Sample Letter Forms

What is the tax extension letter sample?

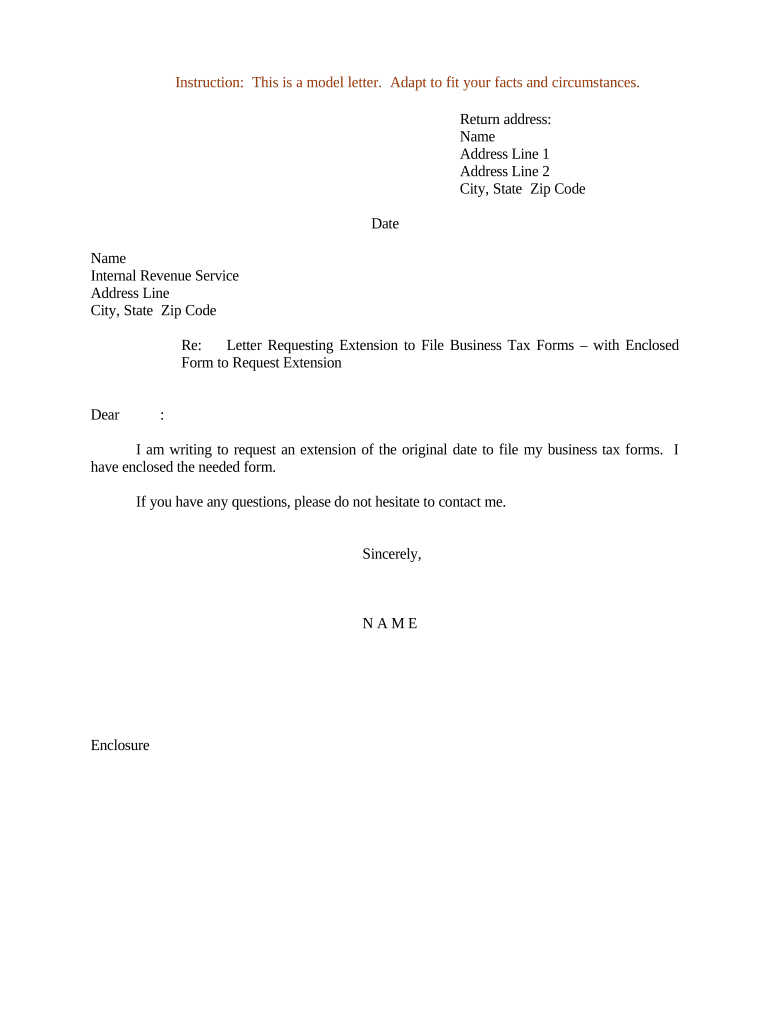

A tax extension letter sample is a formal document that taxpayers use to request additional time to file their income tax returns. This letter is typically sent to the Internal Revenue Service (IRS) or the appropriate state tax authority. By submitting this letter, taxpayers can avoid penalties for late filing while ensuring they have adequate time to prepare their tax documents accurately. The letter should clearly state the reason for the extension request and include relevant personal information, such as the taxpayer's name, address, and Social Security number.

Key elements of the tax extension letter sample

When drafting a tax extension letter, several key elements should be included to ensure clarity and compliance with IRS requirements. These elements typically consist of:

- Taxpayer Information: Full name, address, and Social Security number or taxpayer identification number.

- Recipient Information: Address of the IRS or state tax authority to which the letter is being sent.

- Subject Line: A clear subject line indicating that the letter is a request for a tax extension.

- Reason for Extension: A brief explanation of why additional time is needed to file the tax return.

- Signature: The taxpayer's signature and date at the end of the letter.

Steps to complete the tax extension letter sample

Completing a tax extension letter involves a straightforward process. Follow these steps to ensure your letter is properly formatted and includes all necessary information:

- Gather your personal information, including your name, address, and Social Security number.

- Identify the appropriate IRS address for submitting your extension request.

- Draft the letter, ensuring to include all key elements mentioned above.

- Review the letter for accuracy and completeness.

- Sign and date the letter before sending it to the IRS or state tax authority.

IRS Guidelines for tax extension letters

The IRS provides specific guidelines for taxpayers seeking an extension to file their returns. It is essential to adhere to these guidelines to avoid complications. Generally, taxpayers must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, instead of a traditional letter. However, if a letter is preferred, it should be concise and follow the structure outlined in the previous sections. Taxpayers should also ensure that they pay any taxes owed by the original filing deadline to avoid penalties.

Filing deadlines and important dates

Understanding filing deadlines is crucial for taxpayers requesting an extension. Typically, the deadline for filing individual tax returns is April 15. If taxpayers submit a valid extension request, they may receive an additional six months, extending the deadline to October 15. However, it is important to remember that this extension applies only to filing the return, not to paying any taxes owed. Payments should still be made by the original deadline to avoid interest and penalties.

Penalties for non-compliance

Failing to file a tax return by the deadline, even with an extension request, can result in significant penalties. The IRS imposes a failure-to-file penalty, which is typically five percent of the unpaid taxes for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes from the original due date until the balance is paid in full. Therefore, it is essential to file the extension request on time and ensure that any taxes owed are paid to minimize potential penalties.

Quick guide on how to complete sample letter forms 497332633

Complete Sample Letter Forms seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, amend, and eSign your documents quickly without delays. Manage Sample Letter Forms on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Sample Letter Forms effortlessly

- Find Sample Letter Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Sample Letter Forms while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tax extension letter sample?

A tax extension letter sample is a document that individuals or businesses can use to request an extension for filing their taxes. It typically includes essential information such as the taxpayer's name, SSN, reason for needing an extension, and the deadline for filing. Utilizing a tax extension letter sample can streamline the process, ensuring all necessary details are covered.

-

How can I create a tax extension letter sample using airSlate SignNow?

Creating a tax extension letter sample with airSlate SignNow is simple and efficient. Our platform offers customizable templates where you can insert your specific details and generate a professional document quickly. Plus, you can easily eSign it and send it directly to the relevant tax authority.

-

Is there a cost associated with using airSlate SignNow for tax extension letters?

While airSlate SignNow offers varying pricing plans, you can create and send a tax extension letter sample at a cost-effective rate. We provide flexible plans that cater to different business needs, ensuring you get value without breaking the bank. You may also explore our free trial to test the features for free.

-

What features does airSlate SignNow offer for managing tax extension letters?

airSlate SignNow provides various features to assist you in managing your tax extension letters efficiently. With customizable templates, eSignature capabilities, and document tracking, our platform ensures your documents are secure and easily accessible. This enables you to streamline your tax filing process effectively.

-

Can I integrate airSlate SignNow with my existing tools for tax extension letters?

Yes, airSlate SignNow offers integrations with popular tools like Google Drive, Dropbox, and various CRMs. This means you can easily access and send your tax extension letter sample directly from your preferred applications. Our integration capabilities enhance your workflow and boost productivity.

-

What are the benefits of using a tax extension letter sample from airSlate SignNow?

Using a tax extension letter sample from airSlate SignNow can save you time and ensure accuracy in your communications with tax authorities. Our easy-to-use platform simplifies the creation process, allowing you to focus on other essential tasks. Moreover, our secure eSigning feature provides peace of mind for your sensitive documents.

-

How long does it take to complete a tax extension letter sample using your platform?

Completing a tax extension letter sample on airSlate SignNow can take just a few minutes. With our user-friendly interface and pre-built templates, you can fill in the required fields quickly. Once finalized, you can send it off for eSignature without delay, ensuring timely submission.

Get more for Sample Letter Forms

- Illinois organtissue donor registry cyberdriveillinoiscom form

- Phone 800 367 6401 fax 855 645 8242 form

- Group long term disability claim form dearborn life benefits

- 888 368 3406 form

- Fillable online www2 ohlone completed ohlone college www2 form

- Washington county family ymca membership application form wcfymca

- Washington county family ymca membership application form wcfymca 56151173

- Medical forms and fillable in kansas

Find out other Sample Letter Forms

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast