Certification No Information Reporting Form

What is the Certification No Information Reporting Form

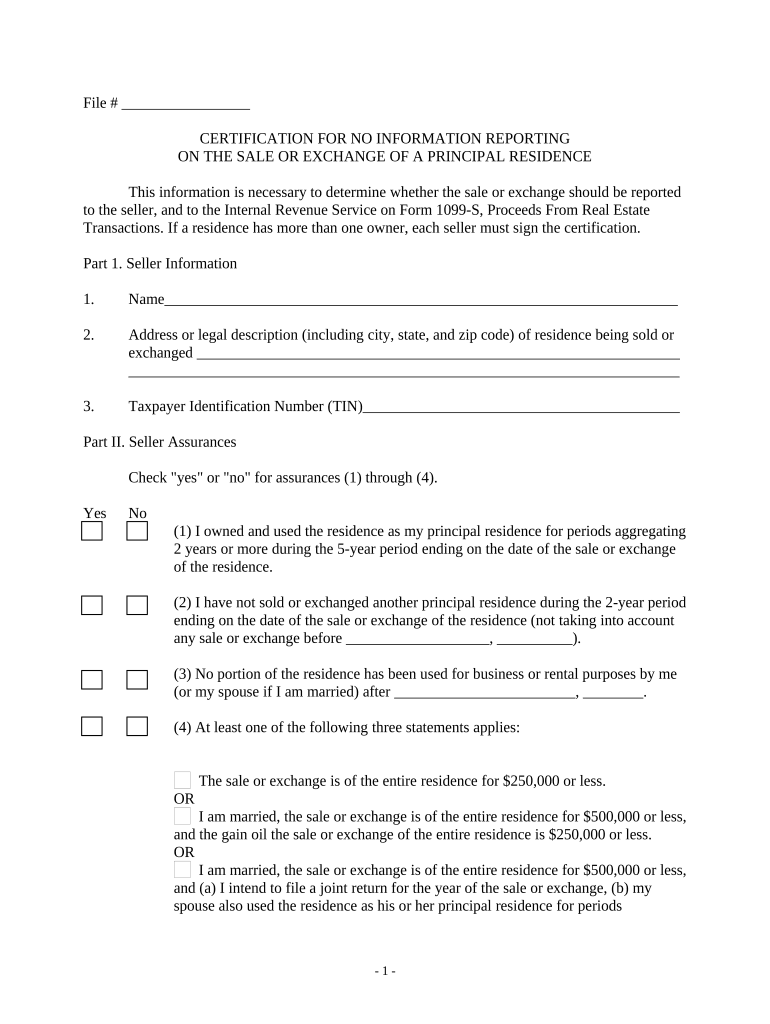

The Certification No Information Reporting Form is a document used primarily for tax purposes, allowing individuals or entities to certify that they do not have any reportable information for a specific tax year. This form is essential for those who may not meet the criteria for reporting certain income or transactions to the IRS. By submitting this form, taxpayers can clarify their status and avoid potential penalties associated with non-compliance.

How to use the Certification No Information Reporting Form

Using the Certification No Information Reporting Form involves several straightforward steps. First, obtain the form from the IRS website or through tax preparation software. Next, fill out the required fields, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, either electronically or via mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the Certification No Information Reporting Form

Completing the Certification No Information Reporting Form requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or your tax software.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Clearly indicate the tax year for which you are certifying no information.

- Sign and date the form to validate your certification.

- Review the form for accuracy before submission.

Legal use of the Certification No Information Reporting Form

The Certification No Information Reporting Form serves a legal purpose in the realm of taxation. It is designed to comply with IRS regulations, ensuring that taxpayers can formally declare their lack of reportable information. By using this form, individuals and businesses can protect themselves from potential audits or penalties that may arise from failing to report income or transactions. It is crucial to ensure that the form is used correctly and submitted on time to maintain compliance with tax laws.

Required Documents

When completing the Certification No Information Reporting Form, certain documents may be required to support your certification. These documents can include:

- Proof of identity, such as a driver's license or Social Security card.

- Any relevant tax documents that may clarify your reporting status.

- Previous tax returns, if applicable, to demonstrate your reporting history.

Having these documents ready can streamline the completion process and ensure that your certification is valid.

Filing Deadlines / Important Dates

Filing deadlines for the Certification No Information Reporting Form vary depending on the tax year and the specific circumstances of the taxpayer. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. It is essential to stay informed about any changes to deadlines, especially if you are filing for an extension or if there are specific state requirements that may differ from federal guidelines.

Quick guide on how to complete certification no information reporting form

Prepare Certification No Information Reporting Form effortlessly on every device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents efficiently without delays. Manage Certification No Information Reporting Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Certification No Information Reporting Form with ease

- Obtain Certification No Information Reporting Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Certification No Information Reporting Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a variety of features for document signing, including templates, secure eSigning, and real-time tracking. With this powerful tool, you can efficiently manage and send documents without worrying about no information being lost. Our intuitive interface makes the signing process straightforward for users of all experience levels.

-

How does pricing work for airSlate SignNow?

Pricing for airSlate SignNow is designed to be cost-effective, with various plans to fit different business needs. Each plan includes essential features, so you won't find yourself in a situation with no information regarding your costs. We offer a free trial as well, allowing you to explore our features before making a commitment.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with many popular applications, including Google Workspace, Salesforce, and more. This ensures that you won't have any barriers and no information will fall through the cracks during workflows. Integrating with tools you already use can enhance your document signing experience.

-

Is there customer support available if I have questions?

Absolutely! Our customer support team is available to assist you with any inquiries. If you ever find yourself with no information about how to use our platform, don't hesitate to signNow out to our support team via chat or email for prompt assistance.

-

What are the security measures in place for signed documents?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your signed documents. You can trust that your sensitive information is secure, ensuring that even if there’s no information visible, the data remains safe from unauthorized access. Compliance with industry regulations further ensures peace of mind.

-

Can airSlate SignNow help businesses save time?

Yes, airSlate SignNow signNowly reduces the time spent on document signing processes. By eliminating the need for physical signatures, businesses can speed up transactions and workflows, meaning there can be no information delays in getting important documents signed. Many of our users report increased efficiency soon after implementation.

-

What types of documents can I sign using airSlate SignNow?

You can sign various types of documents using airSlate SignNow, including contracts, agreements, and forms. Our platform handles multiple file formats, ensuring that you will face no information issues when trying to upload and send documents for signing. This flexibility meets the diverse needs of businesses in different sectors.

Get more for Certification No Information Reporting Form

- Texas driver responsibility program financial affidavit 2011 form

- Vtr265vsf 2012 form

- Texas driving school dl 14a 2012 form

- Dl 43 2012 form

- Power of attorney to transfer motor vehicle in pennsylvania 2002 form

- Texas dps dl 64 2012 form

- Vtr 34 2007 form

- Texas auto title request pdf all state surety bonds form

Find out other Certification No Information Reporting Form

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online