Church Receipt Form

What is the Church Receipt

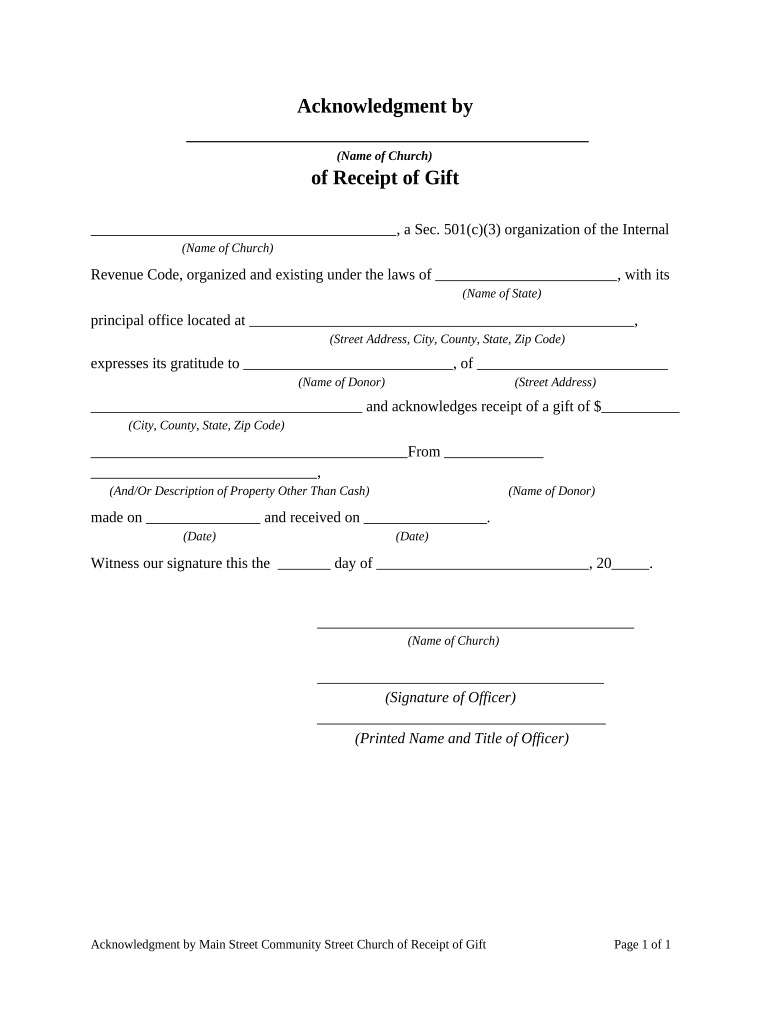

A church receipt is an official document issued by a church or nonprofit organization to acknowledge a donation made by an individual or entity. This receipt serves as proof of the contribution for both the donor and the organization, particularly for tax purposes. It typically includes essential information such as the donor's name, the amount donated, the date of the donation, and a statement confirming that no goods or services were exchanged in return for the donation, which is crucial for tax deduction eligibility.

Key Elements of the Church Receipt

To ensure that a church receipt is valid and useful, it should contain specific key elements. These include:

- Donor Information: Name and address of the donor.

- Donation Amount: The total amount contributed.

- Date of Donation: The date when the donation was made.

- Organization Details: Name and address of the church or nonprofit organization.

- Statement of No Goods or Services: A declaration that the donor did not receive any goods or services in exchange for the donation.

How to Use the Church Receipt

The church receipt can be utilized by the donor for tax filing purposes. When preparing tax returns, donors can use the receipt to substantiate their charitable contributions, which may qualify them for tax deductions. It is essential for donors to keep these receipts organized and accessible, as they may be required to present them in the event of an audit by the IRS.

Steps to Complete the Church Receipt

Completing a church receipt involves several straightforward steps. First, gather all necessary information, including donor details and the donation amount. Next, fill out the receipt template, ensuring that all required fields are accurately completed. After filling out the receipt, review it for accuracy and sign it if necessary. Finally, provide a copy of the completed receipt to the donor while retaining a copy for the church’s records.

Legal Use of the Church Receipt

The church receipt is legally recognized as a document that can support tax deductions for charitable contributions. To be valid, it must comply with IRS guidelines, which stipulate that the receipt must include the donor's information, the amount donated, and a statement regarding the absence of goods or services provided in exchange for the donation. Failure to meet these requirements may result in the receipt being deemed invalid for tax purposes.

IRS Guidelines

The IRS has specific guidelines regarding the issuance and use of church receipts. According to IRS regulations, any donation exceeding a certain amount requires a written acknowledgment from the nonprofit organization. This acknowledgment must be provided to the donor by January thirty-first of the year following the donation. Additionally, the receipt must clearly state that no goods or services were provided in exchange for the donation, ensuring compliance with tax laws.

Quick guide on how to complete church receipt

Effortlessly Prepare Church Receipt on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without hold-ups. Handle Church Receipt on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Edit and eSign Church Receipt with Ease

- Find Church Receipt and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to store your changes.

- Select your preferred method of submitting your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Church Receipt and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a church receipt template?

A church receipt template is a pre-designed document that churches can use to acknowledge donations made by members or supporters. This template typically includes details such as the donor's name, the amount donated, and the date of the donation. Utilizing a church receipt template helps streamline record-keeping and ensures that all contributions are documented accurately.

-

How can I customize the church receipt template?

Customizing the church receipt template is straightforward with airSlate SignNow. You can edit the text, add your church's logo, and modify any fields to fit your specific needs. This flexibility allows you to create a professional receipt that reflects your church's branding and meets legal requirements.

-

Is the church receipt template free to use?

While some basic church receipt templates are available for free, airSlate SignNow offers advanced features for a nominal fee. These paid options provide additional functionalities, like eSignature capabilities and document storage, making the investment worthwhile for churches looking to enhance their donation processes.

-

What are the benefits of using a church receipt template?

Using a church receipt template offers several benefits, including saving time and ensuring accuracy in recording donations. It allows churches to provide a formal acknowledgment to donors, which can be important for tax purposes. Furthermore, having a standardized template enhances professionalism and promotes transparency in financial reporting.

-

Can I send the church receipt template electronically?

Yes, airSlate SignNow allows you to send the church receipt template electronically, making it easy to signNow donors quickly. With electronic delivery, donors can receive their receipts instantly via email, ensuring they have the necessary documentation for their records. This feature also streamlines the overall donation process for your church.

-

How does airSlate SignNow integrate with other tools for managing donations?

airSlate SignNow offers seamless integrations with various donation management tools. This capability allows you to synchronize data between platforms, ensuring that all contributions are accurately recorded and receipts are promptly generated. Such integrations enhance the efficiency of managing donor information and financial reporting.

-

Is the church receipt template legally valid?

Yes, if properly filled out, a church receipt template generated through airSlate SignNow is legally valid. It can serve as an official acknowledgment for donations, which donors may need for tax deductions. Ensure that the receipt includes all necessary details as per IRS guidelines to meet legal requirements.

Get more for Church Receipt

Find out other Church Receipt

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple