Enrollment and Salary Deferral Agreement Form

What is the Enrollment And Salary Deferral Agreement

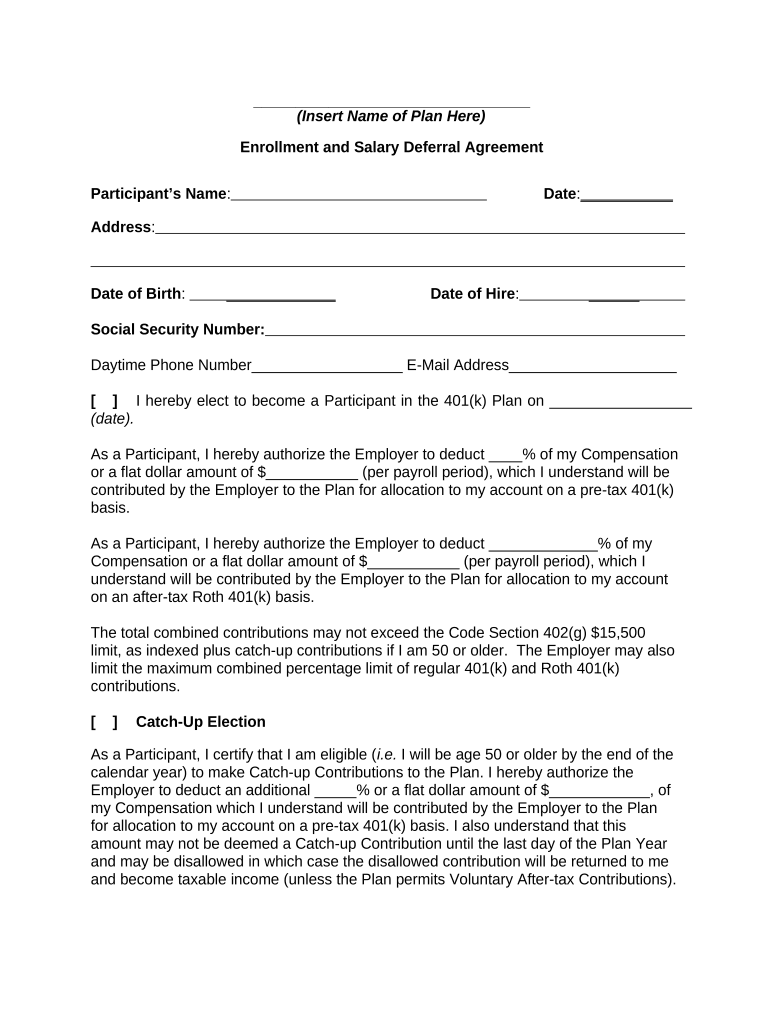

The Enrollment And Salary Deferral Agreement is a formal document that outlines the terms under which an employee agrees to defer a portion of their salary into a retirement plan or other savings vehicle. This agreement typically specifies the percentage or amount of salary to be deferred, the duration of the deferral, and any specific conditions or employer contributions associated with the deferred salary. It is essential for employees participating in retirement plans, such as 401(k) plans, to understand the implications of this agreement on their financial future.

Steps to complete the Enrollment And Salary Deferral Agreement

Completing the Enrollment And Salary Deferral Agreement involves several straightforward steps:

- Review the terms: Carefully read the agreement to understand the deferral percentages, employer contributions, and any associated fees.

- Fill in personal information: Provide necessary details such as your name, employee ID, and contact information.

- Specify deferral amounts: Indicate the percentage or amount of your salary you wish to defer.

- Sign the agreement: Use a secure electronic signature to finalize the document, ensuring compliance with legal standards.

- Submit the form: Send the completed agreement to your HR department or the designated administrator.

Legal use of the Enrollment And Salary Deferral Agreement

The Enrollment And Salary Deferral Agreement is legally binding when executed correctly. To ensure its validity, it must comply with federal regulations such as the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. Additionally, the agreement should be signed electronically using a compliant eSignature solution that meets the requirements of the ESIGN Act and UETA. This legal framework ensures that electronic signatures are recognized as valid, providing protection for both employees and employers.

Key elements of the Enrollment And Salary Deferral Agreement

Several key elements must be included in the Enrollment And Salary Deferral Agreement to ensure clarity and compliance:

- Employee information: Full name, employee ID, and contact details.

- Deferral amount: The specific percentage or dollar amount of salary to be deferred.

- Duration: The time period for which the deferral will be in effect.

- Employer contributions: Details about any matching contributions or additional benefits provided by the employer.

- Withdrawal terms: Conditions under which the deferred amounts can be accessed or withdrawn.

How to use the Enrollment And Salary Deferral Agreement

Using the Enrollment And Salary Deferral Agreement involves understanding its purpose and following the outlined procedures. Employees should first consult their employer's retirement plan guidelines to determine the specific requirements for deferring salary. Once familiar with the plan, employees can complete the agreement, ensuring that all required information is accurately provided. After submitting the agreement, it is advisable to keep a copy for personal records and monitor the deferral amounts reflected in paychecks and retirement account statements.

Examples of using the Enrollment And Salary Deferral Agreement

There are various scenarios where the Enrollment And Salary Deferral Agreement is utilized:

- Retirement planning: Employees may choose to defer a portion of their salary to build a retirement nest egg, taking advantage of potential tax benefits.

- Employer matching contributions: Some employers offer matching contributions, encouraging employees to maximize their deferral amounts.

- Financial flexibility: Employees may opt to adjust their deferral amounts based on changing financial circumstances, such as increased expenses or life events.

Quick guide on how to complete enrollment and salary deferral agreement

Effortlessly prepare Enrollment And Salary Deferral Agreement on any device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Enrollment And Salary Deferral Agreement on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and electronically sign Enrollment And Salary Deferral Agreement with ease

- Locate Enrollment And Salary Deferral Agreement and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious document navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Enrollment And Salary Deferral Agreement and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Enrollment And Salary Deferral Agreement?

An Enrollment And Salary Deferral Agreement is a document that outlines the terms under which employees can defer their salary to a later date. This type of agreement is often used in retirement plans to help employees save for their future. Using airSlate SignNow, you can create and manage these agreements seamlessly and securely.

-

How does airSlate SignNow facilitate the Enrollment And Salary Deferral Agreement process?

airSlate SignNow simplifies the Enrollment And Salary Deferral Agreement process by allowing users to create, send, and eSign documents digitally. Our platform ensures compliance and security while streamlining the signing process, making it easier for both employers and employees to manage deferral agreements.

-

What are the pricing options for using airSlate SignNow for Enrollment And Salary Deferral Agreements?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a monthly or annual subscription that includes features specifically designed for handling Enrollment And Salary Deferral Agreements. Our pricing is transparent with no hidden fees.

-

What features does airSlate SignNow provide for Enrollment And Salary Deferral Agreements?

airSlate SignNow offers features like document templates, eSignature capabilities, and audit trails that enhance the management of Enrollment And Salary Deferral Agreements. Additionally, our platform provides integrations with popular HR and payroll systems to ensure a seamless workflow.

-

What benefits can employees expect from Enrollment And Salary Deferral Agreements?

Employees benefit from Enrollment And Salary Deferral Agreements as they help in tax planning and building retirement savings. By deferring a portion of their salary, employees can reduce their taxable income and invest in their future. airSlate SignNow makes it easy for employees to understand and manage these agreements.

-

Can airSlate SignNow integrate with other HR systems for Enrollment And Salary Deferral Agreements?

Yes, airSlate SignNow can seamlessly integrate with various HR and payroll systems, making it an ideal solution for managing Enrollment And Salary Deferral Agreements. This integration enables automated workflows and ensures that the agreements align with your existing payroll processes.

-

How secure is airSlate SignNow when handling Enrollment And Salary Deferral Agreements?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and comply with industry standards to protect your Enrollment And Salary Deferral Agreements. Your information stays confidential, ensuring peace of mind throughout the signing process.

Get more for Enrollment And Salary Deferral Agreement

Find out other Enrollment And Salary Deferral Agreement

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation