Charitable Remainder Unitrust Form

What is the Charitable Remainder Unitrust

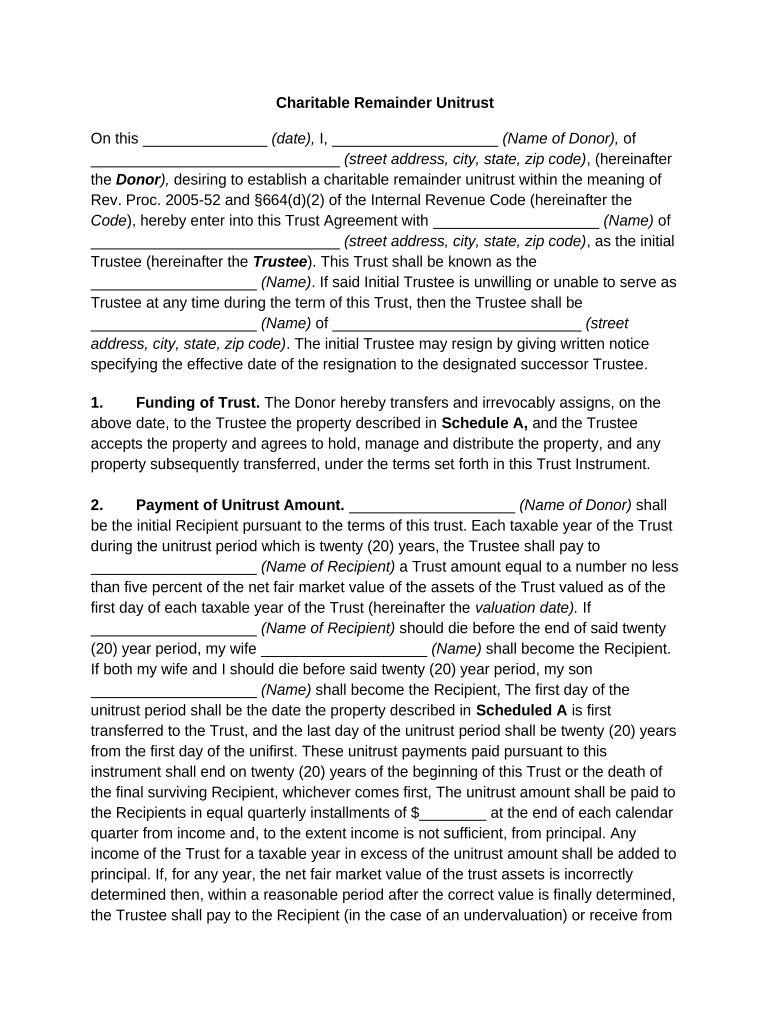

The charitable remainder unitrust (CRUT) is a type of trust that allows a donor to contribute assets while retaining an income stream for a specified period. Upon the termination of the trust, the remaining assets are transferred to a designated charity. This arrangement provides both tax benefits and a means to support philanthropic causes. The CRUT is particularly appealing as it allows for a flexible payout structure, where the income can vary based on the trust's value, ensuring that the donor can benefit from market fluctuations.

Steps to complete the Charitable Remainder Unitrust

Completing a charitable remainder unitrust involves several key steps:

- Determine the trust's structure: Decide whether to establish a standard CRUT or a net income with makeup CRUT, which allows for income variability.

- Select assets: Choose the assets to fund the trust, which can include cash, securities, or real estate.

- Draft the trust document: Work with an attorney to create a legally binding trust document that outlines the terms, beneficiaries, and payout structure.

- Fund the trust: Transfer the selected assets into the trust, ensuring that all legal requirements are met.

- File necessary tax forms: Complete any required IRS forms to establish the trust and claim applicable tax deductions.

Key elements of the Charitable Remainder Unitrust

Several essential components define a charitable remainder unitrust:

- Income distribution: The trust must pay a fixed percentage of its value to the donor or other beneficiaries annually.

- Charitable remainder: Upon termination, the remaining assets must be distributed to a qualified charity.

- Tax benefits: Donors can receive income tax deductions based on the present value of the charitable remainder.

- Trustee designation: A trustee must be appointed to manage the trust's assets and ensure compliance with legal requirements.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for charitable remainder unitrusts, which include:

- The trust must be irrevocable to qualify for tax deductions.

- The payout percentage must be between five and fifty percent of the trust's value.

- The trust must be established for a term of years or for the life of one or more individuals.

- Donors must file Form 5227 to report the trust's activities and distributions annually.

Required Documents

To establish a charitable remainder unitrust, several documents are necessary:

- Trust agreement: A legal document outlining the trust's terms, beneficiaries, and management.

- Asset documentation: Records of the assets being transferred into the trust.

- IRS forms: Any required tax forms, including Form 5227 and potentially Form 1041 for the trust's income tax return.

- Appraisal reports: For non-cash assets, professional appraisals may be needed to establish fair market value.

Legal use of the Charitable Remainder Unitrust

The legal framework surrounding charitable remainder unitrusts is established by federal and state laws. It is crucial to comply with these regulations to ensure that the trust is valid and the intended tax benefits are realized. Legal usage includes proper drafting of the trust document, adherence to IRS guidelines, and ensuring that the charitable beneficiaries are qualified organizations. Consulting with legal and tax professionals is advisable to navigate the complexities of establishing and maintaining a CRUT.

Quick guide on how to complete charitable remainder unitrust

Effortlessly Create Charitable Remainder Unitrust on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily locate the appropriate document and securely store it online. airSlate SignNow equips you with all the utilities required to create, edit, and eSign your documents quickly without delays. Manage Charitable Remainder Unitrust on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Edit and eSign Charitable Remainder Unitrust Seamlessly

- Locate Charitable Remainder Unitrust and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and then click on the Done button to store your modifications.

- Choose your preferred method to send the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Charitable Remainder Unitrust while ensuring seamless communication at every step of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable remainder trust and how do I write one using airSlate SignNow?

A charitable remainder trust (CRT) is a financial vehicle that allows you to provide income to beneficiaries while donating to a charity. To learn how to write a charitable remainder trust using airSlate SignNow, start by outlining your grantor's intentions and the specifics of the trust. Our platform simplifies document creation and eSigning, making it easy to formalize your CRT.

-

What features does airSlate SignNow offer for writing a charitable remainder trust?

airSlate SignNow offers a user-friendly interface for drafting legal documents, including charitable remainder trusts. With customizable templates, you can easily tailor your CRT to fit your unique needs. Additionally, eSigning capabilities allow for quick and secure execution of your trust documents.

-

Is there a cost associated with using airSlate SignNow to write a charitable remainder trust?

Yes, using airSlate SignNow to write a charitable remainder trust comes with a subscription fee. However, our pricing plans are designed to be cost-effective, providing great value considering the convenience and legal compliance features available. Check our website for the latest pricing details.

-

How can airSlate SignNow help ensure my charitable remainder trust is legally valid?

To ensure that your charitable remainder trust is legally valid, airSlate SignNow provides templates that comply with legal requirements. Our platform also allows users to collaborate with legal professionals during the drafting process. This support helps you confidently write a compliant CRT that meets your requirements.

-

What are the benefits of using airSlate SignNow for writing a charitable remainder trust?

Using airSlate SignNow to write a charitable remainder trust offers several benefits, including ease of use and quick document turnaround. Our platform simplifies the eSigning process, allowing all parties to sign from anywhere, boosting efficiency. Plus, our templates can save you time and legal fees.

-

Can I integrate airSlate SignNow with other tools while writing a charitable remainder trust?

Yes, airSlate SignNow offers integrations with various tools and software to enhance your experience while writing a charitable remainder trust. Whether you are using CRM systems, cloud storage, or other productivity apps, our platform can seamlessly integrate to streamline your workflow.

-

What resources does airSlate SignNow provide for learning how to write a charitable remainder trust?

airSlate SignNow provides a wealth of resources including articles, webinars, and tutorials on how to write a charitable remainder trust. Our support center is designed to guide users through the entire process, ensuring you have access to information and best practices to create effective CRTs.

Get more for Charitable Remainder Unitrust

- Bmd 003 form

- Completion drug program form

- Form complaint law enforcement form

- Civ 151 application to be relieved as attorney on completion of limited scope representation judicial council forms

- San mateo county superior court recommends adr options form

- Prefiling order vexatious litigant form

- Nc 400info form

- A 13b 5 form

Find out other Charitable Remainder Unitrust

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer