Receipt Funds Form

What is the Receipt Funds

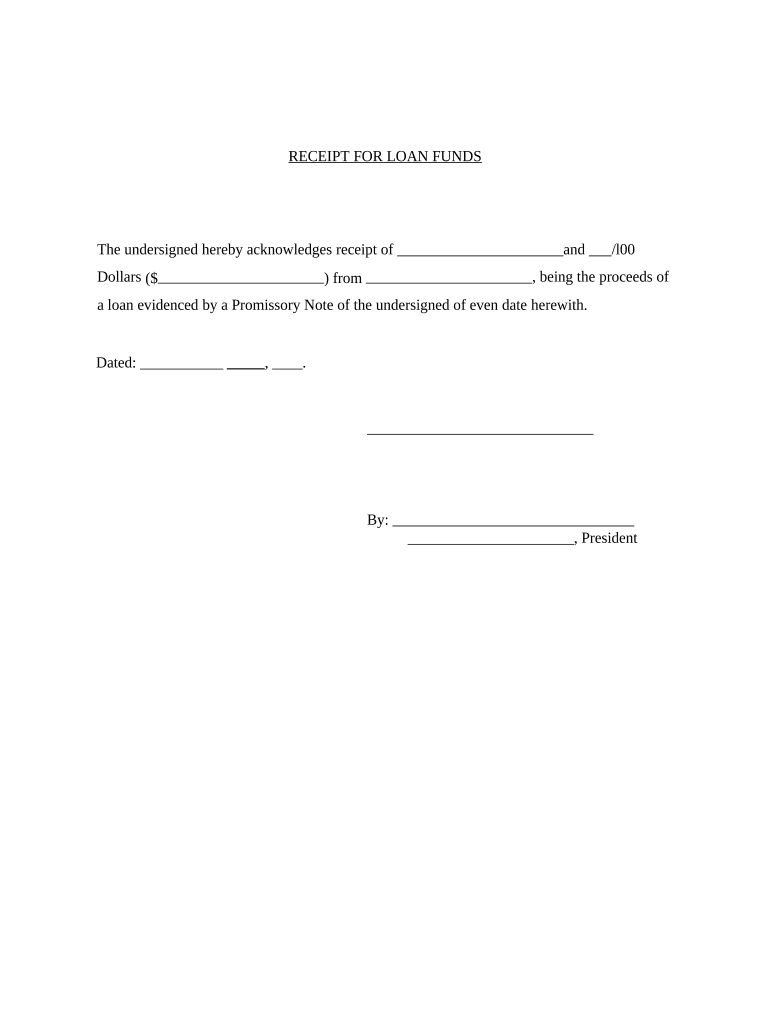

The receipt funds form is a document used to acknowledge the receipt of funds, often in the context of loans or financial transactions. This form serves as proof that a specific amount of money has been received by an individual or organization. It is essential for maintaining accurate financial records and ensuring transparency in transactions. The receipt funds form typically includes details such as the date of the transaction, the amount received, the payer's information, and the purpose of the funds.

How to Use the Receipt Funds

Using the receipt funds form involves several straightforward steps. First, ensure that all necessary information is collected, including the payer's name, the amount received, and the date of the transaction. Next, fill out the form accurately, ensuring that all fields are completed. Once the form is filled out, both the payer and the recipient should sign it to validate the transaction. This signed document can then be stored for record-keeping purposes, providing both parties with a clear acknowledgment of the funds exchanged.

Steps to Complete the Receipt Funds

Completing the receipt funds form involves a series of clear steps:

- Gather all relevant information, including the payer's details and transaction specifics.

- Fill out the form, ensuring accuracy in all entries.

- Include the purpose of the funds to clarify the transaction.

- Have both parties sign the form to confirm the receipt of funds.

- Store the completed form securely for future reference.

Legal Use of the Receipt Funds

The receipt funds form holds legal significance as it serves as a binding agreement between parties involved in a financial transaction. To ensure its legal validity, it is crucial to comply with applicable laws regarding electronic signatures and documentation. Utilizing a reputable eSignature platform can enhance the legal standing of the form, as it provides necessary security features and compliance with regulations such as ESIGN and UETA.

Required Documents

When preparing to complete the receipt funds form, certain documents may be required to support the transaction. These may include:

- Proof of identity for both the payer and recipient.

- Any contracts or agreements related to the funds being exchanged.

- Bank statements or transaction records that verify the funds' source.

Examples of Using the Receipt Funds

The receipt funds form can be utilized in various scenarios, including:

- Documenting a loan received from a friend or family member.

- Confirming payment for services rendered by a contractor or freelancer.

- Recording cash transactions in a business setting.

Quick guide on how to complete receipt funds 497333263

Complete Receipt Funds effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly and efficiently. Manage Receipt Funds on any device using the airSlate SignNow Android or iOS apps and streamline any document-related task today.

The easiest way to edit and eSign Receipt Funds effortlessly

- Obtain Receipt Funds and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management requirements within a few clicks from any device you prefer. Modify and eSign Receipt Funds and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are receipt funds in the context of airSlate SignNow?

Receipt funds refer to the confirmation or acknowledgment of payment received from customers through airSlate SignNow's electronic signature platform. This feature aids businesses in tracking payments directly associated with signed documents, ensuring accurate financial records and efficient payment processes.

-

How does airSlate SignNow help manage receipt funds efficiently?

airSlate SignNow allows users to easily generate and manage documents that are linked to receipt funds. With its intuitive interface, businesses can create, send, and track documents, ensuring that every transaction related to receipt funds is documented and easily accessible.

-

What pricing options are available for airSlate SignNow's features related to receipt funds?

airSlate SignNow offers various pricing plans to cater to different business needs, including features specifically designed for managing receipt funds. These plans provide access to a suite of tools that streamline workflows, making it cost-effective for businesses of all sizes to handle receipt funds efficiently.

-

Can I integrate airSlate SignNow with other systems for tracking receipt funds?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, allowing for easier management of receipt funds. This ensures that all transactions and payment confirmations are synchronized with the systems you already use, enhancing operational efficiency.

-

What benefits does airSlate SignNow provide for managing receipt funds?

The primary benefit of using airSlate SignNow for managing receipt funds is the reduced administrative burden. By automating document workflows and providing real-time tracking, businesses can ensure timely acknowledgment of receipt funds, improving cash flow management and customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive receipt funds data?

Absolutely. airSlate SignNow employs robust security measures, including data encryption and regular security audits, to protect sensitive information related to receipt funds. This ensures that all transactions are safe and compliant with industry standards.

-

Does airSlate SignNow offer support for creating customized receipt funds documentation?

Yes, airSlate SignNow provides tools to create customized documents for receipt funds, allowing businesses to tailor their receipts according to their specific requirements. This flexibility helps in maintaining brand consistency and enhancing customer trust.

Get more for Receipt Funds

Find out other Receipt Funds

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast