Estate After Death Form

Understanding the Estate After Death

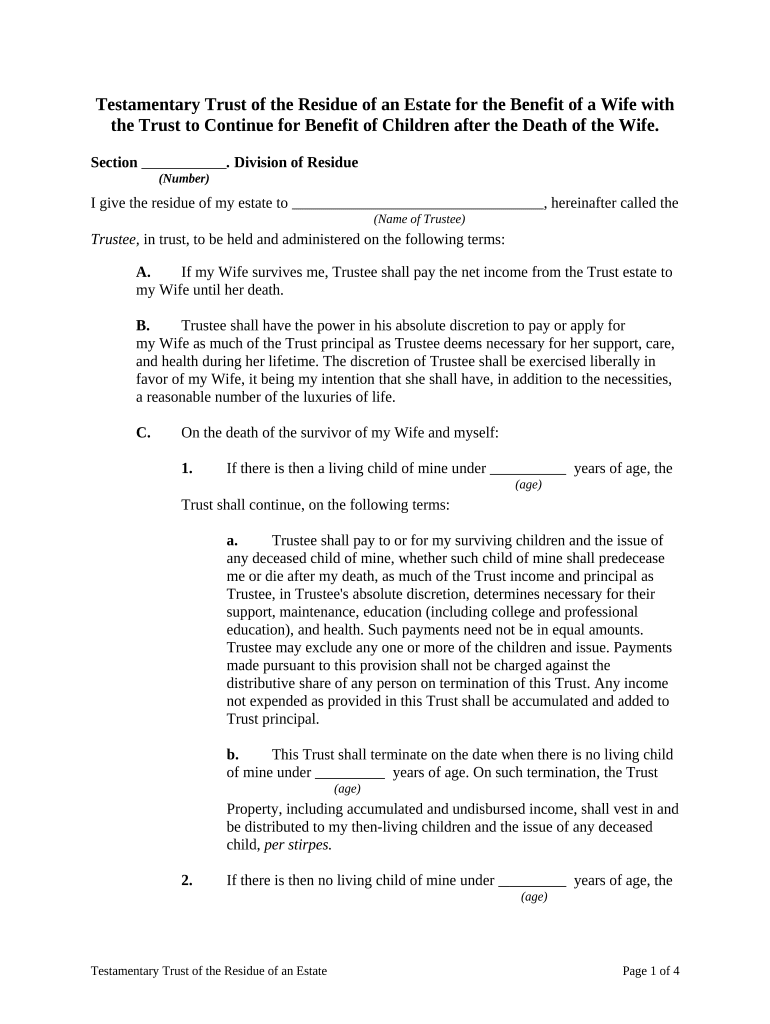

The estate after death refers to the total assets and liabilities left by an individual upon their passing. This can include real estate, bank accounts, investments, personal belongings, and any debts owed. Understanding this concept is crucial for the beneficiaries and executors involved in managing the deceased's estate. The estate is typically settled according to the deceased’s will, or if no will exists, according to state intestacy laws. This process ensures that the deceased's wishes are honored and that assets are distributed fairly among heirs.

Steps to Complete the Estate After Death

Completing the estate after death involves several key steps that must be followed to ensure proper management and distribution of assets. These steps typically include:

- Gathering all necessary documents, including the will, death certificate, and financial statements.

- Identifying and valuing the assets and liabilities of the estate.

- Filing the will with the appropriate probate court if required.

- Notifying beneficiaries and creditors about the estate proceedings.

- Settling any outstanding debts and taxes owed by the estate.

- Distributing the remaining assets to the beneficiaries as per the will or state law.

Legal Use of the Estate After Death

Legal use of the estate after death is governed by state laws and regulations. It is essential to adhere to these laws to avoid potential disputes or legal issues. The executor of the estate has the responsibility to manage the estate according to the law, ensuring that all debts are paid and that the distribution of assets is handled fairly. Additionally, legal documentation, such as the testamentary trust document, may be required to establish how the estate should be managed and distributed, particularly if there are minors or specific conditions attached to the inheritance.

Required Documents for Estate Processing

To process the estate after death, certain documents are necessary. These typically include:

- The deceased's will, if available.

- A certified copy of the death certificate.

- Inventory of assets and liabilities.

- Any trust documents, if applicable.

- Tax returns for the deceased for the last few years.

Having these documents readily available can streamline the process and ensure compliance with legal requirements.

Form Submission Methods for Estate Documents

Submitting estate documents can be done through various methods, depending on state requirements and personal preferences. Common methods include:

- Online submission through state probate court websites, if available.

- Mailing hard copies of the documents to the appropriate court.

- In-person submission at the local probate court.

Choosing the right method can help ensure that the documents are processed efficiently and in accordance with legal timelines.

Key Elements of the Estate After Death Process

Several key elements are vital to the estate after death process. These include:

- The appointment of an executor or personal representative to manage the estate.

- The probate process, which validates the will and oversees the distribution of assets.

- Tax obligations that may arise from the estate, including estate taxes and income taxes on inherited assets.

- The rights of beneficiaries and creditors, which must be respected throughout the process.

Understanding these elements can help all parties involved navigate the complexities of estate management effectively.

Quick guide on how to complete estate after death

Prepare Estate After Death effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Estate After Death on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Estate After Death effortlessly

- Locate Estate After Death and select Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive data using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Estate After Death and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an after death form?

An after death form is a legal document that outlines the wishes of an individual regarding the distribution of their assets after they pass away. airSlate SignNow allows you to create, send, and eSign these important documents conveniently, ensuring your wishes are documented and respected.

-

How can I create an after death form using airSlate SignNow?

Creating an after death form with airSlate SignNow is simple. You can start from a template or upload your own document, then customize it with the necessary fields and signatures, ensuring all required details are included to meet legal standards.

-

Is there a cost to use airSlate SignNow for signing after death forms?

airSlate SignNow offers a cost-effective solution for eSigning after death forms. We provide flexible pricing plans that cater to both individuals and businesses, allowing you to choose the one that fits your needs best. Check our pricing page for detailed options.

-

What features does airSlate SignNow offer for after death forms?

airSlate SignNow includes features like templates for after death forms, easy document sharing, and secure eSigning, ensuring that your documents are handled efficiently and comply with legal requirements. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other applications for handling after death forms?

Yes, airSlate SignNow supports various integrations with popular applications, enhancing your workflow. This allows you to seamlessly incorporate after death forms into your existing systems, making document management more streamlined and efficient.

-

What are the benefits of using airSlate SignNow for after death forms?

Using airSlate SignNow for after death forms saves time and resources by digitizing the signing process. It also ensures that your documents are securely stored and easily accessible, making it more convenient for you and your beneficiaries.

-

Is airSlate SignNow legally compliant for after death forms?

Absolutely! airSlate SignNow is designed to meet legal requirements for electronic signatures, ensuring that your after death forms are valid and legally binding. We adhere to industry standards and regulations for secure document signing.

Get more for Estate After Death

Find out other Estate After Death

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed