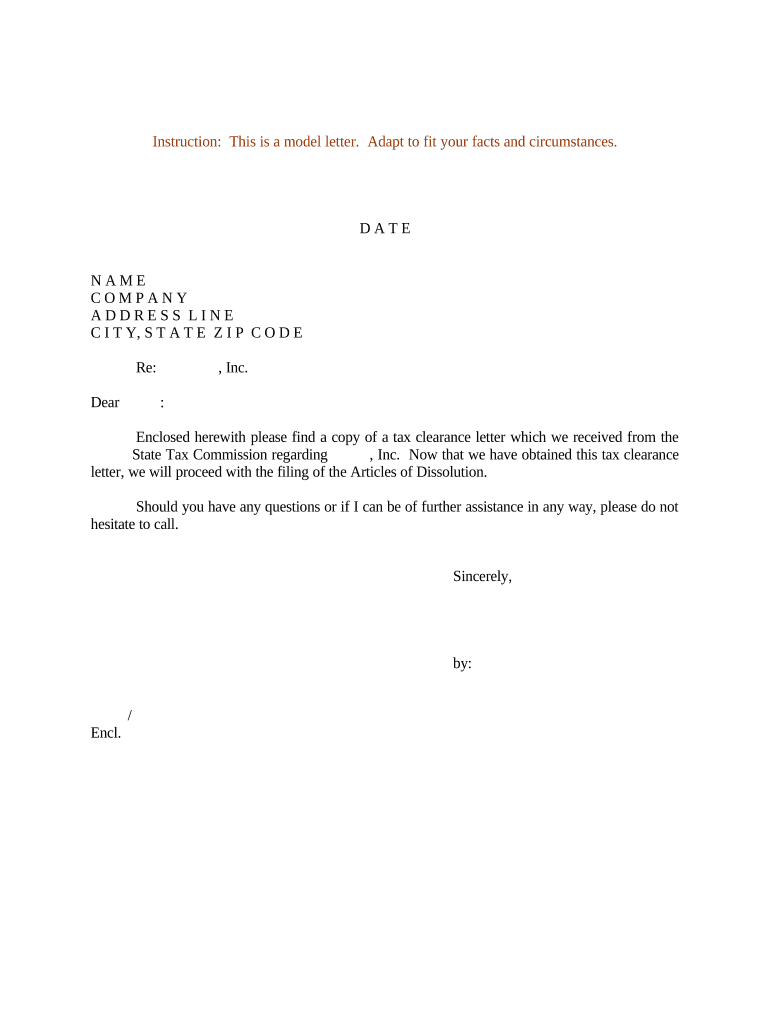

Letter Tax Clearance Form

What is the tax clearance letter?

A tax clearance letter is an official document issued by a state or federal tax authority confirming that an individual or business has paid all due taxes and has no outstanding tax liabilities. This letter is often required for various business transactions, such as applying for loans, securing permits, or reinstating a business entity. It serves as proof of compliance with tax obligations and can be crucial for maintaining good standing with tax authorities.

How to obtain the tax clearance letter

To obtain a tax clearance letter, individuals or businesses typically need to follow these steps:

- Contact the relevant tax authority, either at the state or federal level, to request the letter.

- Provide necessary identification and documentation, which may include tax returns and proof of payments.

- Ensure that all taxes are filed and paid up to date, as outstanding liabilities may delay or prevent the issuance of the letter.

- Submit any required forms or applications as directed by the tax authority.

Key elements of the tax clearance letter

A tax clearance letter typically includes several important elements:

- The name and address of the taxpayer or business.

- The tax identification number (TIN) or Social Security number (SSN) of the taxpayer.

- The period covered by the letter, indicating that all taxes for that period have been paid.

- The signature of an authorized tax official, confirming the letter's authenticity.

- Any applicable state or federal seals or stamps that validate the document.

Steps to complete the tax clearance letter

Completing a tax clearance letter involves several key steps:

- Gather all relevant tax documents, including previous tax returns and payment receipts.

- Fill out any required forms accurately, ensuring all information is current and correct.

- Submit the completed forms along with any supporting documentation to the appropriate tax authority.

- Monitor the status of your request, as processing times may vary based on the authority's workload.

Legal use of the tax clearance letter

The tax clearance letter is legally recognized as proof of tax compliance. It can be used in various scenarios, such as:

- Applying for business licenses or permits.

- Securing loans or financing from banks and other financial institutions.

- Participating in government contracts or bidding processes.

- Reinstating a business entity that has been suspended or dissolved due to tax issues.

IRS guidelines for tax clearance letters

The IRS provides specific guidelines regarding tax clearance letters, particularly for federal tax obligations. It is important to understand:

- What constitutes a tax clearance letter at the federal level.

- The procedures for requesting a letter from the IRS.

- Any applicable deadlines or timelines for obtaining the letter.

- How the IRS communicates with taxpayers regarding their tax status.

Quick guide on how to complete letter tax clearance

Effortlessly Prepare Letter Tax Clearance on Any Device

Digital document management has become widely accepted by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Letter Tax Clearance across any platform with airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Letter Tax Clearance with ease

- Obtain Letter Tax Clearance and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools available specifically for that purpose from airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the tedious search for forms, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Letter Tax Clearance to ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are sample tax letters and how can airSlate SignNow help?

Sample tax letters are preformatted documents used for tax-related communications. With airSlate SignNow, businesses can easily create, send, and eSign these sample tax letters, ensuring that all necessary legal and compliance requirements are met efficiently.

-

Are there any costs associated with using sample tax letters in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that allow users to create and manage sample tax letters. Pricing depends on the features and level of service you choose, ensuring businesses can find a cost-effective solution that fits their needs.

-

What features does airSlate SignNow offer for managing sample tax letters?

airSlate SignNow provides a range of features for managing sample tax letters, including customizable templates, document tracking, and automated workflows. This ensures that users can create professional-looking tax letters quickly and easily.

-

Can I integrate airSlate SignNow with other applications for managing sample tax letters?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems and project management tools. This enables users to manage their sample tax letters alongside existing workflows without any hassle.

-

How does eSigning sample tax letters work with airSlate SignNow?

eSigning sample tax letters with airSlate SignNow is straightforward. Users can upload their documents, add signature fields, and send them for signing, allowing recipients to sign digitally, which speeds up the process signNowly compared to traditional methods.

-

What are the benefits of using airSlate SignNow for sample tax letters?

Using airSlate SignNow for sample tax letters streamlines the document management process, saving you time and reducing paperwork. It ensures compliance with regulations while enhancing collaboration and traceability throughout the signing process.

-

Is airSlate SignNow secure for handling sensitive sample tax letters?

Yes, airSlate SignNow employs top-notch security measures, including encryption and data protection protocols, to safeguard sensitive information. This ensures that all your sample tax letters and related documents are kept secure and confidential.

Get more for Letter Tax Clearance

- 2020 form 1 nrpy massachusetts nonresidentpart year tax return

- Excise must be made available to the department of revenue upon request form

- Massachusetts department of revenue form m 990t unrelated

- 2 date of charter in massachusetts form

- Pdf 2020 form 3k 1 partners massachusetts informationtax massgov

- Form ma nrcr nonresident composite return massgov

- 2021 pcr political contribution refund application form

- Httpswwwrevenuestatemnussitesdefaultfile form

Find out other Letter Tax Clearance

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free