Unincorporated Association Form

What is the Unincorporated Association

An unincorporated association is a group of individuals who come together for a common purpose, often related to social, recreational, or charitable activities. Unlike incorporated entities, these associations do not have a separate legal identity from their members. This means that the members can be personally liable for the association's debts and obligations. In the United States, unincorporated associations are recognized in many states, allowing them to operate without formal incorporation, which can simplify administrative processes.

Key Elements of the Unincorporated Association

Several key elements define an unincorporated association, including:

- Common Purpose: Members must share a common goal or interest.

- Membership: The association typically has defined membership criteria.

- Organizational Structure: While not legally required, many associations have a governing structure, such as officers or a board.

- Rules and Bylaws: Associations often create bylaws to govern their operations and member interactions.

Legal Use of the Unincorporated Association

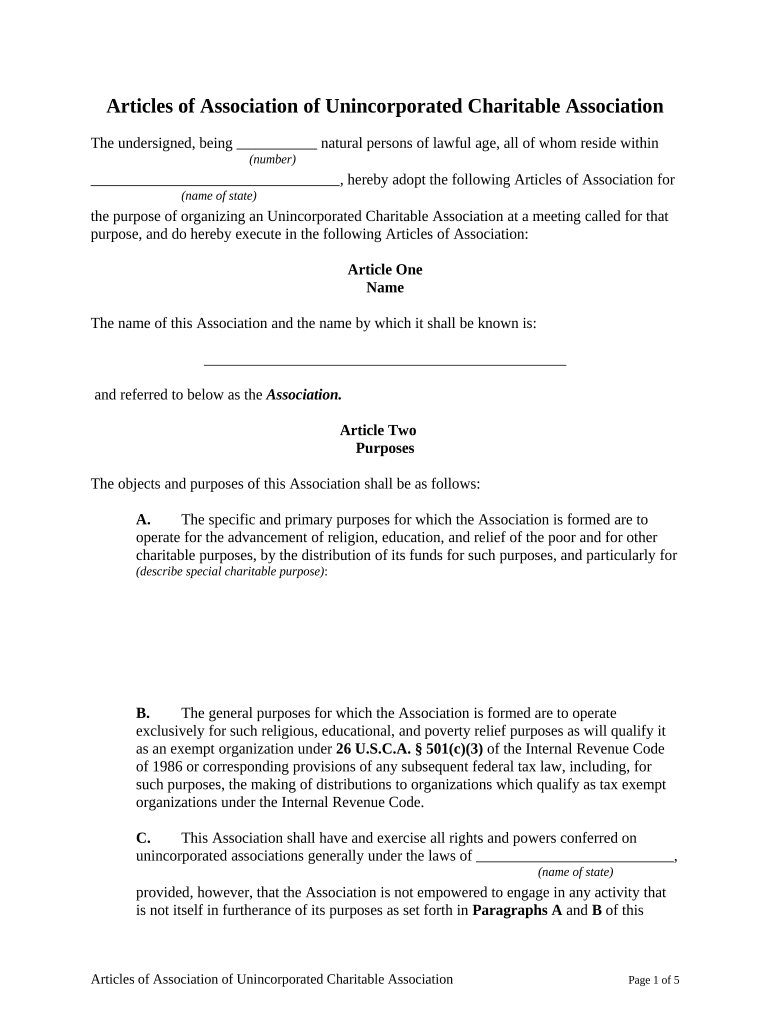

Unincorporated associations can engage in various legal activities, such as entering contracts, owning property, and conducting fundraising. However, the legal standing of these associations can vary by state. It is important for members to understand their rights and obligations under state law, as well as the potential for personal liability. Proper documentation, including articles of association, can help clarify the structure and purpose of the group.

Steps to Complete the Unincorporated Association

To establish an unincorporated association, follow these steps:

- Define the Purpose: Clearly articulate the common goal of the association.

- Draft Bylaws: Create a set of rules that govern the association's operations.

- Gather Members: Recruit individuals who share the common purpose.

- Hold Meetings: Conduct regular meetings to discuss objectives and make decisions.

- Document Activities: Keep records of meetings, decisions, and financial transactions for transparency.

State-Specific Rules for the Unincorporated Association

Each state in the U.S. may have different rules regarding unincorporated associations. These rules can affect how associations operate, their tax obligations, and their ability to enter contracts. Members should research their specific state laws to ensure compliance and understand any reporting requirements. Some states may require registration or filing of certain documents, while others may not impose any formal requirements.

Examples of Using the Unincorporated Association

Unincorporated associations can take many forms, including:

- Clubs: Social or recreational clubs that bring together individuals with shared interests.

- Charitable Organizations: Groups formed to support specific causes or community needs.

- Sports Teams: Local teams that organize competitions and events.

- Advocacy Groups: Organizations focused on promoting particular social or political issues.

Quick guide on how to complete unincorporated association

Effortlessly Prepare Unincorporated Association on Any Device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, adjust, and electronically sign your documents swiftly and without delays. Manage Unincorporated Association on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to Adjust and Electronically Sign Unincorporated Association with Ease

- Find Unincorporated Association and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Adjust and electronically sign Unincorporated Association to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are unincorporated associations and how can airSlate SignNow assist them?

Unincorporated associations are organizations that operate without formal incorporation, making document management vital. airSlate SignNow offers seamless eSigning and document sharing features tailored for these associations, ensuring compliance and easy access to important paperwork.

-

How does airSlate SignNow support the documentation needs of unincorporated associations?

airSlate SignNow provides customizable templates that cater specifically to unincorporated associations. These templates allow associations to quickly generate, send, and eSign essential documents, streamlining their operations and enhancing productivity.

-

What are the pricing options for unincorporated associations using airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed for the needs of unincorporated associations. Whether you're a small group or a larger organization, our flexible pricing options provide cost-effective solutions to manage your documents efficiently.

-

Can unincorporated associations integrate airSlate SignNow with other tools?

Yes, airSlate SignNow allows unincorporated associations to integrate with various tools such as CRMs, project management software, and email platforms. These integrations help simplify workflows and enhance the overall efficiency of managing documents.

-

What features make airSlate SignNow ideal for unincorporated associations?

AirSlate SignNow provides features like secure eSigning, real-time collaboration, and audit trails that are specifically beneficial for unincorporated associations. These functionalities ensure that all transactions are legally binding and easily trackable.

-

Are there any benefits to using airSlate SignNow for unincorporated associations?

Absolutely! Using airSlate SignNow allows unincorporated associations to save time and reduce paper costs signNowly. Additionally, the platform enhances accessibility and ensures that members can quickly sign and exchange documents from anywhere.

-

Is it easy for unincorporated associations to get started with airSlate SignNow?

Yes, airSlate SignNow is user-friendly, allowing unincorporated associations to get started quickly. With an intuitive interface and easy setup, members can begin sending and signing documents within minutes, without requiring extensive training.

Get more for Unincorporated Association

Find out other Unincorporated Association

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template