Balance Sheet Form

What is the Balance Sheet

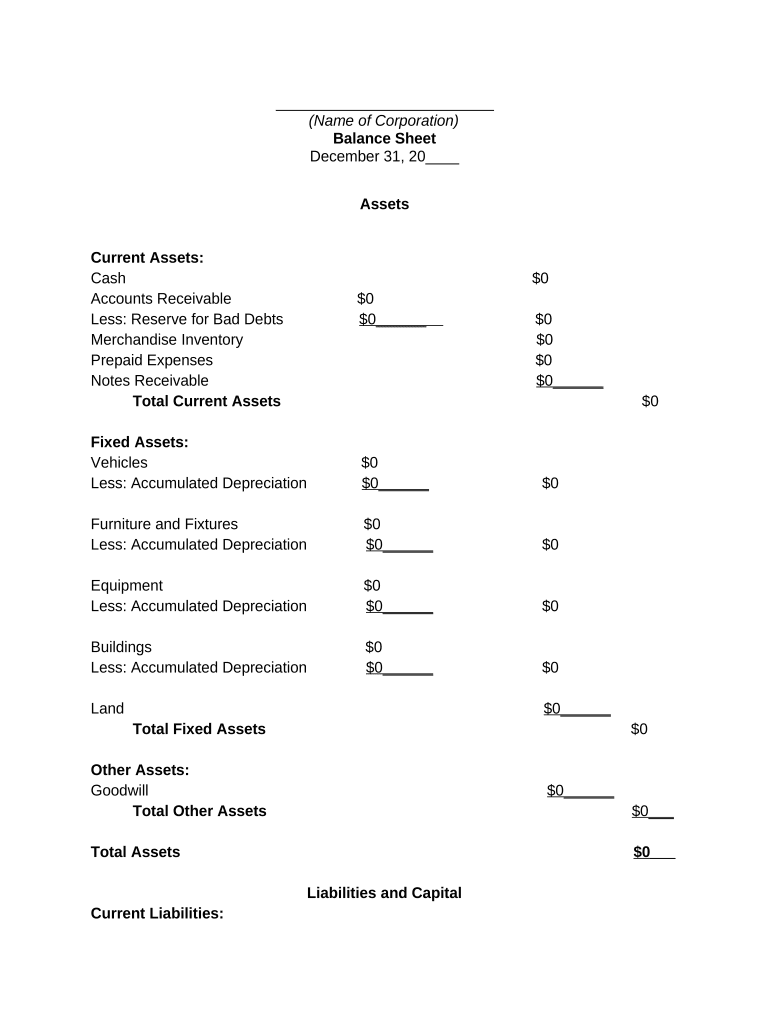

The balance sheet is a financial statement that summarizes a company's assets, liabilities, and equity at a specific point in time. It provides a snapshot of what the business owns and owes, helping stakeholders assess its financial health. The balance sheet is structured around the accounting equation: Assets = Liabilities + Equity. This equation ensures that all resources are financed either by borrowing (liabilities) or by the owners' investments (equity).

Key Elements of the Balance Sheet

A balance sheet consists of three main components:

- Assets: These are resources owned by the company, including cash, inventory, property, and equipment. Assets are typically classified as current (expected to be converted to cash within one year) or non-current.

- Liabilities: These represent the company's obligations, such as loans, accounts payable, and other debts. Like assets, liabilities are divided into current and long-term categories.

- Equity: This reflects the owners' residual interest in the company after liabilities are deducted from assets. It includes common stock, retained earnings, and additional paid-in capital.

Steps to Complete the Balance Sheet

Completing a balance sheet involves several key steps:

- Gather financial data: Collect all relevant financial information, including bank statements, invoices, and receipts.

- List assets: Document all assets, categorizing them into current and non-current based on their liquidity.

- List liabilities: Identify and categorize all liabilities, distinguishing between current and long-term obligations.

- Calculate equity: Determine equity by subtracting total liabilities from total assets.

- Review and verify: Ensure all entries are accurate and reflect the company's financial position.

Legal Use of the Balance Sheet

The balance sheet serves various legal and regulatory purposes. It is often required for tax filings, loan applications, and financial reporting. To be legally valid, the balance sheet must adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction. Accurate representation of financial data is crucial, as discrepancies can lead to legal penalties or issues with stakeholders.

How to Obtain the Balance Sheet

Businesses can obtain a balance sheet through several means:

- Accounting software: Many businesses use accounting software that automatically generates balance sheets based on entered financial data.

- Manual preparation: Companies can manually create a balance sheet using spreadsheets or templates available online.

- Professional assistance: Hiring an accountant or financial advisor can ensure the balance sheet is prepared accurately and complies with legal standards.

Digital vs. Paper Version

While balance sheets can be prepared on paper, digital versions offer significant advantages. Digital balance sheets can be easily updated, shared, and stored securely. They also facilitate integration with accounting software, allowing for real-time data analysis and reporting. Moreover, digital formats are often more compliant with eSignature regulations, making it easier to obtain necessary approvals electronically.

Quick guide on how to complete balance sheet

Manage Balance Sheet seamlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly and without complications. Utilize Balance Sheet on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Balance Sheet effortlessly

- Acquire Balance Sheet and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or mask sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal authority as a standard wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Adjust and eSign Balance Sheet and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Balance Sheet and why is it important for my business?

A Balance Sheet is a financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time. It is essential for assessing your business's financial health and stability, helping you make informed decisions. Understanding your Balance Sheet can enhance your strategic planning and resource allocation.

-

How can airSlate SignNow help me create a Balance Sheet?

With airSlate SignNow, you can easily create and manage your Balance Sheet by utilizing customizable templates and e-signature features. This allows for quick alterations and sharing with stakeholders while ensuring compliance and security. Our intuitive platform streamlines financial documentation, making Balance Sheet management more accessible than ever.

-

What features does airSlate SignNow offer for electronic signatures on financial documents?

airSlate SignNow provides a range of features including customizable templates, secure electronic signatures, and the ability to track document status in real-time. These features ensure seamless collaboration on your Balance Sheet and other financial documents while maintaining integrity and accountability. Additionally, it supports compliance with legal standards for electronic signatures.

-

Is airSlate SignNow cost-effective for small businesses looking to manage their Balance Sheet?

Absolutely! airSlate SignNow offers competitive pricing plans tailored to fit the needs of small businesses. By investing in our service, you can save time and resources while effectively managing your Balance Sheet, ultimately leading to enhanced productivity and decision-making capabilities.

-

Can I integrate airSlate SignNow with other accounting software for my Balance Sheet?

Yes, airSlate SignNow integrates seamlessly with various popular accounting software solutions, allowing you to sync and manage your Balance Sheet effortlessly. This integration facilitates automated workflows and ensures that your financial data remains up-to-date across platforms. Enjoy a streamlined experience as you prepare your Balance Sheet and other financial reports.

-

What benefits does airSlate SignNow provide in handling my Balance Sheet?

By using airSlate SignNow, you gain access to a user-friendly interface and powerful tools that simplify the management of your Balance Sheet. Key benefits include improved accuracy through digital signatures, secure storage of financial documents, and easy collaboration with team members and stakeholders. With airSlate SignNow, your Balance Sheet processes become more efficient and reliable.

-

How does airSlate SignNow ensure the security of my Balance Sheet?

Security is a priority at airSlate SignNow. We employ industry-standard encryption protocols and comply with various regulations to protect your Balance Sheet and other sensitive documents. Your financial information is secure during transmission and storage, allowing you to focus on your business without worrying about data bsignNowes.

Get more for Balance Sheet

Find out other Balance Sheet

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online