Offering Limited Partnership Form

What is the Offering Limited Partnership

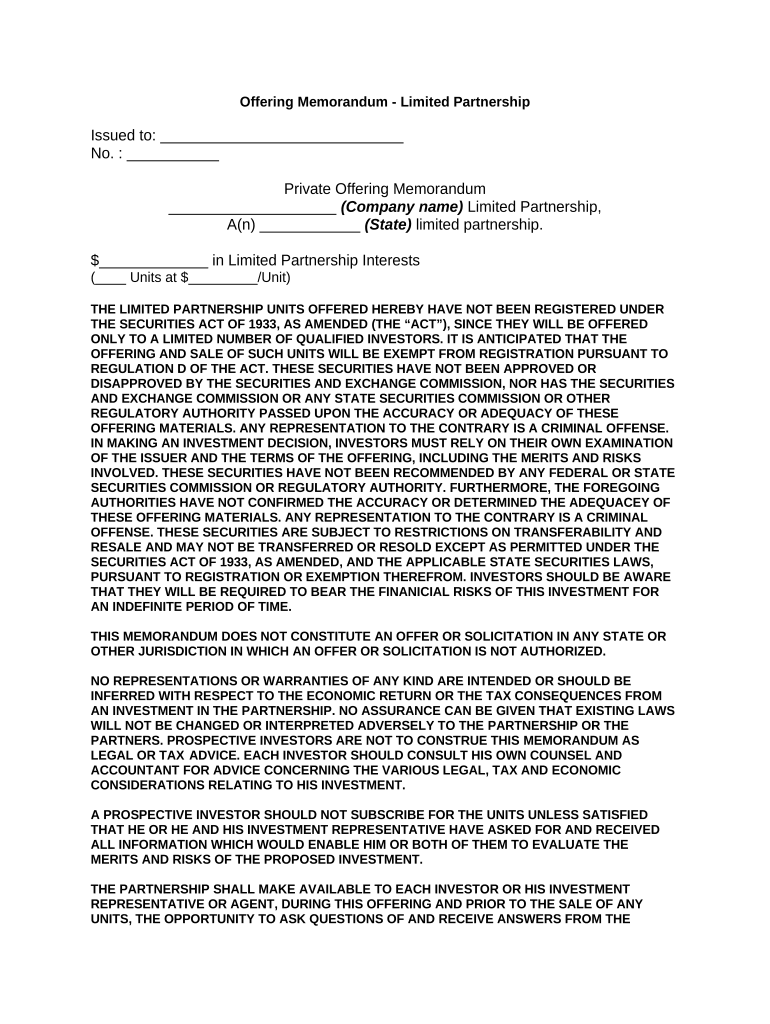

An offering limited partnership is a specific type of investment vehicle where two or more parties come together to conduct business. In this arrangement, one or more general partners manage the business and are responsible for its operations, while limited partners contribute capital but have limited liability and do not participate in day-to-day management. This structure allows investors to benefit from the profits of the partnership while limiting their risk exposure to the amount they invested.

How to use the Offering Limited Partnership

Utilizing an offering limited partnership involves several steps. First, the general partners must draft a partnership agreement that outlines the terms of the partnership, including profit-sharing, management responsibilities, and the rights of limited partners. Next, the partnership must comply with applicable state laws and regulations, which may include filing specific forms and providing disclosures to potential investors. Once established, the partnership can raise funds by offering limited partnership interests to investors, who will then receive returns based on the partnership's performance.

Key elements of the Offering Limited Partnership

Several key elements define an offering limited partnership. These include:

- General Partners: Individuals or entities responsible for managing the partnership and making decisions.

- Limited Partners: Investors who provide capital but have limited involvement in management.

- Partnership Agreement: A legal document that outlines the terms, roles, and responsibilities of all partners.

- Capital Contributions: The funds provided by limited partners to support the partnership's operations.

- Profit Distribution: The method by which profits are shared among partners, typically based on their investment percentage.

Steps to complete the Offering Limited Partnership

Completing the offering limited partnership involves a series of structured steps:

- Draft the partnership agreement, detailing the roles and responsibilities of each partner.

- Register the partnership with the appropriate state authorities, ensuring compliance with local laws.

- Obtain any necessary licenses or permits required for the partnership's business activities.

- Raise capital by offering limited partnership interests to potential investors.

- Maintain accurate records of all financial transactions and partner contributions.

Legal use of the Offering Limited Partnership

The legal use of an offering limited partnership is governed by state laws and regulations. To ensure compliance, it is essential to adhere to the requirements set forth by the state in which the partnership is formed. This includes filing necessary documents, such as the certificate of limited partnership, and ensuring that the partnership agreement complies with state statutes. Additionally, general partners must be aware of the fiduciary duties they owe to limited partners, which include acting in good faith and in the best interests of the partnership.

State-specific rules for the Offering Limited Partnership

Each state has its own set of rules and regulations governing offering limited partnerships. These can include specific filing requirements, fees, and compliance obligations. It is crucial for general partners to research and understand the laws in their state to ensure proper formation and operation of the partnership. Failure to comply with state-specific regulations can result in penalties or the invalidation of the partnership.

Quick guide on how to complete offering limited partnership

Prepare Offering Limited Partnership effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as it allows you to obtain the correct format and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Offering Limited Partnership on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Offering Limited Partnership seamlessly

- Locate Offering Limited Partnership and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and eSign Offering Limited Partnership and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for businesses considering an offering limited partnership?

airSlate SignNow provides a comprehensive suite of features designed for businesses in an offering limited partnership. These include customizable templates, bulk sending options, and advanced eSigning capabilities that streamline the document management process. Users can also track document status in real-time, enhancing transparency and efficiency.

-

How does airSlate SignNow enhance the process of creating an offering limited partnership?

By utilizing airSlate SignNow, businesses can simplify the process of creating an offering limited partnership through its easy-to-use interface. The platform allows for seamless document preparation, ensuring all necessary forms are completed correctly and efficiently. Additionally, the ability to include multiple signers reduces delays in the partnership formation process.

-

Is airSlate SignNow cost-effective for managing an offering limited partnership?

Yes, airSlate SignNow provides a cost-effective solution for managing an offering limited partnership. With competitive pricing plans, businesses can select a package that fits their budget while enjoying powerful features that enhance document signing processes. This affordability helps streamline operations without sacrificing quality.

-

Can airSlate SignNow integrate with other tools for an offering limited partnership?

Absolutely! airSlate SignNow offers various integrations with popular tools and platforms which are beneficial for an offering limited partnership. Users can connect it with CRM systems, cloud storage solutions, and other software applications to create a cohesive business workflow. This integration capability enhances efficiency and organization in managing partnerships.

-

What are the benefits of using airSlate SignNow for an offering limited partnership?

The benefits of using airSlate SignNow for an offering limited partnership include increased speed and accuracy in document handling. The platform minimizes manual errors and reduces turnaround time with its automated workflows. Moreover, users gain peace of mind knowing that all documents are securely stored and legally compliant.

-

How secure is airSlate SignNow for offering limited partnership agreements?

Security is a top priority for airSlate SignNow when managing offering limited partnership agreements. The platform uses advanced encryption and secure cloud storage to protect sensitive information. Additionally, it complies with industry standards, ensuring that all signatures and transactions are secure and legally binding.

-

What support options are available for businesses using airSlate SignNow for an offering limited partnership?

airSlate SignNow offers robust support options for businesses engaged in an offering limited partnership. Customers can access a knowledge base, live chat, and email support to resolve any inquiries or technical issues. This comprehensive support ensures that users can maximize the platform’s features effectively.

Get more for Offering Limited Partnership

Find out other Offering Limited Partnership

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple