Guaranty Agreement Form

What is the guaranty agreement?

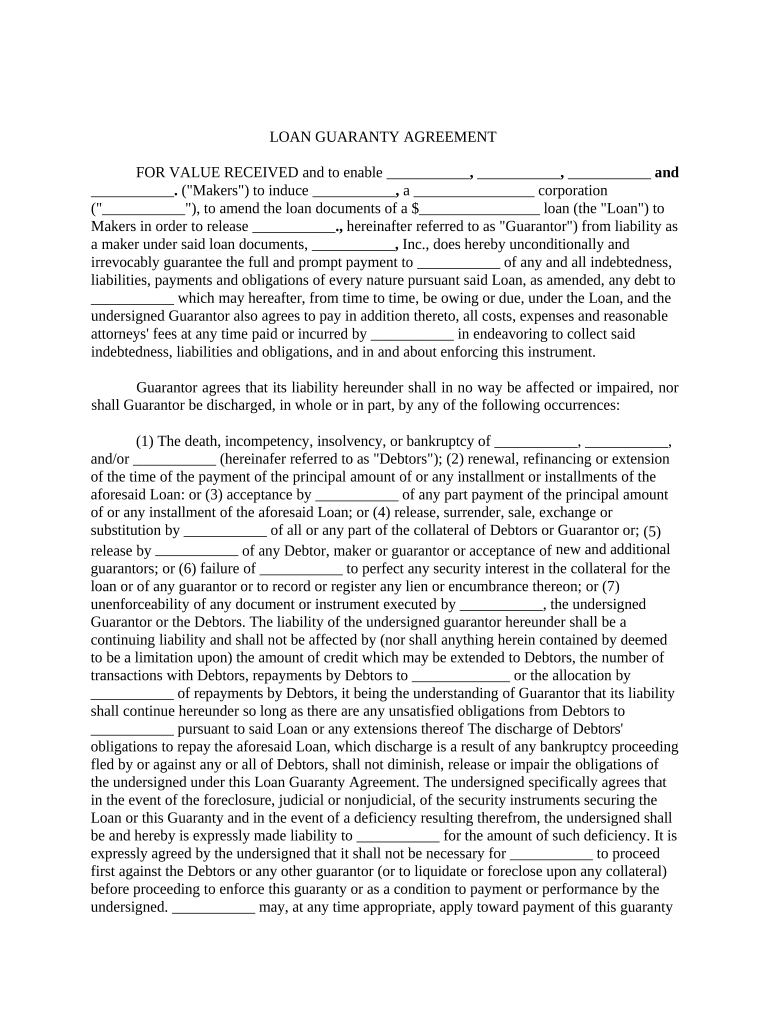

A guaranty agreement is a legal document that outlines the responsibilities of a guarantor, who agrees to pay a borrower's debt if the borrower defaults. This type of agreement is commonly used in various financial transactions, including loans and leases. The guarantor provides an additional layer of security for lenders, ensuring that they will receive payment even if the primary borrower fails to fulfill their obligations.

In the United States, a guaranty agreement must meet certain legal requirements to be considered valid. It typically includes details such as the names of the parties involved, the amount of the debt, the terms of repayment, and any conditions under which the guarantor will be liable. Understanding these elements is crucial for both borrowers and guarantors.

How to use the guaranty agreement

Using a guaranty agreement involves several key steps. First, both the borrower and the guarantor should review the terms of the agreement to ensure they understand their obligations. It is important for the guarantor to assess the borrower's financial situation and the risks involved.

Once both parties are comfortable with the terms, the guarantor should sign the agreement. This signature indicates their commitment to assume responsibility for the debt if necessary. After signing, the completed document should be kept in a secure location, as it may be needed for future reference or in case of a dispute.

Steps to complete the guaranty agreement

Completing a guaranty agreement involves specific steps to ensure its legality and effectiveness. Here are the key steps:

- Gather necessary information, including the borrower's financial details and the terms of the loan.

- Draft the agreement, including all relevant details such as the amount guaranteed, repayment terms, and any conditions.

- Review the document carefully, ensuring that all parties understand their rights and obligations.

- Sign the agreement in the presence of a witness or notary if required by state law.

- Store the signed document securely for future reference.

Key elements of the guaranty agreement

A well-drafted guaranty agreement should include several key elements to ensure clarity and enforceability:

- Parties involved: Clearly identify the borrower, guarantor, and lender.

- Amount of debt: Specify the total amount that the guarantor is responsible for.

- Terms of repayment: Outline the repayment schedule and any interest rates applicable.

- Conditions of liability: Define the circumstances under which the guarantor will be held liable.

- Governing law: Indicate which state laws will govern the agreement.

Legal use of the guaranty agreement

For a guaranty agreement to be legally binding, it must comply with relevant laws and regulations. In the United States, this includes adherence to the Uniform Commercial Code (UCC) and state-specific statutes. The agreement should be clear and unambiguous, ensuring that all parties understand their rights and obligations.

Additionally, the guarantor must have the legal capacity to enter into the agreement, meaning they must be of legal age and mentally competent. It is advisable for both parties to consult with legal professionals to ensure the agreement meets all legal requirements and adequately protects their interests.

Examples of using the guaranty agreement

Guaranty agreements are commonly used in various scenarios, including:

- Loan agreements: A guarantor may be required for personal loans, business loans, or mortgages.

- Lease agreements: Landlords may request a guaranty agreement from a tenant's parent or guardian, especially for first-time renters.

- Credit applications: Businesses may seek a guarantor for credit lines to ensure repayment.

These examples illustrate the versatility of the guaranty agreement in providing security for lenders while allowing borrowers to access necessary funds or resources.

Quick guide on how to complete guaranty agreement

Complete Guaranty Agreement effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents promptly without delays. Handle Guaranty Agreement on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Guaranty Agreement with ease

- Obtain Guaranty Agreement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to preserve your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Guaranty Agreement to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a guaranty agreement and how is it used?

A guaranty agreement is a legal contract where one party agrees to be responsible for the debt or obligations of another party. Typically used in lending scenarios, it provides lenders with added security that the obligations will be met. This agreement is crucial for businesses seeking to establish trust and credibility in their transactions.

-

How can airSlate SignNow help with creating a guaranty agreement?

airSlate SignNow offers intuitive tools that simplify the creation and signing of a guaranty agreement. With customizable templates, users can easily tailor documents to fit specific needs and ensure compliance with legal standards. This efficiency streamlines the process, allowing businesses to save time and reduce errors.

-

Is it secure to sign a guaranty agreement using airSlate SignNow?

Yes, signing a guaranty agreement with airSlate SignNow is highly secure. Our platform utilizes advanced encryption and authentication measures to ensure that all documents remain confidential and are signed securely. This security helps maintain the integrity of your business transactions.

-

What are the pricing options for using airSlate SignNow for guaranty agreements?

airSlate SignNow offers various pricing plans that cater to different business needs when handling guaranty agreements. From individual users to teams, our plans are designed to be cost-effective without sacrificing features. Visit our pricing page to find the best fit for your business requirements.

-

Can I integrate airSlate SignNow with other tools for managing guaranty agreements?

Absolutely! airSlate SignNow seamlessly integrates with many popular platforms, allowing you to manage your guaranty agreements alongside your existing workflows. This includes integration with CRM systems, cloud storage, and project management tools, providing a comprehensive solution.

-

What benefits does airSlate SignNow offer for businesses managing guaranty agreements?

Using airSlate SignNow for your guaranty agreements provides several key benefits, including improved efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly interface ensures that all team members can easily create and review documents. Ultimately, this leads to faster deal closures and improved business relationships.

-

How does airSlate SignNow ensure compliance for guaranty agreements?

airSlate SignNow helps ensure compliance for guaranty agreements by providing legally binding electronic signatures and maintaining detailed audit trails. Our platform is designed to meet regulatory standards, ensuring that all signed documents can withstand legal scrutiny. This assurance is vital for maintaining trust in business transactions.

Get more for Guaranty Agreement

Find out other Guaranty Agreement

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free