loan agreements. These features ensure that the loan agreement between parties is created accurately, executed swiftly, and stored securely for future reference.

-

Is there a cost associated with using airSlate SignNow for a loan agreement between parties?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans include access to features that facilitate the creation and eSigning of loan agreements between parties, all while remaining cost-effective.

-

Can I integrate airSlate SignNow with other software for loan agreements?

Absolutely, airSlate SignNow offers integrations with various platforms such as CRM systems and cloud storage services, enhancing the ease of managing loan agreements between parties. These integrations ensure a seamless workflow, allowing for easy access and sharing of documents.

-

Are loan agreements created with airSlate SignNow legally binding?

Yes, loan agreements created and signed using airSlate SignNow are legally binding, provided they comply with applicable laws. The platform ensures that the eSigning process meets legal standards, guaranteeing that the loan agreement between parties holds up in court.

-

What benefits does airSlate SignNow provide for managing loan agreements?

The benefits of using airSlate SignNow for managing loan agreements include increased efficiency, reduced paperwork, and easier collaboration. By leveraging the platform, businesses can streamline the entire loan agreement process between parties, saving time and resources.

Get more for Loan Agreement Corporate

- Samordnet registermelding del 1 hovedblankett registrering i enhetsregisteret form

- History park facility use application web based rfp form

- Nhra bh form

- Application r certificate form

- Professional reference questionnaire abih form

- Rei wbc intake form

- Sample volunteer application for nonprofit organizations volunteer recruitment form

- Printclearnot for electronic filing contact 60981 form

Find out other Loan Agreement Corporate

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word