General Partnerships Form

What is a partnership agreement?

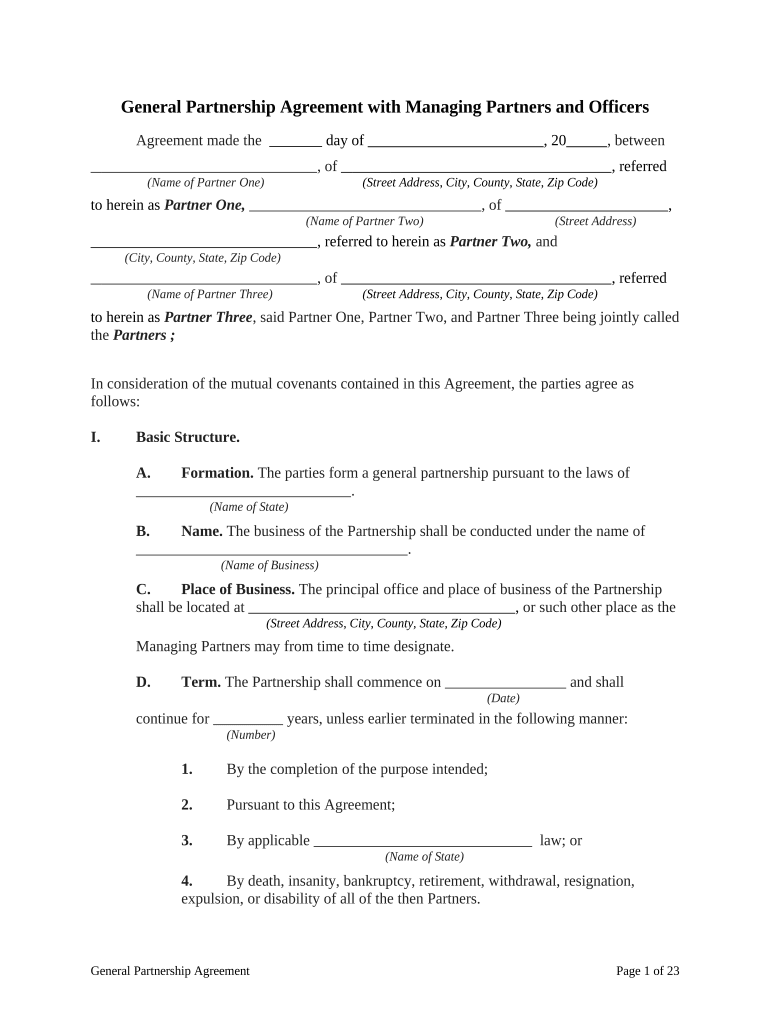

A partnership agreement is a formal contract between two or more individuals or entities that outlines the terms and conditions of their business relationship. This document serves as a foundational framework for how the partners will operate, share profits and losses, and resolve disputes. It is essential for establishing clear expectations and responsibilities among partners, thereby minimizing potential conflicts. A well-drafted partnership agreement includes key elements such as the partnership's purpose, capital contributions, profit-sharing ratios, and the roles of each partner.

Key elements of a partnership agreement

Understanding the key elements of a partnership agreement is crucial for effective collaboration among partners. These elements typically include:

- Partnership name: The official name under which the partnership will operate.

- Purpose: A clear description of the business activities the partnership will engage in.

- Capital contributions: Details regarding each partner's financial investment and any assets contributed to the partnership.

- Profit and loss distribution: How profits and losses will be allocated among partners, often based on their respective contributions.

- Decision-making processes: Guidelines for how decisions will be made, including voting rights and procedures.

- Dispute resolution: Methods for resolving disagreements, such as mediation or arbitration.

- Withdrawal or addition of partners: Procedures for handling changes in partnership composition.

Steps to complete a partnership agreement

Completing a partnership agreement involves several important steps to ensure that all partners are on the same page. Here is a general outline of the process:

- Discuss terms: All partners should meet to discuss and agree on the key elements of the partnership agreement.

- Draft the agreement: Create a written document that includes all agreed-upon terms and conditions.

- Review and revise: Partners should review the draft for clarity and completeness, making necessary revisions.

- Seek legal advice: Consider consulting with a legal professional to ensure the agreement complies with applicable laws and regulations.

- Sign the agreement: All partners must sign the final document to make it legally binding.

Legal use of a partnership agreement

A partnership agreement is legally binding when executed properly. To ensure its enforceability, it must meet specific legal requirements, including:

- Written format: While oral agreements may be valid, a written document is strongly recommended for clarity and legal protection.

- Signatures: All partners must sign the agreement, indicating their consent to the terms.

- Compliance with state laws: The agreement must adhere to the laws governing partnerships in the state where the business operates.

State-specific rules for partnership agreements

Partnership agreements may be subject to specific regulations that vary by state. It is essential for partners to be aware of these rules to ensure compliance. Some states may require certain provisions to be included in the agreement, while others may have unique filing requirements or tax implications. Consulting with a legal expert familiar with local laws can help partners navigate these complexities and create a compliant partnership agreement.

Examples of partnership agreements

Partnership agreements can take various forms depending on the nature of the business and the relationship between partners. Common examples include:

- General partnership agreement: This type of agreement outlines the responsibilities and liabilities of all partners equally.

- Limited partnership agreement: In this arrangement, some partners have limited liability, while others have full liability.

- Joint venture agreement: This agreement is typically for a specific project or purpose, where partners collaborate for a limited time.

Quick guide on how to complete general partnerships

Complete General Partnerships effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute to traditional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage General Partnerships on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign General Partnerships without any hassle

- Obtain General Partnerships and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or shield sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device you prefer. Alter and eSign General Partnerships and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a partnership agreement partners and why do I need one?

A partnership agreement partners is a legal document that outlines the terms and conditions of a partnership between two or more entities. It is essential to clearly define roles, responsibilities, and profit-sharing to prevent misunderstandings and conflicts in the future.

-

How can airSlate SignNow help in creating a partnership agreement partners?

airSlate SignNow provides easy-to-use templates that can be customized to meet the specific needs of your partnership agreement partners. By utilizing our platform, you can streamline the document creation process and ensure that all necessary legal clauses are included.

-

What features does airSlate SignNow offer for partnership agreement partners?

airSlate SignNow offers features such as eSigning, document collaboration, and automated workflows, which are all beneficial for managing your partnership agreement partners. These tools help enhance communication and ensure that all parties are on the same page throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for partnership agreements?

Yes, airSlate SignNow offers several pricing plans tailored to fit various business needs, including plans specifically designed for managing partnership agreement partners. Each plan includes features that maximize productivity while staying cost-effective.

-

Can I integrate airSlate SignNow with other tools for my partnership agreement partners?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as CRM systems, cloud storage solutions, and project management tools to streamline your workflow. This means managing partnership agreement partners becomes even more efficient with centralized access to your documents.

-

What are the benefits of using eSignatures for partnership agreement partners?

Using eSignatures for partnership agreement partners accelerates the signing process, reduces physical paperwork, and enhances security. It ensures that all signatures are legally binding and can be tracked for accountability, providing peace of mind for all involved parties.

-

How secure is my data when using airSlate SignNow for partnership agreement partners?

airSlate SignNow places a high priority on data security, utilizing encryption, secure cloud storage, and compliance with legal standards to keep your partnership agreement partners safe. Your sensitive information is protected, ensuring confidentiality throughout the document management process.

Get more for General Partnerships

Find out other General Partnerships

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template