Sample Letter Financing Form

What is the sample letter financing?

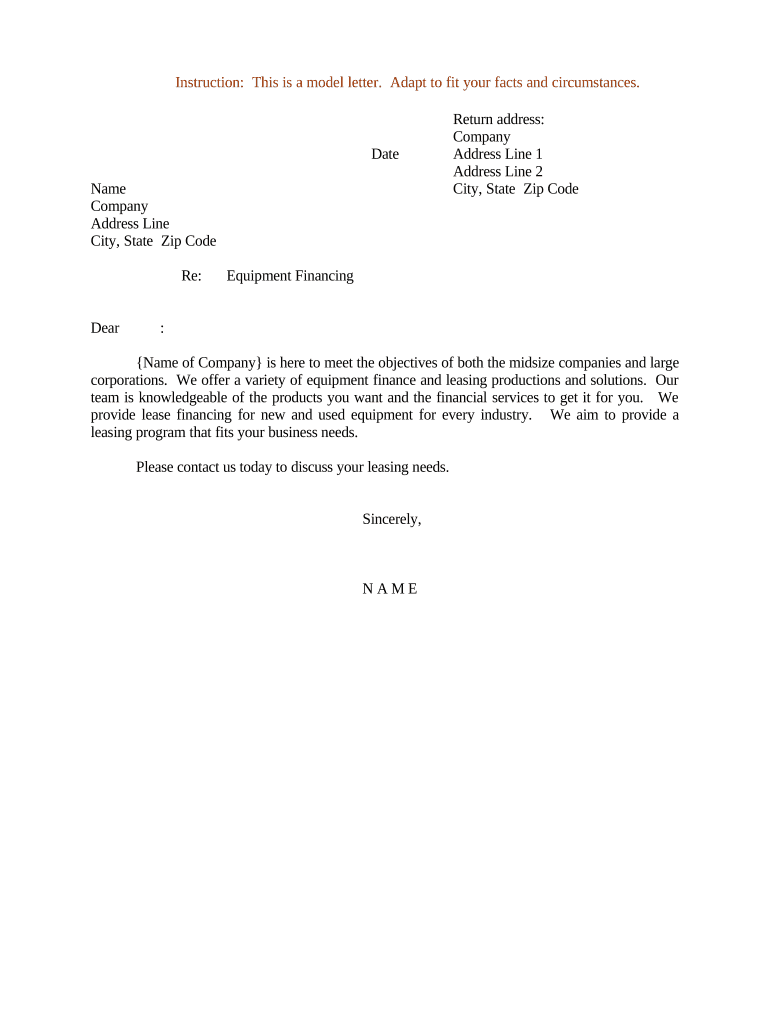

The sample letter financing is a formal document used primarily in business and financial transactions. It serves as a request for funds or support from a lender or financial institution. This letter outlines the purpose of the financing, the amount requested, and any relevant details about the project or investment. It is essential for establishing a clear understanding between the borrower and the lender regarding the terms of the financial arrangement.

How to use the sample letter financing

Using the sample letter financing involves several key steps. First, gather all necessary information, including the purpose of the financing and the amount needed. Next, draft the letter by clearly stating your request and providing supporting details, such as project descriptions or financial forecasts. Ensure that the letter is concise and professional. Finally, send the letter to the appropriate financial institution or lender, either electronically or via traditional mail, depending on their submission guidelines.

Steps to complete the sample letter financing

Completing the sample letter financing requires careful attention to detail. Follow these steps for an effective submission:

- Identify the recipient: Determine the lender or financial institution to whom you will address the letter.

- Include your contact information: Provide your name, address, phone number, and email at the top of the letter.

- State the purpose: Clearly articulate the reason for the financing request.

- Specify the amount: Indicate the exact amount of funding you are seeking.

- Provide supporting information: Include any relevant details that support your request, such as financial statements or project plans.

- Review and edit: Ensure that the letter is free from errors and clearly conveys your message.

- Submit the letter: Send it to the lender using the preferred method of communication.

Key elements of the sample letter financing

Several key elements should be included in the sample letter financing to enhance its effectiveness:

- Introduction: A brief introduction that states the purpose of the letter.

- Details of the request: Specific information regarding the financing amount and its intended use.

- Supporting documentation: Mention any documents attached that support your request, such as business plans or financial projections.

- Closing statement: A polite conclusion that invites further discussion and expresses gratitude for consideration.

Legal use of the sample letter financing

The legal use of the sample letter financing is crucial for ensuring that the document is recognized in formal financial transactions. To be legally binding, the letter must comply with relevant laws and regulations governing financing agreements. This includes clear terms and conditions, signatures from all parties involved, and adherence to any state-specific requirements. Utilizing a reliable electronic signature solution can enhance the legal standing of the document.

Examples of using the sample letter financing

Examples of using the sample letter financing can provide insight into its practical application. Common scenarios include:

- A small business owner seeking a loan to expand operations.

- An entrepreneur requesting funding for a startup project.

- A nonprofit organization applying for grants to support community initiatives.

These examples illustrate the versatility of the sample letter financing in various contexts, highlighting its importance in securing necessary funds.

Quick guide on how to complete sample letter financing

Complete Sample Letter Financing effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without obstacles. Handle Sample Letter Financing on any platform with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest method to alter and eSign Sample Letter Financing seamlessly

- Find Sample Letter Financing and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or hide sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Adjust and eSign Sample Letter Financing and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter financing?

A sample letter financing is a template document used to request financial support or funding for a specific project or need. It is designed to outline the purpose of the financing, the amount needed, and the repayment terms. Using a well-crafted sample letter financing can greatly improve your chances of securing approval from potential lenders.

-

How can airSlate SignNow help with my sample letter financing?

AirSlate SignNow enables you to create, send, and eSign your sample letter financing quickly and securely. Our platform provides templates and easy customization options that allow you to rapidly prepare your documents. With SignNow, you can streamline the signing process and ensure that your financing requests are efficiently managed.

-

What features of airSlate SignNow benefit the financing process?

AirSlate SignNow offers several features that streamline the financing process, including intuitive document templates for sample letter financing and eSigning capabilities. The platform allows for real-time collaboration, enabling users to share documents easily and obtain signatures promptly. Additionally, automated workflows ensure that every step is tracked and managed efficiently.

-

Is airSlate SignNow cost-effective for small businesses seeking sample letter financing?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to manage their sample letter financing. With its competitive pricing plans and the potential for increased efficiency in document management, businesses can save time and money. Our intuitive platform makes it accessible for companies of any size to handle their financing needs effectively.

-

Can I integrate airSlate SignNow with other applications for financing?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of popular applications, enhancing your financing process. You can connect with cloud storage services, CRMs, and team collaboration tools, allowing you to manage your sample letter financing alongside your existing workflows. This integration helps improve productivity and coordination within your business.

-

What are the benefits of using airSlate SignNow for a sample letter financing?

Using airSlate SignNow for your sample letter financing offers numerous benefits, including enhanced efficiency and security. The platform ensures that your documents are stored securely and can be accessed easily when needed. Furthermore, with our eSigning feature, you can obtain signatures instantly, accelerating the financing approval process.

-

How do I get started with airSlate SignNow for my financing documents?

Getting started with airSlate SignNow is easy! Simply sign up for an account and explore our library of templates, including those for sample letter financing. From there, you can customize your documents, send them for eSignature, and track their progress—all in one user-friendly interface.

Get more for Sample Letter Financing

Find out other Sample Letter Financing

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form