Startup Costs Form

What is the Startup Costs

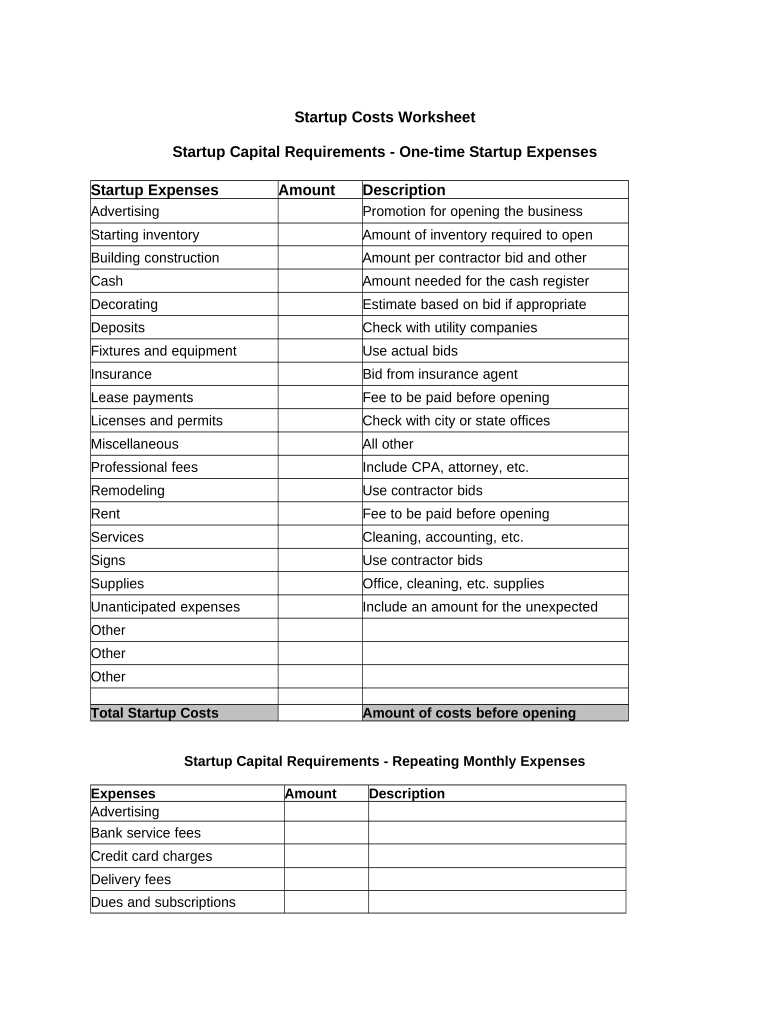

The startup costs refer to the initial expenses incurred when launching a new business. These costs can vary widely depending on the type of business and its location. Common startup costs include expenses for equipment, inventory, marketing, legal fees, and office space. Understanding these costs is crucial for entrepreneurs as they create a comprehensive financial plan and budget.

Key elements of the Startup Costs

Several key elements contribute to the overall startup costs. These include:

- Equipment and Supplies: This encompasses all tools and materials necessary for business operations.

- Licenses and Permits: Depending on the industry, various licenses may be required to legally operate.

- Marketing and Advertising: Initial marketing efforts are essential to attract customers and establish a brand presence.

- Office Space: Costs associated with leasing or purchasing a location for business activities.

- Employee Salaries: If hiring staff, initial payroll expenses must be considered.

Steps to complete the Startup Costs

Completing a startup costs worksheet involves several steps to ensure accuracy and thoroughness. Follow these steps:

- Identify Expenses: List all potential costs associated with starting the business.

- Research Costs: Obtain accurate estimates for each identified expense.

- Organize Data: Categorize expenses into fixed and variable costs for better clarity.

- Calculate Total Costs: Sum all expenses to determine the total startup costs.

- Review and Adjust: Revisit the worksheet to ensure all costs are accounted for and make adjustments as necessary.

Legal use of the Startup Costs

Understanding the legal implications of startup costs is essential for compliance and financial planning. The startup costs can often be deducted on tax returns, subject to specific IRS guidelines. It is important to maintain accurate records and receipts for all expenses, as these may be required for tax purposes. Consulting with a tax professional can provide clarity on what qualifies as a deductible startup cost.

Examples of using the Startup Costs

Examples of how to utilize a startup costs worksheet include:

- Creating a Business Plan: A detailed startup costs worksheet can help in drafting a comprehensive business plan that outlines financial needs.

- Seeking Funding: Presenting a clear breakdown of startup costs can be beneficial when applying for loans or attracting investors.

- Budget Management: Regularly updating the startup costs worksheet can assist in managing ongoing expenses and adjusting financial strategies as needed.

IRS Guidelines

The IRS provides specific guidelines regarding the treatment of startup costs for tax purposes. Generally, businesses can deduct up to five thousand dollars of startup costs in the first year of operation, with any remaining costs amortized over 15 years. It is crucial to familiarize oneself with these regulations to ensure compliance and maximize potential deductions.

Quick guide on how to complete startup costs

Manage Startup Costs effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed materials, allowing you to find the right form and secure it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Startup Costs on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Startup Costs without stress

- Find Startup Costs and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Startup Costs and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a startup worksheet and how can it benefit my business?

A startup worksheet is a valuable tool that helps businesses outline their goals, strategies, and financial projections. By utilizing our startup worksheet, you can gain clarity on your business model and ensure that all essential elements are addressed before launching your startup. This structured approach can save you time and reduce risks as you embark on your entrepreneurial journey.

-

How can airSlate SignNow help in managing my startup worksheet?

With airSlate SignNow, you can easily create, share, and sign your startup worksheet documents online. The platform allows for seamless collaboration among team members, enabling you to gather feedback and make necessary adjustments in real time. This ensures that your startup worksheet is always up-to-date and accessible from anywhere.

-

What features does airSlate SignNow offer to enhance my startup worksheet?

AirSlate SignNow comes equipped with features like customizable templates, electronic signatures, and secure cloud storage that can streamline the management of your startup worksheet. You can also track document status and receive notifications when your worksheet is signed, ensuring a smooth workflow. These features help increase efficiency and productivity for your startup.

-

Is airSlate SignNow affordable for startups looking for a startup worksheet solution?

Yes, airSlate SignNow provides cost-effective pricing plans tailored for startups. With flexible subscription options, you can choose a plan that suits your budget while gaining access to powerful tools for managing your startup worksheet. This allows you to focus on growing your business without breaking the bank.

-

Can I integrate airSlate SignNow with other tools I use for my startup worksheet?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, including project management and CRM tools. This allows you to easily import data into your startup worksheet and ensure that all aspects of your business are connected, simplifying your overall workflow.

-

How secure is my startup worksheet data with airSlate SignNow?

Security is a top priority at airSlate SignNow. All data, including your startup worksheet documents, is protected with advanced encryption protocols and complies with industry standards. This ensures that your sensitive information remains safe and secure, giving you peace of mind as you manage your business.

-

Can I track changes made to my startup worksheet in airSlate SignNow?

Yes, airSlate SignNow provides a comprehensive audit trail that allows you to track all changes made to your startup worksheet. You can see who made alterations and when, which helps maintain accountability and transparency within your team. This feature is particularly useful for keeping your startup worksheet updated and aligned with your goals.

Get more for Startup Costs

Find out other Startup Costs

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF