Mortgage Form Template

What is the Mortgage Form Template

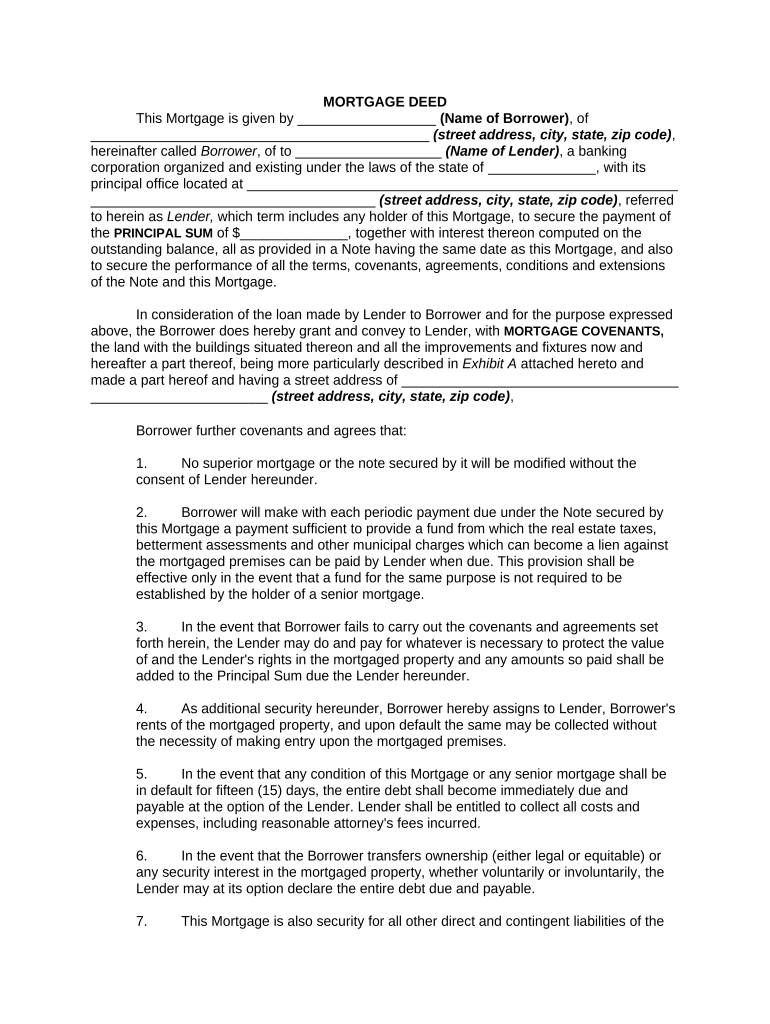

The mortgage form template is a standardized document used in the process of obtaining a mortgage loan. This template outlines the terms and conditions of the mortgage agreement between the borrower and the lender. It typically includes essential information such as the loan amount, interest rate, repayment schedule, and property details. Utilizing a mortgage form template ensures that all necessary legal stipulations are included, making the document both comprehensive and compliant with relevant regulations.

How to Use the Mortgage Form Template

Using the mortgage form template involves several straightforward steps. First, gather all necessary personal and financial information, including income details, credit history, and property information. Next, access the mortgage form template through a reliable digital platform. Fill in the required fields accurately, ensuring that all information is current and truthful. Finally, review the completed document for any errors before proceeding to eSign it, which will finalize the agreement electronically.

Steps to Complete the Mortgage Form Template

Completing the mortgage form template requires careful attention to detail. Begin by entering your personal information, including your full name, address, and Social Security number. Next, provide details about the property you intend to purchase, such as its address and purchase price. After that, include financial information, including your income, employment history, and any existing debts. Once all sections are filled out, review the document thoroughly to ensure accuracy and compliance with lender requirements.

Legal Use of the Mortgage Form Template

To ensure the legal validity of the mortgage form template, it must comply with federal and state laws governing mortgage agreements. This includes adherence to the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows electronic signatures to hold the same legal weight as traditional handwritten signatures. Additionally, the template should include all necessary disclosures and be signed by both parties involved in the transaction. Utilizing a reputable eSignature solution can further enhance the legal standing of the completed document.

Key Elements of the Mortgage Form Template

The mortgage form template contains several key elements that are crucial for a complete and legally binding agreement. These elements include:

- Borrower Information: Full name, address, and contact details of the borrower.

- Lender Information: Name and contact details of the lending institution.

- Loan Details: Amount of the loan, interest rate, and repayment terms.

- Property Information: Description and address of the property being financed.

- Signatures: Required signatures from both the borrower and lender, along with dates.

State-Specific Rules for the Mortgage Form Template

Each state in the U.S. may have specific rules and regulations governing mortgage agreements. These can include requirements for disclosures, interest rate limits, and specific language that must be included in the mortgage form template. It is essential to be aware of your state's laws to ensure compliance and avoid legal issues. Consulting with a legal professional or a mortgage expert familiar with local regulations can provide valuable guidance in this area.

Quick guide on how to complete mortgage form template

Complete Mortgage Form Template effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, since you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Mortgage Form Template on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Mortgage Form Template with ease

- Obtain Mortgage Form Template and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from your device of choice. Modify and electronically sign Mortgage Form Template and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage form in the context of airSlate SignNow?

A mortgage form is a document that details the terms and conditions of a mortgage loan. With airSlate SignNow, you can easily create, send, and eSign mortgage forms, streamlining the process for both lenders and borrowers. This ensures that all parties can quickly review and approve necessary documentation.

-

How can I use airSlate SignNow to create a mortgage form?

Creating a mortgage form with airSlate SignNow is simple and intuitive. You can start by selecting a template or customizing a form to fit your specific needs, then add fields for signatures, dates, and other essential information. This functionality helps save time and ensures accuracy in your mortgage documentation.

-

What are the pricing options for using airSlate SignNow for mortgage forms?

airSlate SignNow offers several pricing plans that cater to different business needs, including an affordable option for small businesses focused on managing mortgage forms. Each plan provides varying features such as unlimited templates and advanced integrations, allowing you to choose the best solution that fits your budget when dealing with mortgage forms.

-

What features of airSlate SignNow are beneficial for managing mortgage forms?

airSlate SignNow includes features like templates, real-time tracking, and automated reminders which are essential for managing mortgage forms efficiently. The platform's user-friendly interface allows for quick navigation and editing of documents, while ensuring that all legal requirements are met. These features enhance the overall mortgage application process.

-

Are there integrations available for airSlate SignNow with other tools related to mortgage forms?

Yes, airSlate SignNow integrates seamlessly with various tools that are crucial for managing mortgage forms effectively. You can connect it with CRM software, cloud storage solutions, and other productivity tools to streamline your workflow and ensure a cohesive document management process. These integrations help improve efficiency and reduce the chances of errors.

-

How does eSigning a mortgage form work in airSlate SignNow?

eSigning a mortgage form in airSlate SignNow is a straightforward process that allows signers to electronically approve documents from anywhere. Users receive a secure link to the mortgage form, where they can review and add their signature with a few simple clicks. This feature enhances convenience and speeds up the mortgage closing process.

-

Can I customize my mortgage form in airSlate SignNow?

Absolutely! airSlate SignNow offers extensive customization options for your mortgage forms. You can adjust headings, fields, and layout to match your branding or specific requirements, ensuring that the final document reflects your professional image while meeting all regulatory standards.

Get more for Mortgage Form Template

Find out other Mortgage Form Template

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online