S Corp Document Form

What is the S Corp Document

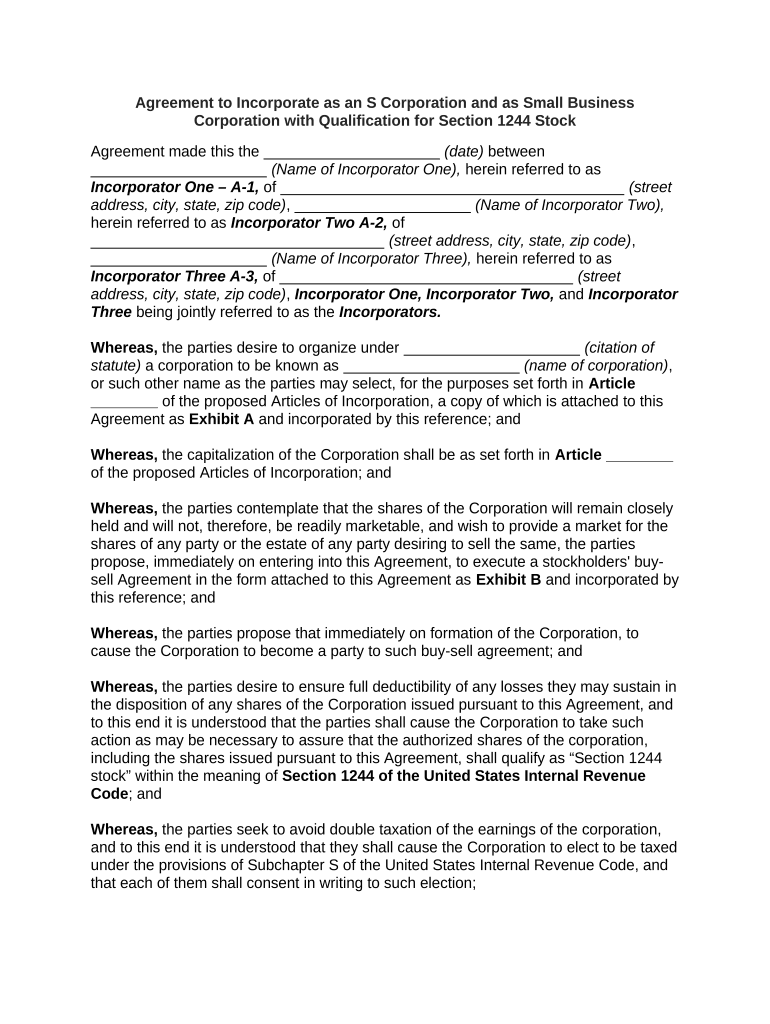

The S Corp document is a legal form that enables a business to elect S Corporation status with the Internal Revenue Service (IRS). This designation allows the corporation to pass income, losses, deductions, and credits directly to shareholders, avoiding double taxation on corporate income. To qualify, the corporation must meet certain criteria, including having a limited number of shareholders and only one class of stock. Understanding the S Corp document is crucial for business owners seeking tax advantages while maintaining limited liability protection.

How to use the S Corp Document

Using the S Corp document involves several steps to ensure compliance with IRS regulations. First, business owners must complete and file Form 2553, the official S Corporation Election form. This form requires details about the corporation, including its name, address, and the tax year it wishes to adopt. Once filed, the corporation must adhere to specific operational and tax requirements to maintain its S Corp status. Regular record-keeping and timely tax filings are essential for ongoing compliance.

Steps to complete the S Corp Document

Completing the S Corp document involves a systematic approach:

- Gather necessary information about the corporation, including its legal name and address.

- Determine eligibility criteria, ensuring the corporation meets the requirements for S Corp status.

- Fill out Form 2553 accurately, providing all requested details about the business and its shareholders.

- Obtain signatures from all shareholders, indicating their consent to the S Corp election.

- Submit the completed form to the IRS within the specified timeframe, typically within two months and fifteen days of the desired effective date.

Legal use of the S Corp Document

The S Corp document is legally binding once filed with the IRS, provided all requirements are met. This form allows the corporation to be taxed as an S Corporation, which can lead to significant tax savings. However, failure to comply with ongoing requirements, such as maintaining proper records and adhering to shareholder limits, can result in the loss of S Corp status. It's important for businesses to understand the legal implications and responsibilities associated with this designation.

Key elements of the S Corp Document

Several key elements must be included in the S Corp document to ensure its validity:

- The corporation's name and address.

- The date of incorporation and the state of incorporation.

- A list of all shareholders, including their consent to the S Corp election.

- The tax year the corporation will follow.

- Any additional information required by the IRS to determine eligibility.

Filing Deadlines / Important Dates

Timely filing of the S Corp document is crucial for maintaining compliance. The IRS requires Form 2553 to be filed within two months and fifteen days of the beginning of the tax year in which the S Corp election is to take effect. For new corporations, this means submitting the form shortly after incorporation. Failing to meet this deadline can result in the corporation being taxed as a standard C Corporation, which may have significant tax implications.

Quick guide on how to complete s corp document

Finalize S Corp Document effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without interruptions. Manage S Corp Document on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign S Corp Document with ease

- Locate S Corp Document and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with the tools that airSlate SignNow offers explicitly for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign S Corp Document to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an S Corp document?

An S Corp document is essential for companies that want to elect S Corporation status with the IRS. This document outlines the corporation's eligibility and election, allowing it to be taxed as an S Corporation instead of a traditional C Corporation. Proper documentation is crucial for gaining tax benefits and ensuring compliance.

-

How can airSlate SignNow assist with S Corp documents?

airSlate SignNow provides a streamlined platform to create, send, and eSign S Corp documents securely. With our user-friendly interface, you can efficiently manage your corporate documents and ensure they are signed and finalized in compliance with state requirements. This saves you time and helps maintain organizational efficiency.

-

What features does airSlate SignNow offer for managing S Corp documents?

Our platform offers features such as templates for S Corp documents, secure electronic signatures, and customizable workflows. You can track document status in real-time and ensure that all required parties sign the necessary paperwork promptly. This flexibility simplifies the management of your business's legal documentation.

-

Is there a cost associated with using airSlate SignNow for S Corp documents?

Yes, airSlate SignNow offers various pricing plans that provide access to features for managing S Corp documents. Our plans are designed to be cost-effective for businesses of any size, ensuring you get the right tools for your needs without overspending. You can explore our pricing options and find the plan that fits your budget.

-

What are the benefits of using airSlate SignNow for S Corp documentation?

Using airSlate SignNow for S Corp documentation offers several benefits including increased efficiency, improved accuracy, and enhanced security. Our platform reduces the risk of errors often associated with paper documents and accelerates the signing process. This ultimately leads to quicker business decisions and smoother operations.

-

Can I integrate airSlate SignNow with other software for managing S Corp documents?

Yes, airSlate SignNow offers integrations with a variety of popular software solutions, allowing you to seamlessly manage your S Corp documents within your existing workflows. This can include integration with CRM systems, accounting software, and more, enhancing productivity and collaboration within your team.

-

How secure is airSlate SignNow for my S Corp documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive S Corp documents. Our platform employs industry-standard encryption and comprehensive security measures to protect your information, ensuring that your documents remain confidential while being processed and stored.

Get more for S Corp Document

Find out other S Corp Document

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template