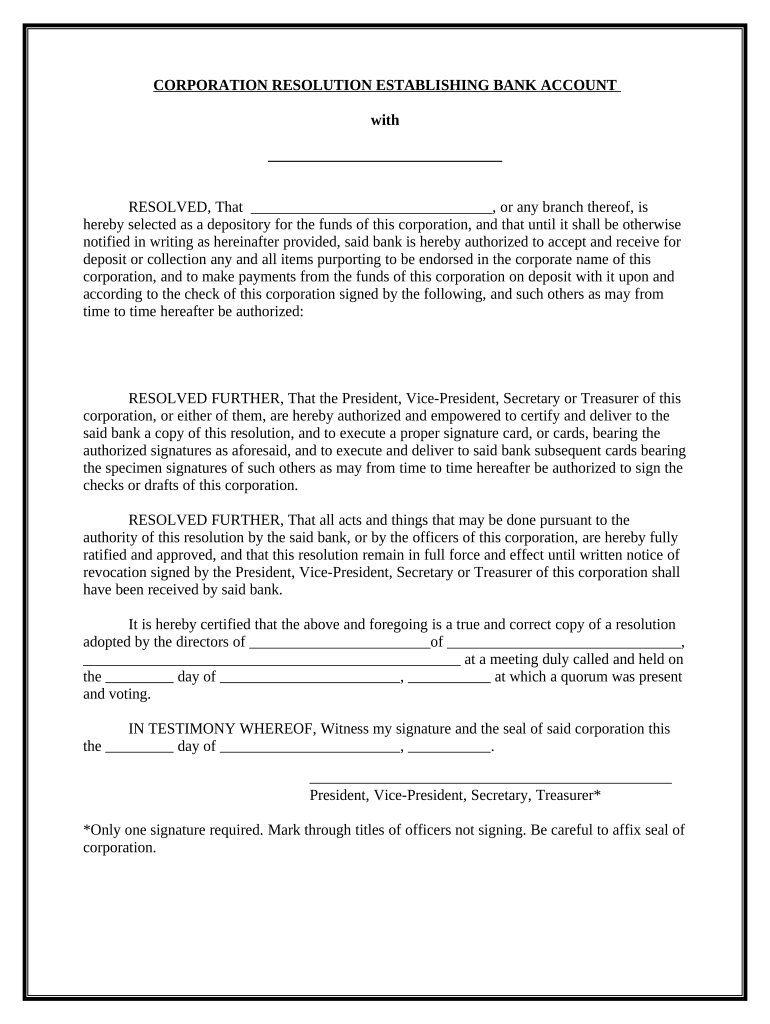

Depository Bank Form

What is the Depository Bank?

A depository bank is a financial institution that holds and safeguards a company's funds, allowing for secure transactions and management of financial assets. These banks play a crucial role in ensuring that businesses can efficiently manage their cash flow and execute various banking operations. The depository bank is responsible for maintaining records of all transactions and providing services such as deposits, withdrawals, and account management. This institution is essential for businesses that require a reliable partner to handle their financial dealings.

Key Elements of the Depository Bank

Understanding the key elements of a depository bank is vital for businesses looking to establish a banking relationship. These elements include:

- Account Signatories: Individuals authorized to act on behalf of the business in banking matters.

- Resolution Account Create: The process of establishing a bank account under the business's name, often requiring specific documentation.

- Depository Bank Agreement: A formal contract outlining the terms and conditions of the banking relationship.

- Compliance Requirements: Regulations that the bank and the business must adhere to, ensuring legal and secure operations.

Steps to Complete the Depository Bank

To successfully establish a relationship with a depository bank, businesses should follow these steps:

- Identify the necessary documentation, including business registration and tax identification numbers.

- Designate account signatories who will be authorized to manage the account.

- Complete the required forms, such as the resolution bank template, to formalize the account creation.

- Submit the forms to the bank, either online or in person, depending on the bank's policies.

- Review and sign the depository bank agreement, ensuring all terms are understood and accepted.

Legal Use of the Depository Bank

Utilizing a depository bank legally involves adhering to various regulations and laws that govern financial transactions. It is essential for businesses to ensure that all account signatories are properly authorized and that the bank maintains compliance with federal and state laws. This includes understanding the implications of the Electronic Signatures in Global and National Commerce (ESIGN) Act, which provides a legal framework for electronic signatures and records. Ensuring compliance protects the business from potential legal issues and fosters trust with stakeholders.

Examples of Using the Depository Bank

Businesses can leverage a depository bank for various financial activities, including:

- Managing payroll by depositing employee salaries directly into their accounts.

- Facilitating vendor payments through electronic transfers.

- Securing loans and lines of credit to support business operations and growth.

- Maintaining a reserve of funds for unexpected expenses or investments.

Required Documents

When establishing a depository bank account, several documents are typically required to ensure compliance and proper identification. These may include:

- Business registration documents, such as articles of incorporation or partnership agreements.

- Tax identification number (TIN) or employer identification number (EIN).

- Identification documents for all account signatories, such as driver's licenses or passports.

- Resolution documents that outline the authority of signatories to act on behalf of the business.

Quick guide on how to complete depository bank

Complete Depository Bank effortlessly on any device

Online document administration has become increasingly popular with businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, adjust, and eSign your documents swiftly without delays. Manage Depository Bank on any device through airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest method to modify and eSign Depository Bank with ease

- Find Depository Bank and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Depository Bank and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are bank signatories and why are they important?

Bank signatories are individuals authorized to approve and execute transactions on behalf of a business or organization. They play a crucial role in managing financial operations, ensuring that funds are handled securely and according to established protocols.

-

How can airSlate SignNow assist in managing bank signatories?

airSlate SignNow provides a seamless platform for managing bank signatories by enabling businesses to easily eSign documents related to bank authorizations. With electronic signatures, the process is quicker and more efficient, minimizing the risk of delays in transaction approvals.

-

What features does airSlate SignNow offer for bank signatories?

airSlate SignNow includes features such as automated workflows, document tracking, and secure storage, which streamline the process for bank signatories. These tools ensure that all parties are informed and that all necessary approvals are documented accurately.

-

Is airSlate SignNow cost-effective for managing bank signatories?

Yes, airSlate SignNow offers a competitive pricing structure designed to provide signNow cost savings for businesses managing bank signatories. By reducing the time and resources spent on traditional signature processes, companies can allocate funds towards other vital business areas.

-

Can airSlate SignNow integrate with other financial software for bank signatories?

Absolutely! airSlate SignNow integrates seamlessly with various financial software platforms, enhancing the functionalities available to bank signatories. This integration allows for easier data management and improved workflow efficiency across different applications.

-

What are the benefits of using electronic signatures for bank signatories?

Using electronic signatures through airSlate SignNow offers numerous benefits for bank signatories, including faster turnaround times and improved security. Additionally, the ability to access documents from anywhere enhances collaboration and allows for more effective decision-making.

-

Are the signatures legally binding for bank signatories?

Yes, electronic signatures created with airSlate SignNow are legally binding and comply with regulations such as the ESIGN Act and UETA. This ensures that documents signed by bank signatories maintain their validity and can be used in legal proceedings.

Get more for Depository Bank

- Nevada vocp 65635125 form

- Prove it to move it program wcb ny form

- Pd inquiry form

- 6 nycrr part 595 tank registration application instructions form

- Request for proposals rfp c000440 for website redesign and form

- Ny state police amendment form 2000

- Pistol instructions form

- Fax bpss 153 student records request new york state education department 2014 form

Find out other Depository Bank

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT