Promissory Note Payments Form

What is the Promissory Note Payments

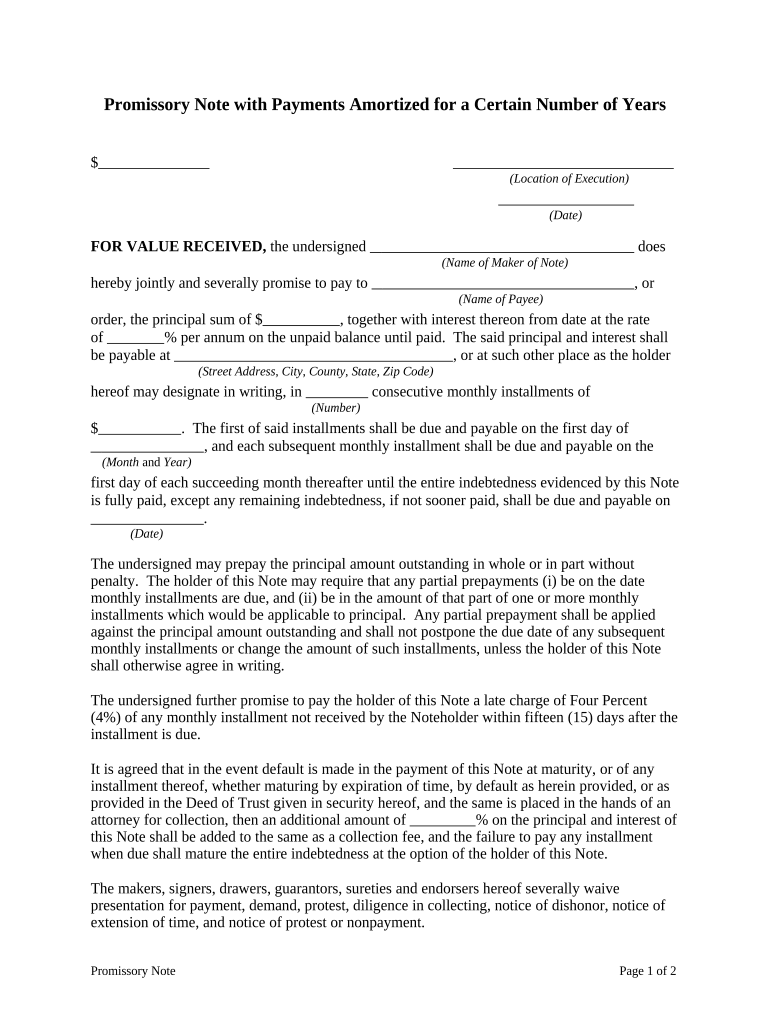

A promissory note payment is a written promise to pay a specified amount of money to a designated party at a predetermined time or on demand. This financial instrument is often used in various lending situations, including personal loans, business loans, and real estate transactions. The note outlines the terms of the loan, including the principal amount, interest rate, payment schedule, and any collateral securing the loan. Understanding the components of a promissory note is essential for both lenders and borrowers to ensure clarity and legal compliance.

How to use the Promissory Note Payments

Using a promissory note for payments involves several steps. First, both parties should agree on the loan terms, including the amount, interest rate, and repayment schedule. Next, the lender and borrower should fill out the promissory note form, ensuring all necessary details are included. Once completed, both parties should sign the document to make it legally binding. It is advisable to keep copies of the signed note for record-keeping purposes. Utilizing a digital platform for this process can streamline the signing and storage of documents, enhancing security and accessibility.

Steps to complete the Promissory Note Payments

Completing a promissory note payment form involves the following steps:

- Determine the loan amount and interest rate.

- Outline the repayment schedule, including due dates.

- Fill out the promissory note form with all relevant information.

- Review the document for accuracy and completeness.

- Both parties should sign the document, either digitally or in person.

- Distribute copies of the signed note to all parties involved.

Following these steps ensures that the promissory note is properly executed and enforceable.

Legal use of the Promissory Note Payments

The legal use of promissory note payments is governed by various laws and regulations, which can vary by state. For a promissory note to be legally binding, it must contain specific elements, such as a clear promise to pay, the amount, and the signature of the borrower. The note should also comply with the Uniform Commercial Code (UCC) provisions, which govern commercial transactions in the United States. Ensuring compliance with these legal standards is crucial for both lenders and borrowers to protect their rights and obligations.

Key elements of the Promissory Note Payments

Several key elements define a promissory note payment, including:

- Principal Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the principal amount over time.

- Payment Schedule: The timeline for repayment, including due dates.

- Borrower and Lender Information: Names and contact details of both parties.

- Signatures: Required signatures of both the borrower and lender to validate the agreement.

Including these elements ensures that the promissory note is comprehensive and legally enforceable.

Examples of using the Promissory Note Payments

Promissory notes can be used in various scenarios, such as:

- A family member lending money to another family member for a personal project.

- A business owner borrowing funds from a bank to expand operations.

- A real estate transaction where the buyer finances part of the purchase price through a promissory note.

These examples illustrate the versatility of promissory notes in different financial contexts, highlighting their importance in formalizing lending agreements.

Quick guide on how to complete promissory note payments

Complete Promissory Note Payments effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Promissory Note Payments on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Promissory Note Payments with ease

- Find Promissory Note Payments and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Promissory Note Payments to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are promissory note payments?

Promissory note payments are financial obligations documented in a promissory note, where one party agrees to pay another a specified amount by a certain date. With airSlate SignNow, you can easily manage and eSign these documents, streamlining the entire process of setting up and tracking promissory note payments.

-

How does airSlate SignNow facilitate promissory note payments?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing promissory notes electronically. This not only speeds up the process of securing promissory note payments but also ensures that all agreements are legally binding and easily accessible at any time.

-

What features does airSlate SignNow offer for managing promissory note payments?

airSlate SignNow offers features such as customizable templates for promissory notes, multiple signing options, and real-time tracking of document statuses. These tools help you efficiently manage promissory note payments, ensuring all parties are informed and accountable throughout the process.

-

Is there a cost associated with using airSlate SignNow for promissory note payments?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. These plans allow you to manage promissory note payments effectively while providing a cost-effective solution for document management and eSignature services.

-

Can I integrate airSlate SignNow with other software for promissory note payments?

Absolutely! airSlate SignNow supports integrations with popular applications like Google Drive and Dropbox. This allows for seamless file sharing and enhances the workflow for managing promissory note payments within your existing systems.

-

How secure is airSlate SignNow when handling promissory note payments?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption methods and complies with industry standards to protect your data, ensuring that all promissory note payments and related documents remain confidential and secure against unauthorized access.

-

Can I customize my promissory note templates on airSlate SignNow?

Yes, you can easily customize your promissory note templates using airSlate SignNow's intuitive editor. This flexibility allows you to tailor your documents according to your specific needs and requirements for promissory note payments, making them more personalized and effective.

Get more for Promissory Note Payments

Find out other Promissory Note Payments

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract