Promissory Note Long Form

What is the Promissory Note Long

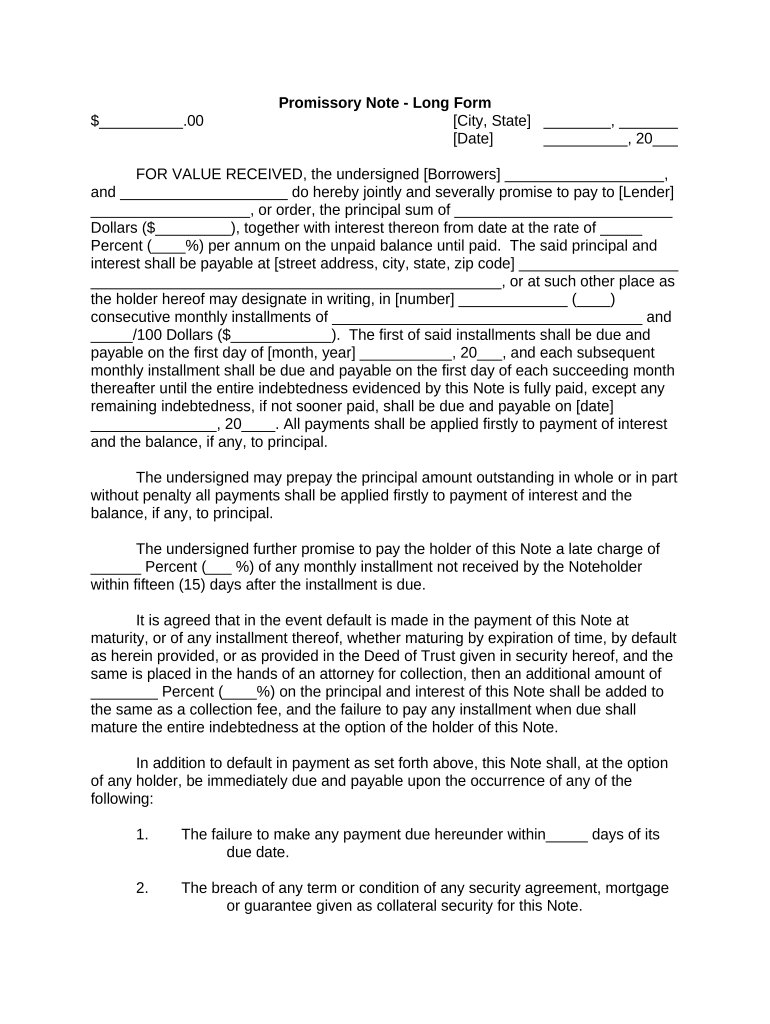

A promissory note long is a legal document in which one party (the borrower) agrees to pay a specified sum of money to another party (the lender) under agreed-upon terms. This document serves as a written promise to repay a loan, detailing the amount borrowed, interest rates, repayment schedule, and any collateral involved. It is essential for establishing the terms of the loan and protecting the rights of both parties. The promissory note long is particularly important in formal lending situations, where clear documentation is necessary to avoid misunderstandings.

Key elements of the Promissory Note Long

Understanding the key elements of a promissory note long is crucial for both borrowers and lenders. The primary components include:

- Principal Amount: The total amount of money borrowed.

- Interest Rate: The rate at which interest will accrue on the principal amount.

- Repayment Schedule: The timeline for repayments, including due dates and payment amounts.

- Signatures: Both parties must sign the document to validate the agreement.

- Default Terms: Conditions under which the lender can declare the borrower in default.

These elements ensure that all parties are aware of their obligations and the consequences of failing to meet them.

Steps to complete the Promissory Note Long

Completing a promissory note long involves several important steps to ensure its legality and effectiveness. Follow these steps:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Write the principal amount being borrowed in both numerical and written form.

- Outline the Interest Rate: Include the annual interest rate applicable to the loan.

- Detail the Repayment Terms: Specify the repayment schedule, including the frequency of payments and due dates.

- Include Default Clauses: Define what constitutes a default and the lender's rights in such an event.

- Sign the Document: Both parties must sign the promissory note long to make it legally binding.

Following these steps will help ensure that the promissory note long is properly executed and enforceable.

Legal use of the Promissory Note Long

The legal use of a promissory note long is governed by state laws and regulations. It is essential for the document to comply with the Uniform Commercial Code (UCC), which outlines the legal framework for negotiable instruments in the United States. A properly executed promissory note long can be enforced in court, allowing the lender to seek repayment through legal means if the borrower defaults. Additionally, the note may be used as collateral for further financing or as evidence in financial disputes.

How to use the Promissory Note Long

Using a promissory note long effectively requires understanding its purpose and application. It can be utilized in various scenarios, such as:

- Personal Loans: Individuals borrowing money from friends or family.

- Business Financing: Companies seeking loans from financial institutions or private investors.

- Real Estate Transactions: Buyers financing property purchases with seller financing agreements.

In each case, the promissory note long serves to formalize the agreement, providing legal protection and clarity for both parties involved.

Examples of using the Promissory Note Long

Examples of using a promissory note long can illustrate its practical applications. Consider the following scenarios:

- Family Loan: A parent lends $10,000 to their child for a down payment on a home, documented with a promissory note long outlining repayment terms.

- Business Loan: A small business owner borrows $50,000 from a bank, secured by a promissory note long that details interest rates and repayment schedules.

- Real Estate Purchase: A buyer finances a portion of a home purchase through a seller financing agreement, formalized with a promissory note long.

These examples demonstrate how the promissory note long can facilitate various financial transactions, ensuring that all parties understand their rights and responsibilities.

Quick guide on how to complete promissory note long

Complete Promissory Note Long effortlessly on any device

Online document management has become popular among enterprises and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Promissory Note Long on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Promissory Note Long without stress

- Find Promissory Note Long and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Promissory Note Long to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory note long and why is it important?

A promissory note long is a legal document that outlines a borrower's promise to repay a loan under specified terms. It is essential for formalizing financial agreements, ensuring that both parties understand their obligations and rights. Using airSlate SignNow to create and eSign your promissory note long simplifies this process, making it more efficient.

-

How can airSlate SignNow help with creating a promissory note long?

airSlate SignNow offers a user-friendly platform that enables you to draft, customize, and eSign your promissory note long effortlessly. With templates and easy-to-navigate tools, you can ensure that all necessary details are included, saving you time and reducing errors. It’s an effective solution for all your document signing needs.

-

What features does airSlate SignNow offer for managing promissory note long agreements?

airSlate SignNow provides features such as document templates, customizable fields, and secure eSigning for your promissory note long. You can access real-time notifications and track the signing process, ensuring that your documents are always processed efficiently. These features enhance overall workflow and simplify document management.

-

Is airSlate SignNow cost-effective for creating a promissory note long?

Yes, airSlate SignNow is a cost-effective solution for creating a promissory note long, offering various pricing plans to fit the needs of individuals and businesses alike. With its straightforward pricing structure, you can access all the necessary features without hidden costs, ensuring excellent value for your investment.

-

Can I integrate airSlate SignNow with other applications for my promissory note long?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications like Google Workspace, Salesforce, and more. This means you can easily incorporate your promissory note long into your existing workflows, making document management even more convenient and efficient.

-

What are the benefits of using airSlate SignNow for a promissory note long?

Using airSlate SignNow for a promissory note long provides increased efficiency, legal compliance, and enhanced security for your documents. The platform ensures that your agreements are signed timely and stored securely, reducing the risk of data loss. Additionally, it offers a professional image for your business relationships.

-

How secure are the documents signed through airSlate SignNow?

Documents signed through airSlate SignNow, including your promissory note long, are secured with advanced encryption and compliance protocols. This ensures that your sensitive information remains protected and private. You can trust that your signed documents are safe and legally binding.

Get more for Promissory Note Long

Find out other Promissory Note Long

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement