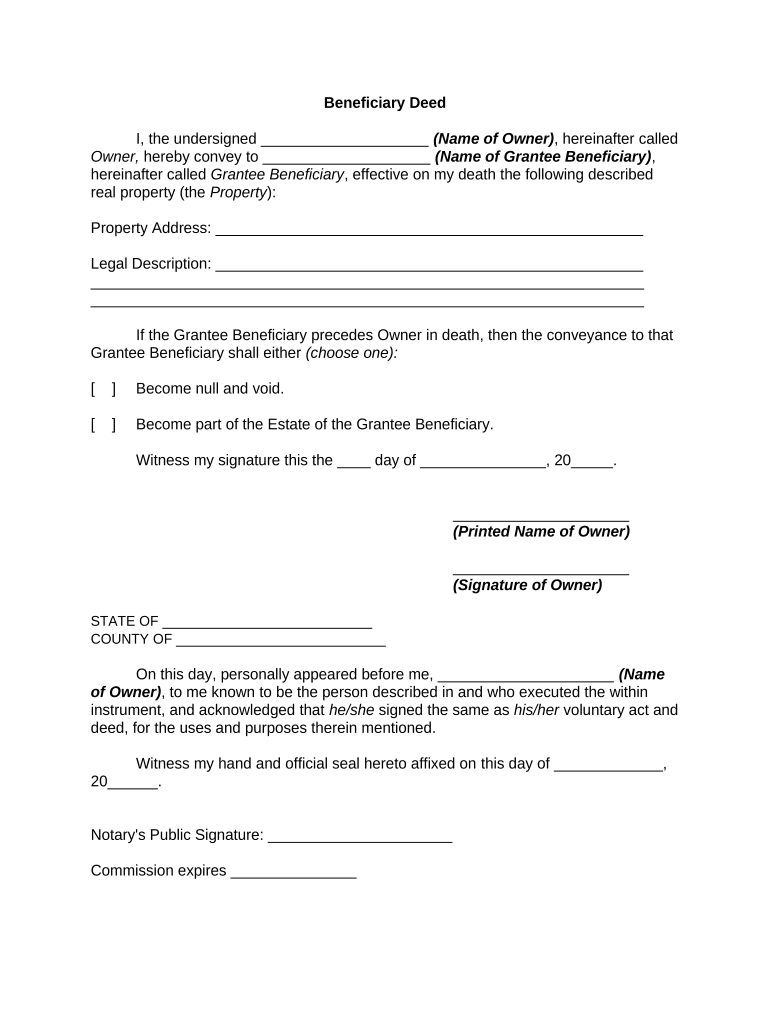

Beneficiary Deed Form

What is the beneficiary deed?

A beneficiary deed is a legal document that allows property owners to designate one or more beneficiaries to receive their real estate upon their death, without the need for probate. This type of deed is particularly useful for individuals who wish to simplify the transfer of property to heirs while avoiding the complexities and costs associated with the probate process. The beneficiary deed becomes effective only upon the death of the property owner, ensuring that the owner retains full control of the property during their lifetime.

How to use the beneficiary deed

Using a beneficiary deed involves several key steps. First, the property owner must complete the beneficiary deed form, which includes details about the property and the designated beneficiaries. Once completed, the form must be signed and notarized. After notarization, the deed should be filed with the appropriate county recorder's office to ensure it is legally recognized. It is essential to inform the beneficiaries about the deed and its implications to avoid any confusion in the future.

Steps to complete the beneficiary deed

Completing a beneficiary deed involves the following steps:

- Obtain the beneficiary deed form from a reliable source.

- Fill out the form with accurate property details and beneficiary information.

- Sign the form in the presence of a notary public.

- File the signed and notarized deed with the county recorder's office.

- Keep a copy of the filed deed for personal records.

Legal use of the beneficiary deed

The legal use of a beneficiary deed is governed by state laws, which can vary significantly. It is crucial to ensure that the deed complies with the specific requirements of the state where the property is located. Generally, a beneficiary deed must be executed in accordance with state statutes, including proper notarization and recording. Failure to adhere to these legal requirements may result in the deed being deemed invalid.

State-specific rules for the beneficiary deed

Each state has its own regulations regarding beneficiary deeds. For example, some states may require specific language to be included in the deed, while others may have particular filing procedures. It is important for property owners to familiarize themselves with their state's laws to ensure compliance. Consulting with a legal professional can provide clarity on state-specific requirements and help avoid potential issues.

Key elements of the beneficiary deed

Key elements of a beneficiary deed include:

- The name and address of the property owner.

- A clear description of the property being transferred.

- The names and addresses of the designated beneficiaries.

- A statement indicating that the transfer is to occur upon the death of the owner.

- Signature of the owner and notarization.

Examples of using the beneficiary deed

Beneficiary deeds can be utilized in various scenarios, such as:

- A parent transferring their home to their children to avoid probate.

- An individual designating a partner as the beneficiary of a vacation property.

- A property owner ensuring that their estate is settled quickly and efficiently after their passing.

Quick guide on how to complete beneficiary deed 497332412

Finalize Beneficiary Deed effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, alter, and electronically sign your documents rapidly without delays. Manage Beneficiary Deed on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Beneficiary Deed with ease

- Obtain Beneficiary Deed and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information using tools that airSlate SignNow provides specifically for that reason.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, prolonged form searches, or errors that necessitate new document prints. airSlate SignNow addresses your requirements in document management with just a few clicks from any device of your choice. Alter and electronically sign Beneficiary Deed and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary deed and how does it work?

A beneficiary deed is a legal document that allows property owners to transfer their real estate to named beneficiaries upon their death, avoiding probate. This deed ensures a simple process for transferring property directly to heirs, making estate planning more efficient.

-

How can airSlate SignNow help with creating a beneficiary deed?

airSlate SignNow offers an intuitive platform that enables you to create, fill out, and eSign a beneficiary deed quickly and securely. With our templates and user-friendly interface, you can ensure your beneficiary deed is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for a beneficiary deed?

Yes, airSlate SignNow provides various pricing plans tailored to meet your needs, including options for individual users and businesses. Each plan offers features that facilitate the creation and signing of documents like a beneficiary deed without hidden fees.

-

What features does airSlate SignNow offer for electronic signature on a beneficiary deed?

airSlate SignNow includes features such as secure electronic signatures, document tracking, and integration with cloud storage services. These tools enhance the efficiency and reliability of signing a beneficiary deed, ensuring all parties can easily comply with legal requirements.

-

Can I integrate airSlate SignNow with other tools for managing my beneficiary deed?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Dropbox. This allows you to manage your beneficiary deed alongside other business tools, streamlining your workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for a beneficiary deed?

The primary benefits of using airSlate SignNow for your beneficiary deed include ease of use, improved security, and faster processing times. By eliminating the hassle of paper documents, you can finalize your estate planning more efficiently.

-

Is my information secure when using airSlate SignNow for a beneficiary deed?

Absolutely, airSlate SignNow prioritizes your security by employing encryption, secure data protocols, and compliance with industry standards. Your information related to the beneficiary deed and any other documents you create is kept safe and confidential.

Get more for Beneficiary Deed

- Form 5208d ampquotamended tax ampampamp wage reportampquot washington

- Abl 946 1350 44221026 sc department of revenue scgov form

- Form 89 350 20 3 1 000 rev

- State of south carolina department of revenue l 2087 form

- Form 72 010 20 3 1 000 rev

- Eargle plans to seek another term as horry county auditor form

- Save time by registering online at mydorway form

- Rs 1 sc department of revenue scgov form

Find out other Beneficiary Deed

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple