Loan Shareholders Form

What is the loan shareholders form?

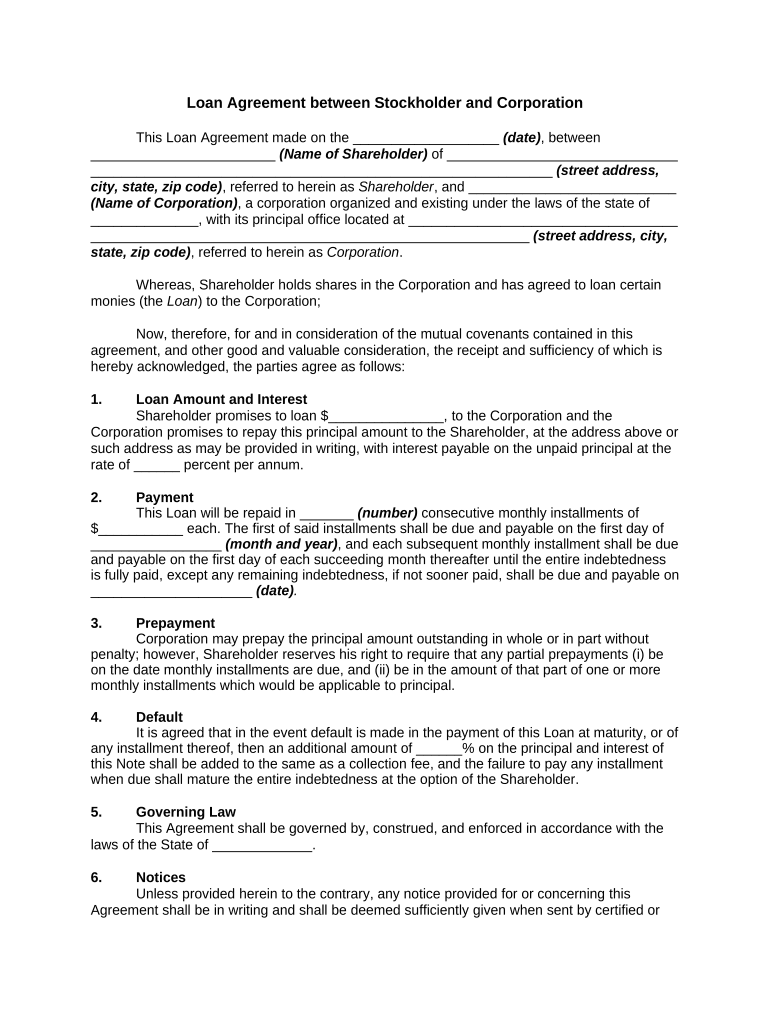

The loan shareholders form is a legal document used to outline the terms and conditions of a loan agreement between shareholders of a company. This form is essential for documenting the financial relationship between parties, ensuring clarity on repayment terms, interest rates, and any collateral involved. By formalizing these agreements, businesses can avoid misunderstandings and potential disputes in the future.

Key elements of the loan shareholders form

Several critical components must be included in the loan shareholders form to ensure its effectiveness and legal standing:

- Borrower and Lender Information: Names and contact details of all parties involved.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: Specific details regarding payment schedules and due dates.

- Default Clauses: Conditions under which the loan may be considered in default.

- Signatures: Required signatures of all parties to validate the agreement.

Steps to complete the loan shareholders form

Completing the loan shareholders form involves several straightforward steps:

- Gather necessary information about the borrower and lender.

- Clearly define the loan amount and interest rate.

- Outline repayment terms, including the schedule and method of payment.

- Include any additional terms or conditions relevant to the loan.

- Ensure all parties review the form for accuracy.

- Obtain signatures from all involved parties.

Legal use of the loan shareholders form

For the loan shareholders form to be legally binding, it must comply with relevant laws and regulations. In the United States, the form should adhere to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish the legality of electronic signatures and ensure that digital documents hold the same weight as their paper counterparts when properly executed.

How to use the loan shareholders form

The loan shareholders form can be utilized in various scenarios, typically when a shareholder needs to borrow funds from another shareholder or the company itself. By using this form, parties can formalize the loan agreement, ensuring that all terms are documented and agreed upon. It is advisable to keep a copy of the signed form for record-keeping and future reference.

Examples of using the loan shareholders form

Common situations for employing the loan shareholders form include:

- A shareholder needing funds for personal expenses.

- A shareholder investing in a new project within the company.

- Loans taken to cover operational costs during financial downturns.

Quick guide on how to complete loan shareholders

Complete Loan Shareholders effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to acquire the correct format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Loan Shareholders on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Loan Shareholders effortlessly

- Find Loan Shareholders and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to store your alterations.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Loan Shareholders and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are loan shareholders?

Loan shareholders are individuals or entities that hold a financial interest in a loan. They play a crucial role in the lending process, particularly in securing funding and ensuring reliable repayments. Understanding the dynamics of loan shareholders can help businesses make better decisions when seeking loans.

-

How does airSlate SignNow benefit loan shareholders?

airSlate SignNow streamlines the document signing process, allowing loan shareholders to quickly and securely eSign documents related to loans. This efficiency enhances communication between parties and reduces the time it takes to finalize agreements. With a focus on ease of use, airSlate SignNow supports the needs of loan shareholders effectively.

-

What features does airSlate SignNow offer for managing loan agreements?

AirSlate SignNow provides features such as customizable templates, document tracking, and secure electronic signatures, which are essential for managing loan agreements. These tools help loan shareholders ensure compliance and maintain organized records, making the entire process smoother and more efficient.

-

Is airSlate SignNow cost-effective for loan shareholders?

Yes, airSlate SignNow is designed to be a cost-effective solution, especially for loan shareholders who need to manage multiple agreements efficiently. With competitive pricing plans, businesses can utilize a powerful eSigning solution without breaking the bank. This affordability allows loan shareholders to focus their resources on other critical areas.

-

What integrations does airSlate SignNow offer to support loan shareholders?

AirSlate SignNow integrates with various platforms such as CRM systems, payment processors, and cloud storage services to enhance workflow for loan shareholders. These integrations allow users to manage their documents and data seamlessly across different applications, increasing productivity and reducing manual tasks.

-

How can loan shareholders ensure document security with airSlate SignNow?

AirSlate SignNow employs advanced security measures like encryption and two-factor authentication to protect documents signed by loan shareholders. This ensures that sensitive information remains confidential and secure throughout the signing process. Trusting airSlate SignNow means loan shareholders can feel safe when managing important agreements.

-

Can loan shareholders track the status of their documents with airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking for documents, allowing loan shareholders to monitor the signing process closely. This feature helps users stay informed and ensures timely actions are taken when necessary, improving the overall management of loan agreements.

Get more for Loan Shareholders

Find out other Loan Shareholders

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer