Form Partnership

What is the Form Partnership

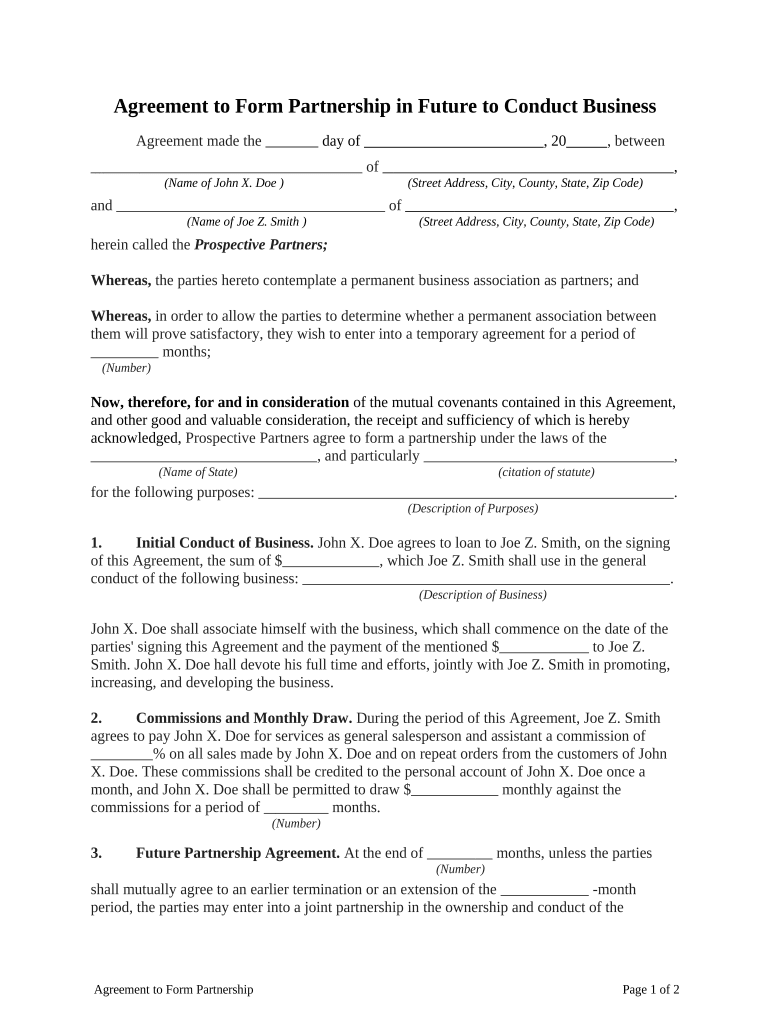

The form partnership is a legal document that outlines the terms and conditions of a partnership agreement between two or more parties. This document serves as a foundation for the partnership, detailing each partner's roles, responsibilities, and contributions. It is essential for establishing clear expectations and protecting the interests of all parties involved. The agreement future is particularly important as it sets the stage for how the partnership will operate, including profit sharing, decision-making processes, and dispute resolution methods.

How to Use the Form Partnership

Using the form partnership involves several key steps to ensure that all parties are in agreement and that the document is legally binding. First, all partners should discuss and agree on the terms that will be included in the partnership. This may cover aspects such as financial contributions, profit distribution, and management roles. Once the terms are finalized, the form can be filled out electronically, ensuring that all necessary information is accurately captured. After completing the form, each partner should eSign the document using a reliable eSignature solution to validate the agreement.

Key Elements of the Form Partnership

Several key elements must be included in the form partnership to ensure its effectiveness and legality. These elements typically consist of:

- Partnership Name: The official name under which the partnership will operate.

- Purpose: A clear statement of the business activities the partnership will engage in.

- Contributions: Details of each partner's financial and non-financial contributions.

- Profit and Loss Distribution: How profits and losses will be shared among partners.

- Decision-Making Process: Guidelines on how decisions will be made within the partnership.

- Duration: The length of time the partnership will remain in effect.

- Dispute Resolution: Procedures for resolving disagreements among partners.

Steps to Complete the Form Partnership

Completing the form partnership involves a systematic approach to ensure all necessary information is accurately captured. Follow these steps:

- Gather all partners to discuss and agree on the terms of the partnership.

- Draft the form partnership, including all key elements mentioned above.

- Review the document collectively to ensure clarity and mutual understanding.

- Fill out the form electronically, ensuring all information is accurate and complete.

- Each partner should eSign the document using a secure eSignature tool.

- Store the completed form partnership in a secure location for future reference.

Legal Use of the Form Partnership

The legal use of the form partnership is governed by various laws and regulations that ensure its validity. In the United States, the partnership agreement must comply with state-specific laws regarding business partnerships. This includes adherence to the Uniform Partnership Act and any relevant local statutes. Additionally, for the agreement to be enforceable, it must be signed by all partners and should clearly outline the terms agreed upon. Utilizing a reliable eSignature solution can help ensure compliance with legal standards, making the document legally binding.

Examples of Using the Form Partnership

There are several scenarios where a form partnership may be utilized. Common examples include:

- Business Ventures: Two or more individuals may create a partnership to start a new business, sharing responsibilities and profits.

- Joint Projects: Organizations may enter into a partnership for a specific project, outlining the scope and contributions of each party.

- Investment Partnerships: Investors may form a partnership to pool resources for real estate or other investment opportunities.

Quick guide on how to complete form partnership

Effortlessly Prepare Form Partnership on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Administer Form Partnership on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

How to Alter and Electronically Sign Form Partnership with Ease

- Find Form Partnership and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with specialized tools that airSlate SignNow provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Partnership and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of an agreement future in digital document management?

An agreement future is essential for organizations to streamline their document management processes. With airSlate SignNow, you can easily create, send, and eSign agreements, ensuring that your business stays ahead in a competitive landscape. This empowers you to focus on your core operations while maintaining compliance and security in your agreements.

-

How does airSlate SignNow facilitate the signing of agreements for the future?

airSlate SignNow offers a seamless platform for signing agreements digitally, enhancing both efficiency and convenience. Our tool allows you to automate workflows and reduce turnaround times for agreements, enabling faster decision-making. This ensures that you can respond to future opportunities promptly and effectively.

-

What pricing plans does airSlate SignNow offer for managing agreement futures?

airSlate SignNow provides a variety of pricing plans tailored to suit different business needs, making it a cost-effective solution for managing your agreement future. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget and requirements. Additionally, our scalable options allow for growth as your business evolves.

-

Can I integrate airSlate SignNow with other tools for handling agreement futures?

Yes, airSlate SignNow integrates easily with popular tools such as Google Drive, Salesforce, and Dropbox. This integration enables you to centralize your document management and eSigning process, making it even more efficient for handling your agreement future. You can streamline your operations by connecting your existing software stack with our platform.

-

What features does airSlate SignNow offer to enhance the future of my agreements?

airSlate SignNow is equipped with a variety of features designed to improve your agreement future, including customizable templates, real-time tracking, and advanced security options. These features ensure that you have full control over your documents while providing a user-friendly experience. Businesses can easily adapt their agreement processes with these innovative tools.

-

How can airSlate SignNow improve the efficiency of my agreement future?

By using airSlate SignNow, you can signNowly enhance the efficiency of your agreement future through automated workflows and user-friendly eSigning options. This allows for quicker approvals and reduces the time typically spent on manual processes. Ultimately, this leads to faster business growth and improved customer satisfaction.

-

Is airSlate SignNow suitable for businesses of all sizes for their agreement future?

Absolutely! airSlate SignNow is designed to be adaptable for businesses of all sizes, from startups to large corporations, for managing their agreement future. The platform's flexibility ensures that it can accommodate various needs, making it an ideal choice regardless of your business scale. Our goal is to empower every organization to facilitate efficient document management.

Get more for Form Partnership

Find out other Form Partnership

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares