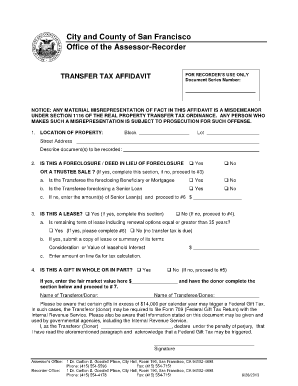

San Francisco Transfer Tax Affidavit 2013

What is the San Francisco Transfer Tax Affidavit

The San Francisco Transfer Tax Affidavit is a crucial document used during real estate transactions in San Francisco County. It serves to report the transfer of property and the associated tax obligations. This affidavit is required when a property is sold or transferred, ensuring compliance with local tax regulations. It provides necessary information regarding the transaction, such as the sale price, property details, and the parties involved. Understanding this affidavit is essential for both buyers and sellers to ensure that all tax liabilities are met and documented correctly.

How to Use the San Francisco Transfer Tax Affidavit

Using the San Francisco Transfer Tax Affidavit involves several key steps. First, ensure that you have the correct form, which can typically be obtained from the San Francisco Assessor's office or their official website. Once you have the form, fill it out with accurate information regarding the property transfer, including the names of the buyer and seller, property address, and sale price. After completing the affidavit, it must be signed by both parties involved in the transaction. This document is then submitted to the appropriate county office, either in person or electronically, depending on the submission methods available.

Steps to Complete the San Francisco Transfer Tax Affidavit

Completing the San Francisco Transfer Tax Affidavit requires careful attention to detail. Follow these steps:

- Obtain the latest version of the affidavit from the San Francisco Assessor's office.

- Fill in the required fields, including the property details, parties involved, and sale price.

- Review the affidavit for accuracy to avoid potential delays or issues.

- Ensure all necessary signatures are obtained from both the buyer and seller.

- Submit the completed affidavit to the appropriate county office, either online or in person.

Key Elements of the San Francisco Transfer Tax Affidavit

The San Francisco Transfer Tax Affidavit contains several key elements that must be accurately completed. These include:

- Property Information: Address and legal description of the property being transferred.

- Transaction Details: Sale price and date of transfer.

- Parties Involved: Names and contact information of the buyer and seller.

- Signatures: Required signatures of both parties to validate the affidavit.

Legal Use of the San Francisco Transfer Tax Affidavit

The legal use of the San Francisco Transfer Tax Affidavit is essential for ensuring compliance with local tax laws. This affidavit must be filed with the county to document the transfer of property and to assess any applicable transfer taxes. Failure to submit this affidavit can result in penalties and complications during the property transfer process. It is crucial to understand the legal implications of this document, as it serves as evidence of the transaction and may be referenced in future legal matters regarding the property.

Form Submission Methods

The San Francisco Transfer Tax Affidavit can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online Submission: Many users prefer to submit the affidavit electronically, which can streamline the process.

- Mail: The completed affidavit can be mailed to the appropriate county office, ensuring it is sent via a reliable service.

- In-Person: Individuals may also choose to submit the affidavit in person at the county office, allowing for immediate confirmation of receipt.

Quick guide on how to complete san francisco transfer tax affidavit

Effortlessly Prepare San Francisco Transfer Tax Affidavit on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage San Francisco Transfer Tax Affidavit on any device through airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to Alter and Electronically Sign San Francisco Transfer Tax Affidavit with Ease

- Locate San Francisco Transfer Tax Affidavit and click on Acquire Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Generate your electronic signature using the Signature feature, which takes just moments and holds the same legal authority as a conventional ink signature.

- Verify the details and click on the Finish button to retain your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign San Francisco Transfer Tax Affidavit to guarantee exceptional communication throughout the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct san francisco transfer tax affidavit

Create this form in 5 minutes!

How to create an eSignature for the san francisco transfer tax affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a San Francisco transfer tax affidavit?

A San Francisco transfer tax affidavit is a legal document required during the sale of real estate properties in San Francisco. This affidavit helps ensure that the appropriate transfer taxes are calculated and paid, complying with local regulations. It is essential for sellers to provide this document to avoid any delays in the transaction.

-

How can I complete a San Francisco transfer tax affidavit using airSlate SignNow?

To complete a San Francisco transfer tax affidavit using airSlate SignNow, simply upload your document to our platform, fill in the required fields, and eSign it easily. Our user-friendly interface allows for quick navigation and editing, making it an effective solution for managing transfer tax affidavits. Additionally, you can invite other parties to sign directly through our platform.

-

What are the benefits of using airSlate SignNow for a San Francisco transfer tax affidavit?

Using airSlate SignNow for a San Francisco transfer tax affidavit streamlines the signing process, reducing time spent on paperwork. Our cost-effective solution also ensures that your document remains secure while being easily accessible. This convenience can lead to faster real estate transactions and enhanced compliance with local tax regulations.

-

Are there any fees associated with using airSlate SignNow for the San Francisco transfer tax affidavit?

airSlate SignNow offers competitive pricing plans that include features for managing San Francisco transfer tax affidavits. We provide a free trial, and our affordable monthly subscriptions cater to various business needs. Transparency in our pricing ensures you only pay for the features that fit your requirements.

-

Is airSlate SignNow compliant with San Francisco transfer tax affidavit regulations?

Yes, airSlate SignNow is designed to assist users in creating compliant San Francisco transfer tax affidavits. Our platform incorporates all necessary fields and guidelines required by local laws, ensuring your documentation meets legal standards. This helps mitigate the risk of errors that could slow down your real estate transactions.

-

Can I integrate airSlate SignNow with other tools for managing my San Francisco transfer tax affidavit?

Absolutely! airSlate SignNow offers seamless integrations with various business tools such as CRM systems and document management applications. This allows you to manage your San Francisco transfer tax affidavit within the ecosystem you already use, enhancing overall productivity while keeping everything organized.

-

What types of documents can I prepare apart from the San Francisco transfer tax affidavit?

In addition to the San Francisco transfer tax affidavit, airSlate SignNow allows you to create and manage various document types, including contracts, agreements, and invoices. The versatility of our platform means you can handle all your document needs in one place. This simplifies your workflow and increases efficiency across different business processes.

Get more for San Francisco Transfer Tax Affidavit

Find out other San Francisco Transfer Tax Affidavit

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free